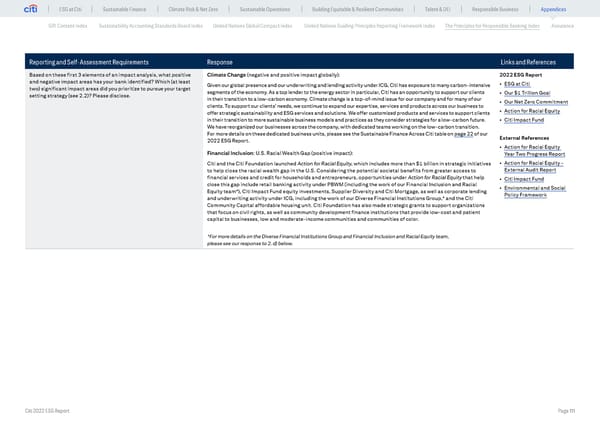

ESG at Citi Sustainable Finance Climate Risk & Net Zero Sustainable Operations Building Equitable & Resilient Communities Talent & DEI Responsible Business Appendices GRI Content Index Sustainability Accounting Standards Board Index United Nations Global Compact Index United Nations Guiding Principles Reporting Framework Index The Principles for Responsible Banking Index Assurance Reporting and Self-Assessment Requirements Response Links and References Based on these first 3 elements of an impact analysis, what positive Climate Change (negative and positive impact globally): 2022 ESG Report and negative impact areas has your bank identified? Which (at least Given our global presence and our underwriting and lending activity under ICG, Citi has exposure to many carbon-intensive • ESG at Citi two) significant impact areas did you prioritize to pursue your target segments of the economy. As a top lender to the energy sector in particular, Citi has an opportunity to support our clients • Our $1 Trillion Goal setting strategy (see 2.2)? Please disclose. in their transition to a low-carbon economy. Climate change is a top-of-mind issue for our company and for many of our clients. To support our clients’ needs, we continue to expand our expertise, services and products across our business to • Our Net Zero Commitment offer strategic sustainability and ESG services and solutions. We offer customized products and services to support clients • Action for Racial Equity in their transition to more sustainable business models and practices as they consider strategies for a low-carbon future. • Citi Impact Fund We have reorganized our businesses across the company, with dedicated teams working on the low-carbon transition. For more details on these dedicated business units, please see the Sustainable Finance Across Citi table on page 22 of our External References 2022 ESG Report. • Action for Racial Equity Financial Inclusion: U.S. Racial Wealth Gap (positive impact): Year Two Progress Report Citi and the Citi Foundation launched Action for Racial Equity, which includes more than $1 billion in strategic initiatives • Action for Racial Equity - to help close the racial wealth gap in the U.S. Considering the potential societal benefits from greater access to External Audit Report financial services and credit for households and entrepreneurs, opportunities under Action for Racial Equity that help • Citi Impact Fund close this gap include retail banking activity under PBWM (including the work of our Financial Inclusion and Racial • Environmental and Social Equity team*), Citi Impact Fund equity investments, Supplier Diversity and Citi Mortgage, as well as corporate lending Policy Framework and underwriting activity under ICG, including the work of our Diverse Financial Institutions Group,* and the Citi Community Capital affordable housing unit. Citi Foundation has also made strategic grants to support organizations that focus on civil rights, as well as community development finance institutions that provide low-cost and patient capital to businesses, low and moderate-income communities and communities of color. *For more details on the Diverse Financial Institutions Group and Financial Inclusion and Racial Equity team, please see our response to 2. d) below. Citi 2022 ESG Report Page 111

Global ESG Report 2022 Citi Bookmarked Page 110 Page 112

Global ESG Report 2022 Citi Bookmarked Page 110 Page 112