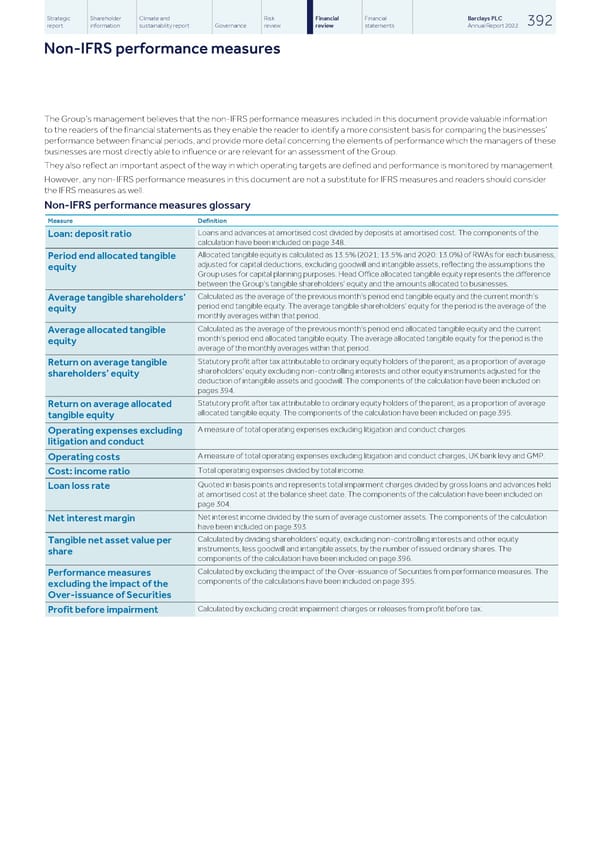

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 392 report information sustainability report Governance review review statements Annual Report 2022 Non-IFRS performance measures The Group’s management believes that the non-IFRS performance measures included in this document provide valuable information to the readers of the financial statements as they enable the reader to identify a more consistent basis for comparing the businesses’ performance between financial periods, and provide more detail concerning the elements of performance which the managers of these businesses are most directly able to influence or are relevant for an assessment of the Group. They also reflect an important aspect of the way in which operating targets are defined and performance is monitored by management. However, any non-IFRS performance measures in this document are not a substitute for IFRS measures and readers should consider the IFRS measures as well. Non-IFRS performance measures glossary Measure Definition Loans and advances at amortised cost divided by deposits at amortised cost. The components of the Loan: deposit ratio calculation have been included on page 348. Allocated tangible equity is calculated as 13.5% (2021; 13.5% and 2020: 13.0%) of RWAs for each business, Period end allocated tangible adjusted for capital deductions, excluding goodwill and intangible assets, reflecting the assumptions the equity Group uses for capital planning purposes. Head Office allocated tangible equity represents the difference between the Group’s tangible shareholders’ equity and the amounts allocated to businesses. Calculated as the average of the previous month’s period end tangible equity and the current month’s Average tangible shareholders’ period end tangible equity. The average tangible shareholders’ equity for the period is the average of the equity monthly averages within that period. Calculated as the average of the previous month’s period end allocated tangible equity and the current Average allocated tangible month’s period end allocated tangible equity. The average allocated tangible equity for the period is the equity average of the monthly averages within that period. Statutory profit after tax attributable to ordinary equity holders of the parent, as a proportion of average Return on average tangible shareholders’ equity excluding non-controlling interests and other equity instruments adjusted for the shareholders’ equity deduction of intangible assets and goodwill. The components of the calculation have been included on pages 394. Statutory profit after tax attributable to ordinary equity holders of the parent, as a proportion of average Return on average allocated allocated tangible equity. The components of the calculation have been included on page 395. tangible equity A measure of total operating expenses excluding litigation and conduct charges. Operating expenses excluding litigation and conduct A measure of total operating expenses excluding litigation and conduct charges, UK bank levy and GMP. Operating costs Total operating expenses divided by total income. Cost: income ratio Quoted in basis points and represents total impairment charges divided by gross loans and advances held Loan loss rate at amortised cost at the balance sheet date. The components of the calculation have been included on page 304. Net interest income divided by the sum of average customer assets. The components of the calculation Net interest margin have been included on page 393. Calculated by dividing shareholders’ equity, excluding non-controlling interests and other equity Tangible net asset value per instruments, less goodwill and intangible assets, by the number of issued ordinary shares. The share components of the calculation have been included on page 396. Calculated by excluding the impact of the Over-issuance of Securities from performance measures. The Performance measures components of the calculations have been included on page 395. excluding the impact of the Over-issuance of Securities Calculated by excluding credit impairment charges or releases from profit before tax. Profit before impairment

Barclays PLC - Annual Report - 2022 Page 393 Page 395

Barclays PLC - Annual Report - 2022 Page 393 Page 395