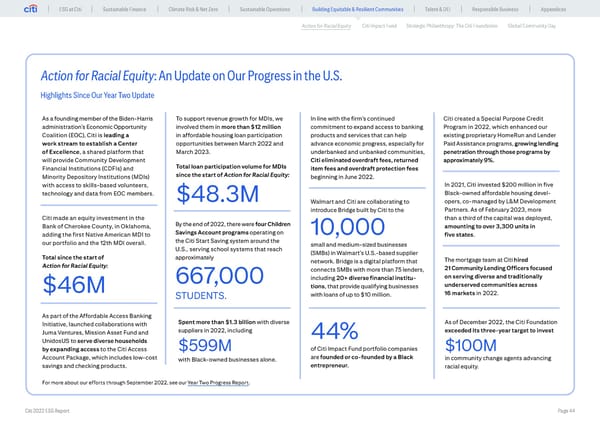

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices Action for Racial Equity Citi Impact Fund Strategic Philanthropy: The Citi Foundation Global Community Day Action for Racial Equity: An Update on Our Progress in the U.S. Highlights Since Our Year Two Update As a founding member of the Biden-Harris To support revenue growth for MDIs, we In line with the firm’s continued Citi created a Special Purpose Credit administration’s Economic Opportunity involved them in more than $12 million commitment to expand access to banking Program in 2022, which enhanced our Coalition (EOC), Citi is leading a in affordable housing loan participation products and services that can help existing proprietary HomeRun and Lender work stream to establish a Center opportunities between March 2022 and advance economic progress, especially for Paid Assistance programs, growing lending of Excellence, a shared platform that March 2023. underbanked and unbanked communities, penetration through those programs by will provide Community Development Citi eliminated overdraft fees, returned approximately 9%. Financial Institutions (CDFIs) and Total loan participation volume for MDIs item fees and overdraft protection fees Minority Depository Institutions (MDIs) since the start of Action for Racial Equity: beginning in June 2022. with access to skills-based volunteers, In 2021, Citi invested $200 million in five technology and data from EOC members. $48.3M Black-owned affordable housing devel- Walmart and Citi are collaborating to opers, co-managed by L&M Development introduce Bridge built by Citi to the Partners. As of February 2023, more Citi made an equity investment in the than a third of the capital was deployed, Bank of Cherokee County, in Oklahoma, By the end of 2022, there were four Children amounting to over 3,300 units in adding the first Native American MDI to Savings Account programs operating on 10,000 five states. our portfolio and the 12th MDI overall. the Citi Start Saving system around the small and medium-sized businesses U.S., serving school systems that reach (SMBs) in Walmart’s U.S.-based supplier Total since the start of approximately network. Bridge is a digital platform that The mortgage team at Citi hired Action for Racial Equity: connects SMBs with more than 75 lenders, 21 Community Lending Officers focused 667,000 including 20+ diverse financial institu- on serving diverse and traditionally $46M tions, that provide qualifying businesses underserved communities across STUDENTS. with loans of up to $10 million. 16 markets in 2022. As part of the Affordable Access Banking Initiative, launched collaborations with Spent more than $1.3 billion with diverse As of December 2022, the Citi Foundation Juma Ventures, Mission Asset Fund and suppliers in 2022, including 44% exceeded its three-year target to invest UnidosUS to serve diverse households by expanding access to the Citi Access $599M of Citi Impact Fund portfolio companies $100M Account Package, which includes low-cost with Black-owned businesses alone. are founded or co-founded by a Black in community change agents advancing savings and checking products. entrepreneur. racial equity. For more about our efforts through September 2022, see our Year Two Progress Report. Citi 2022 ESG Report Page 44

Global ESG Report 2022 Citi Bookmarked Page 43 Page 45

Global ESG Report 2022 Citi Bookmarked Page 43 Page 45