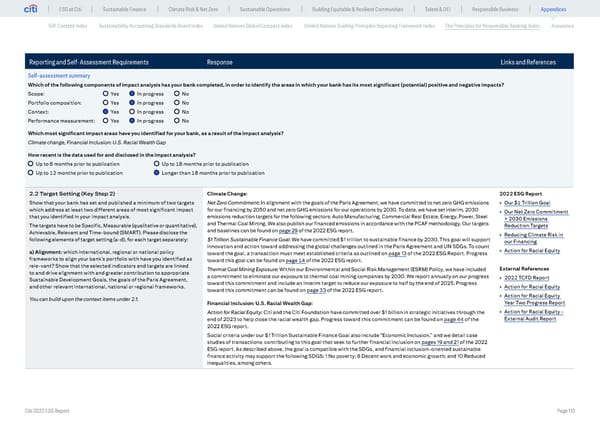

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices GRI Content Index Sustainability Accounting Standards Board Index United Nations Global Compact Index United Nations Guiding Principles Reporting Framework Index The Principles for Responsible Banking Index Assurance Reporting and Self-Assessment Requirements Response Links and References Self-assessment summary Which of the following components of impact analysis has your bank completed, in order to identify the areas in which your bank has its most significant (potential) positive and negative impacts? Scope: Yes In progress No Portfolio composition: Yes In progress No Context: Yes In progress No Performance measurement: Yes In progress No Which most significant impact areas have you identified for your bank, as a result of the impact analysis? Climate change, Financial Inclusion: U.S. Racial Wealth Gap How recent is the data used for and disclosed in the impact analysis? Up to 6 months prior to publication Up to 18 months prior to publication Up to 12 months prior to publication Longer than 18 months prior to publication 2.2 Target Setting (Key Step 2) Climate Change: 2022 ESG Report Show that your bank has set and published a minimum of two targets Net Zero Commitment: In alignment with the goals of the Paris Agreement, we have committed to net zero GHG emissions • Our $1 Trillion Goal which address at least two different areas of most significant impact for our financing by 2050 and net zero GHG emissions for our operations by 2030. To date, we have set interim, 2030 • Our Net Zero Commitment that you identified in your impact analysis. emissions reduction targets for the following sectors: Auto Manufacturing, Commercial Real Estate, Energy, Power, Steel > 2030 Emissions The targets have to be Specific, Measurable (qualitative or quantitative), and Thermal Coal Mining. We also publish our financed emissions in accordance with the PCAF methodology. Our targets Reduction Targets Achievable, Relevant and Time-bound (SMART). Please disclose the and baselines can be found on page 29 of the 2022 ESG report. • Reducing Climate Risk in following elements of target setting (a-d), for each target separately: $1 Trillion Sustainable Finance Goal: We have committed $1 trillion to sustainable finance by 2030. This goal will support our Financing innovation and action toward addressing the global challenges outlined in the Paris Agreement and UN SDGs. To count • Action for Racial Equity a) Alignment: which international, regional or national policy toward the goal, a transaction must meet established criteria as outlined on page 13 of the 2022 ESG Report. Progress frameworks to align your bank’s portfolio with have you identified as toward this goal can be found on page 14 of the 2022 ESG report. rele-vant? Show that the selected indicators and targets are linked Thermal Coal Mining Exposure: Within our Environmental and Social Risk Management (ESRM) Policy, we have included External References to and drive alignment with and greater contribution to appropriate a commitment to eliminate our exposure to thermal coal mining companies by 2030. We report annually on our progress Sustainable Development Goals, the goals of the Paris Agreement, • 2022 TCFD Report and other relevant international, national or regional frameworks. toward this commitment and include an interim target to reduce our exposure to half by the end of 2025. Progress • Action for Racial Equity toward this commitment can be found on page 33 of the 2022 ESG report. You can build upon the context items under 2.1. • Action for Racial Equity Financial Inclusion: U.S. Racial Wealth Gap: Year Two Progress Report Action for Racial Equity: Citi and the Citi Foundation have committed over $1 billion in strategic initiatives through the • Action for Racial Equity - end of 2023 to help close the racial wealth gap. Progress toward this commitment can be found on page 44 of the External Audit Report 2022 ESG report. Social criteria under our $1 Trillion Sustainable Finance Goal also include “Economic Inclusion,” and we detail case studies of transactions contributing to this goal that seek to further financial inclusion on pages 19 and 21 of the 2022 ESG report. As described above, the goal is compatible with the SDGs, and financial inclusion-oriented sustainable finance activity may support the following SDGS: 1 No poverty; 8 Decent work and economic growth; and 10 Reduced inequalities, among others. Citi 2022 ESG Report Page 113

Global ESG Report 2022 Citi Bookmarked Page 112 Page 114

Global ESG Report 2022 Citi Bookmarked Page 112 Page 114