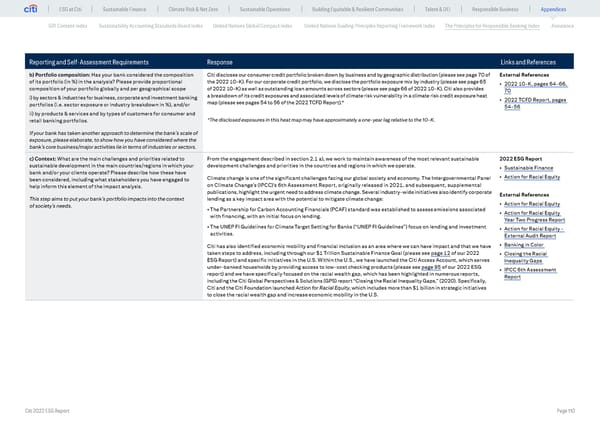

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices GRI Content Index Sustainability Accounting Standards Board Index United Nations Global Compact Index United Nations Guiding Principles Reporting Framework Index The Principles for Responsible Banking Index Assurance Reporting and Self-Assessment Requirements Response Links and References b) Portfolio composition: Has your bank considered the composition Citi discloses our consumer credit portfolio broken down by business and by geographic distribution (please see page 70 of External References of its portfolio (in %) in the analysis? Please provide proportional the 2022 10-K). For our corporate credit portfolio, we disclose the portfolio exposure mix by industry (please see page 65 • 2022 10-K, pages 64-66, composition of your portfolio globally and per geographical scope of 2022 10-K) as well as outstanding loan amounts across sectors (please see page 66 of 2022 10-K). Citi also provides 70 i) by sectors & industries for business, corporate and investment banking a breakdown of its credit exposures and associated levels of climate risk vulnerability in a climate risk credit exposure heat • 2022 TCFD Report, pages portfolios (i.e. sector exposure or industry breakdown in %), and/or map (please see pages 54 to 56 of the 2022 TCFD Report).* 54-56 ii) by products & services and by types of customers for consumer and retail banking portfolios. *The disclosed exposures in this heat map may have approximately a one-year lag relative to the 10-K. If your bank has taken another approach to determine the bank’s scale of exposure, please elaborate, to show how you have considered where the bank’s core business/major activities lie in terms of industries or sectors. c) Context: What are the main challenges and priorities related to From the engagement described in section 2.1 a), we work to maintain awareness of the most relevant sustainable 2022 ESG Report sustainable development in the main countries/regions in which your development challenges and priorities in the countries and regions in which we operate. • Sustainable Finance bank and/or your clients operate? Please describe how these have • Action for Racial Equity been considered, including what stakeholders you have engaged to Climate change is one of the significant challenges facing our global society and economy. The Intergovernmental Panel help inform this element of the impact analysis. on Climate Change’s (IPCC)’s 6th Assessment Report, originally released in 2021, and subsequent, supplemental publications, highlight the urgent need to address climate change. Several industry-wide initiatives also identify corporate External References This step aims to put your bank’s portfolio impacts into the context lending as a key impact area with the potential to mitigate climate change: of society’s needs. • Action for Racial Equity • The Partnership for Carbon Accounting Financials (PCAF) standard was established to assess emissions associated • Action for Racial Equity with financing, with an initial focus on lending. Year Two Progress Report • The UNEP FI Guidelines for Climate Target Setting for Banks (“UNEP FI Guidelines”) focus on lending and investment • Action for Racial Equity - activities. External Audit Report Citi has also identified economic mobility and financial inclusion as an area where we can have impact and that we have • Banking in Color taken steps to address, including through our $1 Trillion Sustainable Finance Goal (please see page 12 of our 2022 • Closing the Racial ESG Report) and specific initiatives in the U.S. Within the U.S., we have launched the Citi Access Account, which serves Inequality Gaps under-banked households by providing access to low-cost checking products (please see page 95 of our 2022 ESG • IPCC 6th Assessment report) and we have specifically focused on the racial wealth gap, which has been highlighted in numerous reports, Report including the Citi Global Perspectives & Solutions (GPS) report “Closing the Racial Inequality Gaps,” (2020). Specifically, Citi and the Citi Foundation launched Action for Racial Equity, which includes more than $1 billion in strategic initiatives to close the racial wealth gap and increase economic mobility in the U.S. Citi 2022 ESG Report Page 110

Global ESG Report 2022 Citi Bookmarked Page 109 Page 111

Global ESG Report 2022 Citi Bookmarked Page 109 Page 111