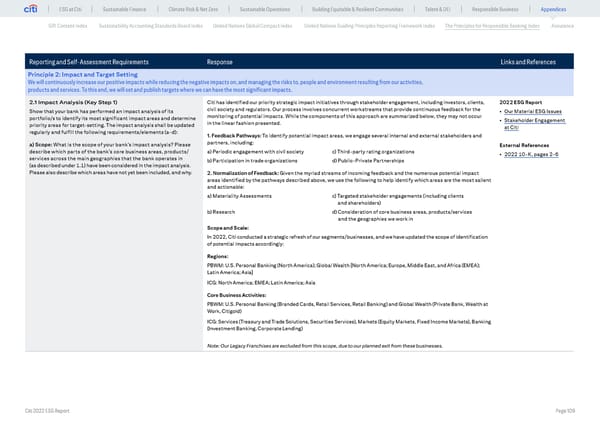

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices GRI Content Index Sustainability Accounting Standards Board Index United Nations Global Compact Index United Nations Guiding Principles Reporting Framework Index The Principles for Responsible Banking Index Assurance Reporting and Self-Assessment Requirements Response Links and References Principle 2: Impact and Target Setting We will continuously increase our positive impacts while reducing the negative impacts on, and managing the risks to, people and environment resulting from our activities, products and services. To this end, we will set and publish targets where we can have the most significant impacts. 2.1 Impact Analysis (Key Step 1) Citi has identified our priority strategic impact initiatives through stakeholder engagement, including investors, clients, 2022 ESG Report Show that your bank has performed an impact analysis of its civil society and regulators. Our process involves concurrent workstreams that provide continuous feedback for the • Our Material ESG Issues portfolio/s to identify its most significant impact areas and determine monitoring of potential impacts. While the components of this approach are summarized below, they may not occur • Stakeholder Engagement priority areas for target-setting. The impact analysis shall be updated in the linear fashion presented. at Citi regularly and fulfill the following requirements/elements (a-d): 1. Feedback Pathways: To identify potential impact areas, we engage several internal and external stakeholders and a) Scope: What is the scope of your bank’s impact analysis? Please partners, including: External References describe which parts of the bank’s core business areas, products/ a) Periodic engagement with civil society c) Third-party rating organizations • 2022 10-K, pages 2-6 services across the main geographies that the bank operates in b) Participation in trade organizations d) Public-Private Partnerships (as described under 1.1) have been considered in the impact analysis. Please also describe which areas have not yet been included, and why. 2. Normalization of Feedback: Given the myriad streams of incoming feedback and the numerous potential impact areas identified by the pathways described above, we use the following to help identify which areas are the most salient and actionable: a) Materiality Assessments c) Targeted stakeholder engagements (including clients and shareholders) b) Research d) Consideration of core business areas, products/services and the geographies we work in Scope and Scale: In 2022, Citi conducted a strategic refresh of our segments/businesses, and we have updated the scope of identification of potential impacts accordingly: Regions: PBWM: U.S. Personal Banking (North America); Global Wealth [North America; Europe, Middle East, and Africa (EMEA); Latin America; Asia] ICG: North America; EMEA; Latin America; Asia Core Business Activities: PBWM: U.S. Personal Banking (Branded Cards, Retail Services, Retail Banking) and Global Wealth (Private Bank, Wealth at Work, Citigold) ICG: Services (Treasury and Trade Solutions, Securities Services), Markets (Equity Markets, Fixed Income Markets), Banking (Investment Banking, Corporate Lending) Note: Our Legacy Franchises are excluded from this scope, due to our planned exit from these businesses. Citi 2022 ESG Report Page 109

Global ESG Report 2022 Citi Bookmarked Page 108 Page 110

Global ESG Report 2022 Citi Bookmarked Page 108 Page 110