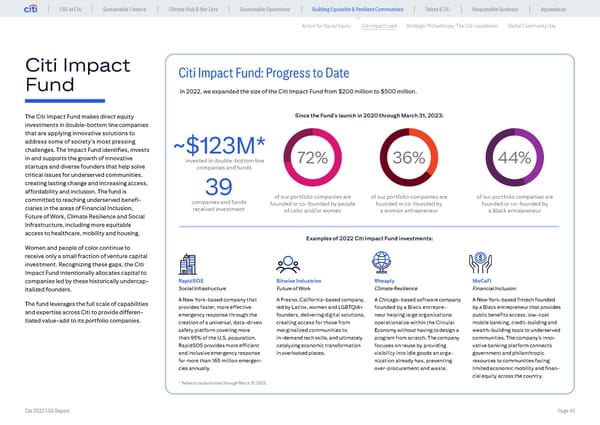

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices Action for Racial Equity Citi Impact Fund Strategic Philanthropy: The Citi Foundation Global Community Day Citi Impact Citi Impact Fund: Progress to Date Fund In 2022, we expanded the size of the Citi Impact Fund from $200 million to $500 million. The Citi Impact Fund makes direct equity Since the Fund’s launch in 2020 through March 31, 2023: investments in double-bottom line companies that are applying innovative solutions to address some of society’s most pressing challenges. The Impact Fund identifies, invests ~$123M* in and supports the growth of innovative invested in double-bottom line 72% 36% 44% startups and diverse founders that help solve companies and funds critical issues for underserved communities, creating lasting change and increasing access, affordability and inclusion. The fund is 39 committed to reaching underserved benefi- of our portfolio companies are of our portfolio companies are of our portfolio companies are companies and funds founded or co-founded by people founded or co-founded by founded or co-founded by ciaries in the areas of Financial Inclusion, received investment of color and/or women a woman entrepreneur a Black entrepreneur Future of Work, Climate Resilience and Social Infrastructure, including more equitable access to healthcare, mobility and housing. Examples of 2022 Citi Impact Fund investments: Women and people of color continue to receive only a small fraction of venture capital investment. Recognizing these gaps, the Citi Impact Fund intentionally allocates capital to companies led by these historically undercap- RapidSOS Bitwise Industries Rheaply MoCaFi italized founders. Social Infrastructure Future of Work Climate Resilience Financial Inclusion The fund leverages the full scale of capabilities A New York-based company that A Fresno, California-based company, A Chicago-based software company A New York-based fintech founded provides faster, more effective led by Latinx, women and LGBTQIA+ founded by a Black entrepre- by a Black entrepreneur that provides and expertise across Citi to provide differen- emergency response through the founders, delivering digital solutions, neur helping large organizations public benefits access, low-cost tiated value-add to its portfolio companies. creation of a universal, data-driven creating access for those from operationalize within the Circular mobile banking, credit-building and safety platform covering more marginalized communities to Economy without having to design a wealth-building tools to underserved than 95% of the U.S. population. in-demand tech skills, and ultimately program from scratch. The company communities. The company’s inno- RapidSOS provides more efficient catalyzing economic transformation focuses on reuse by providing vative banking platform connects and inclusive emergency response in overlooked places. visibility into idle goods an orga- government and philanthropic for more than 165 million emergen- nization already has, preventing resources to communities facing cies annually. over-procurement and waste. limited economic mobility and finan- cial equity across the country. * Reflects capital funded through March 31, 2023. Citi 2022 ESG Report Page 45

Global ESG Report 2022 Citi Bookmarked Page 44 Page 46

Global ESG Report 2022 Citi Bookmarked Page 44 Page 46