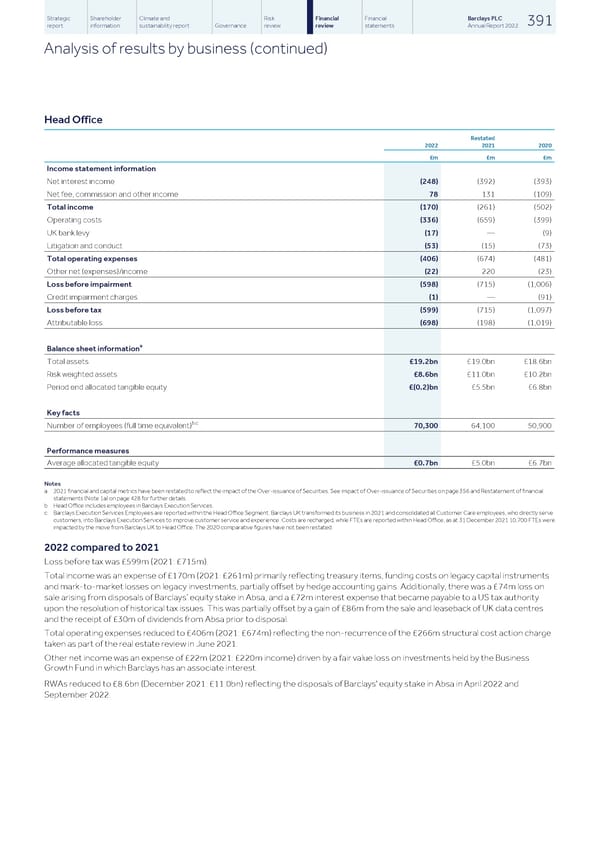

Strategic Shareholder Climate and Risk Financial Financial Barclays PLC 391 report information sustainability report Governance review review statements Annual Report 2022 Analysis of results by business (continued) Head Office Restated 2022 2021 2020 £m £m £m Income statement information Net interest income (248) (392) (393) Net fee, commission and other income 78 131 (109) Total income (170) (261) (502) Operating costs (336) (659) (399) UK bank levy (17) — (9) Litigation and conduct (53) (15) (73) Total operating expenses (406) (674) (481) Other net (expenses)/income (22) 220 (23) Loss before impairment (598) (715) (1,006) Credit impairment charges (1) — (91) Loss before tax (599) (715) (1,097) Attributable loss (698) (198) (1,019) a Balance sheet information Total assets £19.2bn £19.0bn £18.6bn Risk weighted assets £8.6bn £11.0bn £10.2bn Period end allocated tangible equity £(0.2)bn £5.5bn £6.8bn Key facts b,c Number of employees (full time equivalent) 70,300 64,100 50,900 Performance measures Average allocated tangible equity £0.7bn £5.0bn £6.7bn Notes a 2021 financial and capital metrics have been restated to reflect the impact of the Over-issuance of Securities. See impact of Over-issuance of Securities on page 356 and Restatement of financial statements (Note 1a) on page 428 for further details. b Head Office includes employees in Barclays Execution Services. c Barclays Execution Services Employees are reported within the Head Office Segment. Barclays UK transformed its business in 2021 and consolidated all Customer Care employees, who directly serve customers, into Barclays Execution Services to improve customer service and experience. Costs are recharged, while FTEs are reported within Head Office, as at 31 December 2021 10,700 FTEs were impacted by the move from Barclays UK to Head Office. The 2020 comparative figures have not been restated. 2022 compared to 2021 Loss before tax was £599m (2021: £715m). Total income was an expense of £170m (2021: £261m) primarily reflecting treasury items, funding costs on legacy capital instruments and mark-to-market losses on legacy investments, partially offset by hedge accounting gains. Additionally, there was a £74m loss on sale arising from disposals of Barclays’ equity stake in Absa, and a £72m interest expense that became payable to a US tax authority upon the resolution of historical tax issues. This was partially offset by a gain of £86m from the sale and leaseback of UK data centres and the receipt of £30m of dividends from Absa prior to disposal. Total operating expenses reduced to £406m (2021: £674m) reflecting the non-recurrence of the £266m structural cost action charge taken as part of the real estate review in June 2021. Other net income was an expense of £22m (2021: £220m income) driven by a fair value loss on investments held by the Business Growth Fund in which Barclays has an associate interest. RWAs reduced to £8.6bn (December 2021: £11.0bn) reflecting the disposals of Barclays' equity stake in Absa in April 2022 and September 2022.

Barclays PLC - Annual Report - 2022 Page 392 Page 394

Barclays PLC - Annual Report - 2022 Page 392 Page 394