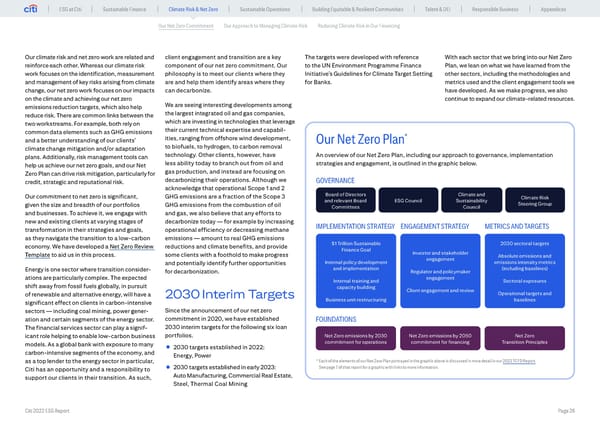

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices Our Net Zero Commitment Our Approach to Managing Climate Risk Reducing Climate Risk in Our Financing Our climate risk and net zero work are related and client engagement and transition are a key The targets were developed with reference With each sector that we bring into our Net Zero reinforce each other. Whereas our climate risk component of our net zero commitment. Our to the UN Environment Programme Finance Plan, we lean on what we have learned from the work focuses on the identification, measurement philosophy is to meet our clients where they Initiative’s Guidelines for Climate Target Setting other sectors, including the methodologies and and management of key risks arising from climate are and help them identify areas where they for Banks. metrics used and the client engagement tools we change, our net zero work focuses on our impacts can decarbonize. have developed. As we make progress, we also on the climate and achieving our net zero continue to expand our climate-related resources. emissions reduction targets, which also help We are seeing interesting developments among reduce risk. There are common links between the the largest integrated oil and gas companies, two workstreams. For example, both rely on which are investing in technologies that leverage common data elements such as GHG emissions their current technical expertise and capabil- and a better understanding of our clients’ ities, ranging from offshore wind development, * Our Net Zero Plan climate change mitigation and/or adaptation to biofuels, to hydrogen, to carbon removal plans. Additionally, risk management tools can technology. Other clients, however, have An overview of our Net Zero Plan, including our approach to governance, implementation help us achieve our net zero goals, and our Net less ability today to branch out from oil and strategies and engagement, is outlined in the graphic below. Zero Plan can drive risk mitigation, particularly for gas production, and instead are focusing on credit, strategic and reputational risk. decarbonizing their operations. Although we GOVERNANCE acknowledge that operational Scope 1 and 2 Our commitment to net zero is significant, GHG emissions are a fraction of the Scope 3 Board of Directors Climate and Climate Risk given the size and breadth of our portfolios GHG emissions from the combustion of oil and relevant Board ESG Council Sustainability Steering Group Committees Council and businesses. To achieve it, we engage with and gas, we also believe that any efforts to new and existing clients at varying stages of decarbonize today — for example by increasing IMPLEMENTATION STRATEGY ENGAGEMENT STRATEGY METRICS AND TARGETS transformation in their strategies and goals, operational efficiency or decreasing methane as they navigate the transition to a low-carbon emissions — amount to real GHG emissions economy. We have developed a Net Zero Review reductions and climate benefits, and provide $1 Trillion Sustainable 2030 sectoral targets Finance Goal Investor and stakeholder Template to aid us in this process. some clients with a foothold to make progress engagement Absolute emissions and and potentially identify further opportunities Internal policy development emissions intensity metrics Energy is one sector where transition consider- for decarbonization. and implementation Regulator and policymaker (including baselines) ations are particularly complex. The expected Internal training and engagement Sectoral exposures shift away from fossil fuels globally, in pursuit capacity building Client engagement and review of renewable and alternative energy, will have a 2030 Interim Targets Operational targets and significant effect on clients in carbon-intensive Business unit restructuring baselines sectors — including coal mining, power gener- Since the announcement of our net zero ation and certain segments of the energy sector. commitment in 2020, we have established FOUNDATIONS The financial services sector can play a signif- 2030 interim targets for the following six loan icant role helping to enable low-carbon business portfolios. Net Zero emissions by 2030 Net Zero emissions by 2050 Net Zero models. As a global bank with exposure to many commitment for operations commitment for financing Transition Principles • 2030 targets established in 2022: carbon-intensive segments of the economy, and Energy, Power as a top lender to the energy sector in particular, * Each of the elements of our Net Zero Plan portrayed in the graphic above is discussed in more detail in our 2022 TCFD Report. Citi has an opportunity and a responsibility to • 2030 targets established in early 2023: See page 7 of that report for a graphic with links to more information. support our clients in their transition. As such, Auto Manufacturing, Commercial Real Estate, Steel, Thermal Coal Mining Citi 2022 ESG Report Page 26

Global ESG Report 2022 Citi Bookmarked Page 25 Page 27

Global ESG Report 2022 Citi Bookmarked Page 25 Page 27