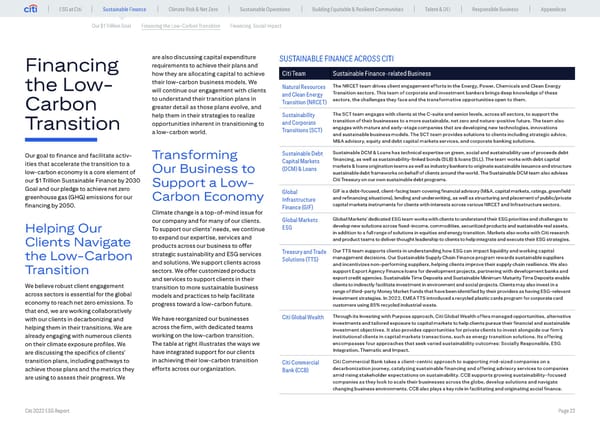

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices Our $1 Trillion Goal Financing the Low-Carbon Transition Financing Social Impact are also discussing capital expenditure SUSTAINABLE FINANCE ACROSS CITI Financing requirements to achieve their plans and how they are allocating capital to achieve Citi Team Sustainable Finance-related Business the Low- their low-carbon business models. We Natural Resources The NRCET team drives client engagement efforts in the Energy, Power, Chemicals and Clean Energy will continue our engagement with clients and Clean Energy Transition sectors. This team of corporate and investment bankers brings deep knowledge of these to understand their transition plans in Transition (NRCET) sectors, the challenges they face and the transformative opportunities open to them. Carbon greater detail as those plans evolve, and help them in their strategies to realize Sustainability The SCT team engages with clients at the C-suite and senior levels, across all sectors, to support the opportunities inherent in transitioning to and Corporate transition of their businesses to a more sustainable, net zero and nature-positive future. The team also Transition a low-carbon world. Transitions (SCT) engages with mature and early-stage companies that are developing new technologies, innovations and sustainable business models. The SCT team provides solutions to clients including strategic advice, M&A advisory, equity and debt capital markets services, and corporate banking solutions. Our goal to finance and facilitate activ- Transforming Sustainable Debt Sustainable DCM & Loans has technical expertise on green, social and sustainability use of proceeds debt ities that accelerate the transition to a Capital Markets financing, as well as sustainability-linked bonds (SLB) & loans (SLL). The team works with debt capital Our Business to (DCM) & Loans markets & loans origination teams as well as industry bankers to originate sustainable issuance and structure low-carbon economy is a core element of sustainable debt frameworks on behalf of clients around the world. The Sustainable DCM team also advises our $1 Trillion Sustainable Finance by 2030 Support a Low- Citi Treasury on our own sustainable debt programs. Goal and our pledge to achieve net zero Global GIF is a debt-focused, client-facing team covering financial advisory (M&A, capital markets, ratings, greenfield greenhouse gas (GHG) emissions for our Carbon Economy Infrastructure and refinancing situations), lending and underwriting, as well as structuring and placement of public/private financing by 2050. Finance (GIF) capital markets instruments for clients with interests across various NRCET and Infrastructure sectors. Climate change is a top-of-mind issue for our company and for many of our clients. Global Markets Global Markets’ dedicated ESG team works with clients to understand their ESG priorities and challenges to Helping Our To support our clients’ needs, we continue ESG develop new solutions across fixed-income, commodities, securitized products and sustainable real assets, in addition to a full range of solutions in equities and energy transition. Markets also works with Citi research Clients Navigate to expand our expertise, services and and product teams to deliver thought leadership to clients to help integrate and execute their ESG strategies. products across our business to offer strategic sustainability and ESG services Treasury and Trade Our TTS team supports clients in understanding how ESG can impact liquidity and working capital the Low-Carbon Solutions (TTS) management decisions. Our Sustainable Supply Chain Finance program rewards sustainable suppliers and solutions. We support clients across and incentivizes non-performing suppliers, helping clients improve their supply chain resilience. We also Transition sectors. We offer customized products support Export Agency Finance loans for development projects, partnering with development banks and and services to support clients in their export credit agencies. Sustainable Time Deposits and Sustainable Minimum Maturity Time Deposits enable We believe robust client engagement transition to more sustainable business clients to indirectly facilitate investment in environment and social projects. Clients may also invest in a across sectors is essential for the global models and practices to help facilitate range of third-party Money Market Funds that have been identified by their providers as having ESG-relevant economy to reach net zero emissions. To investment strategies. In 2022, EMEA TTS introduced a recycled plastic cards program for corporate card progress toward a low-carbon future. customers using 85% recycled industrial waste. that end, we are working collaboratively with our clients in decarbonizing and We have reorganized our businesses Citi Global Wealth Through its Investing with Purpose approach, Citi Global Wealth offers managed opportunities, alternative helping them in their transitions. We are across the firm, with dedicated teams investments and tailored exposure to capital markets to help clients pursue their financial and sustainable investment objectives. It also provides opportunities for private clients to invest alongside our firm’s already engaging with numerous clients working on the low-carbon transition. institutional clients in capital markets transactions, such as energy transition solutions. Its offering on their climate exposure profiles. We The table at right illustrates the ways we encompasses four approaches that seek varied sustainability outcomes: Socially Responsible, ESG are discussing the specifics of clients’ have integrated support for our clients Integration, Thematic and Impact. transition plans, including pathways to in achieving their low-carbon transition Citi Commercial Citi Commercial Bank takes a client-centric approach to supporting mid-sized companies on a achieve those plans and the metrics they efforts across our organization. Bank (CCB) decarbonization journey, catalyzing sustainable financing and offering advisory services to companies are using to assess their progress. We amid rising stakeholder expectations on sustainability. CCB supports growing sustainability-focused companies as they look to scale their businesses across the globe, develop solutions and navigate changing business environments. CCB also plays a key role in facilitating and originating social finance. Citi 2022 ESG Report Page 22

Global ESG Report 2022 Citi Bookmarked Page 21 Page 23

Global ESG Report 2022 Citi Bookmarked Page 21 Page 23