1997 U.S. Individual Income Tax Return (B_Clinton_1997)

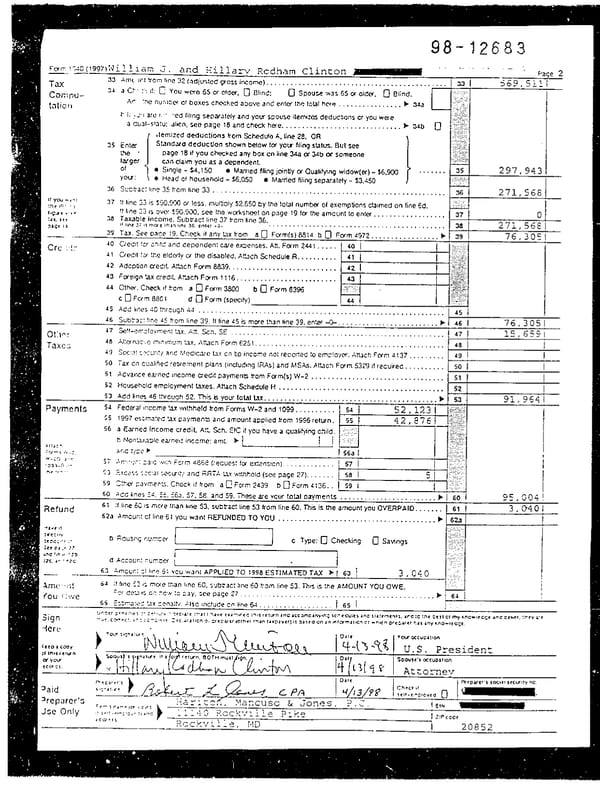

THE WHITE HOUSE Office of the Press Secretary w IGx 1 rnmcdi;tte Rclexe April 13, 1998 STATEMENT BY THE PRESS SECRETiUXY The President and Mrs. Clinton’s 1997 federal income tax return shows $9 Z ,964 in Federal Income Tax on an Adjusted Gross Income of $569,5 1 I, of which S200,OOO Was the President’s S&U-V. The return shows that the CIintons made an overpayment on their taxes d -_ . H ons have elected to apply this overpayment to their 1998 in addition to the Presider 1 t’s salary, the Clintons’ income included royalty income in the amount otS2S 139s from hlrs. C 1 inton’s book, It Takes A Wlla~; interest and dividend income and cx~it~l gains reported bv Pell Rudman Trust Company, the Trustee of the Clinton? blind . e ;rust; other interest and divideild’income; a retid of 1996 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAtaxes paid by the Clmtons to the State of Arkansas; and residual payments. . ‘AK return reports dividend and interest income of S 12,000 from the “Henry G. Freeman, jr., Pin &Ioney Fund,” established under his 1912 will for whoever is, at a given time, the spouse of the President of the TI,jnired States. ivirs. Clinton w-iii contribute this income to charitable . . emtre s, a.s she hx in prior years. The renx-n also reports S270,725 in charitable contributions by the Clintons. The contributions ivere derived primarily from the proceeds of Mrs. Clinton’s book. A11 income from . the book (net of taxes and administrative expenses) is being donated to charity. Ci~Isea Clinton filed her oavn federal income tax return for 1997, which shows S1,106 in tax on income of SS,-247.

oq%nmYnt d 1tw 1-v - Mm Gevuwn cJ’vt# 1997 1 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA 11 1040 U.S. Individual Income Tax Return zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA ’ IRS use Onfy - 00 not wfe ff S~JDIC tn rhts s3ace. Ld (991 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA FcY the yea.’ Jan. 1 1997, ar.utng - Dec. 31. t 997, or other fry you oegtnntng . .19 ORA8 NO. 1 f&S-0074 Label You lrtt arms rnd tn~tlrl Last Nrn. YarsacwDaHtyrrrntnf E Hillary Rodham zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAClinton zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA oaub ma IRS I I i home rac~ess (number rna srrect\. If you have I P.O. box. sea PIW 10. Apt. no. r-1 For help flndlng llnc E 1600 Pennsvlvania Avenue, N.W. 4 in~tructfon~, see p3gc3 2 CI;~. town CT cost off ~0. strfe. and ZIP code. G ycu have a forergn rdcresr. fee zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAoage *C. 2 afid 3 In the boaMet c iy cs4dentJal 1 Waskinaton, DC 205X) Yes NO me: Checrrq -es* 1 EhcUon Campaign C)oyouwant~togotothisfund? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Xl WIT zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAnot chrr\~e ycu I’.>@ t zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBADave 1 C.) . _ , faxorreaue you refund. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA I II a jornt return, does your spouse want zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA$3 to go to this fund? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . d I .I. X 1 1 Single Liing zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAStatus 2 X Manied filhg joint return (e-&n if only one had irfcome) 3 Mamed filing separate return. Entw spouse’s $0~. WC. no. above b full name here b I - bCI( only 4 I Head of household (with QuAtifying person). (See page 10.) I! the qualifying person is a child but not your deoendent. ‘- l Box enter this child’s name here ) . . - S 1 Qualifying widow@) with ckxxndent child (year spouse died ) 19 ). (See page 10.) 1.1 6a 0 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAYowsdf. If you parent (cr s::tmeone eke) can claim you ds a dependent on his of her tax Lxemptions return, do not cboi? box &I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Ho. cf bcxes cnec&ea on - b s Spouse................. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Q ma 6b L .., _ c lkpcndents: I cr) Oepenoenf’s socuI (3) C. -.enaent’s I (4)No. 01 mos. NO o1 yw faculty numoer reufIonsnl0 lo you 1 trvea In you cnrlaren on (l) ;rsr N&me Las1 name I 1 home tn 1997 fx wno: . . Chelsea V Cl irxon . 1 1ti-i Dauqhter ! 12 0 wea wn yau Oeosaen!s I on 6c not I I enterea a3ov-e _ ._-_ d Total number of exemotions cIa!moT . . . . . . . . . . . . . . . , . . . . . . .*. . . . . . . . . . . . . . . . . . . . . . . . . . . enterer3 on a..- lrnes abuve b s I ‘)‘Jacps, sakwes, tjps, etc. Attacn Fj~m(s) W-2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 1 200,07tSr Taxable inWest. Attach schedule ~3 rf required. ..................................... k I 22,555! b Tax-exempt interest DO NOT iw~+x on lrne $a ......... 8b ! 5,458/ 1.. I 9 Dwdends. Attach Schedule E3 ? roared ............. ........................... . . 9 * 7,764/ Taxable refunds, aedits, Y offs& ,!stateendlocalinco;netaxes(seepage 12) . . . . . . . . . . . 10 1 i,O f 11 ~Jimonyreceived............................................................. 11 I 12 8uwess Income oI (loss). Mach Mwdule c cx GF7 ................................ 12 1 281,0981 13 WMcpin w(loss ). AtfachSch~:.:~O ........................................... I 13 1 65,0281 14 Other garns o1 (IossBs). At?*.ch Fcrr 4797.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 II ! 1Sa To’af IF% dt;btbubom . . . . . 1 1Sa 1 b Taxable amount zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA(tee pg. I 3) .* - “se, but CO not 168 Total pmsrons and annuitks t 1fU b Taxable amount (SCO PC I 3) 1 n, my payment I? hntal real &ate, royaftk. part&~hrps. S corporations, Irusts, etc. Attach Schedule E . . . . . . clersc use 18 Farm income OT (loss). At&h Schw:~le F. . . . . .-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ’ *’ 1040-V. Unemloment commsation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . 19 I Social securty Sendits . . . . 1204f1~ __i_ 1 ] b Taxable amount (SW OQ 14) ’ 20b 1 Other rncome. _ “.‘ 1 21 1 . Add the amounts in !M tar nqht CdrJfTn for lines 7 through 21. This IS yaw total Income. . . . , b t 22 I Adjusted 23 IRA oeaucbon(eapage IS)......................... 1 1 I 24 iv%dlcal Cswngs account deducW~ Mach Form 8853 . . . . . ; 1 4 Gross 24 ! I] 1 Jnwme 25 ~~~o~ng emend&. Mach Fcrm 39X cy 3903-F.. . , . . . . . . . 26 Onwhalf of self-empbyrwnt tax. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAAt?nCh $kb&~le SE . . . . 27 sif*mp(oyed health Insurance dccucbon (see page 17). . . J: II MdN 28 Km@ and s&f-employed SEP and WWt_E plens . . . . . . . . I ‘~3 (waef 29 Penalty m sa/~y witndfawal o! 1;8~1r\~.:5. . . . . . . . . . . . . . . . . i 4 ., (1 1 cntlc I-. ’ -I lfvr WI’? 30 Alimony pald. b Recry\ant’s SSN @ Y’ L : .c EIC WI1 3: AdUIlncr,Zjthro~h30a....... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,630 WI. .>rZl. 32 Subtract I~ne 31 from llne ‘L2. This 1~. wr sdjusttd gou income . . . . . . . , , . . . . . . . . . . . _ . b 569,511 h, - - ..Y Fcv Wvacy Act and Puperwodc Rcductlon Act NoUct, se-p rmgc 34. FiTrh 1050 I’*:

98-112683 . SCHEDULES A&E Schedule A - Itemized Deductions (Fwm lOUI) b zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAAttxh to FOCTTI 1010. b See Indructlon~ faf Schedules A and 8 (Form 10). urmc(s) snow*n cm Fcrm 1040 William zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAJ. anrj Rillary iiodham Clinton :.: * ‘:: . . . . . I . . . . CauUon: Do not indude ex~~rtss reimbursed or paid by others. . ..’ .:. :.:*. .’ ‘.‘.‘.... : .’ . . . . . . . . . . . . . . . *. :::.:. .‘.::‘. . .*a.. , :;::. . ..I. Md 1 Medical and dental expenses (see pago A-l). . . . . . . . . . . . . . . . . . . . . . 1 : : ;a:.* :**.y. :’ I :. . :. :.. .:.,.;i_.::: 3cnM . . . :. . . .::;;: 2 Enter amount from Form 1040, line 33.. . . : .‘,..” . ::: :, ;I:?. . . . . . .:, =qflse3 :i. :. ::. ..:: “.‘..‘. Multiply line 2 above by 7.5% (.0X) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 3 ., . ..*.. .*.*. . .,. . 3 ,’ *. ‘.‘,. 4 Subtrectliw3fromline 1.tfline3kmotettintine l,entor-d- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 0 raxes You 5 StateandI0calmcometaxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 'aM 6 Realestatetaxes(seepageA-2) . . . . . . . . . . . . . l . ..m.d..e.....e... 6 7 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA SC62 8 C%w taxes. list type and amount 4gc A- 1 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA.) b _---- __---__I-_ ---_-- --_-___-_ _--___---_ -----_-__-____I --___-___ -* c 9 MChes S~~OUQ~~................................................................ 1 9 1 -4, 2% , 1 1 4 .:i.:: ,..,I .: ntffest 10 Home m-age lnkest and pocnts reported on Form 1098. . . . . . . . . . . 10 ! 3 1. ,’ ‘.. . . .._ I*. ; : . ‘OU Pald 1.: : * .: . . 11 Home m-age In&rest not repwted on Form lW3.1r DUJ to the owx from .:.;,:~;;:I; , : : ‘.’ . .:. . . . . :. ‘. . . . . , . . . . . ..*. . .: ‘. : --~ ;’ See whom you ooupl zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBArne rime. see or~a A-3 d show zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAmar pefscm’s fume. IO no. A address :. .: ,.: ; .,.. ‘..li.,, rgc A-2.) ‘..’ . . :b .; *.,:..:... ‘.’ : : .. ::. . . b : _.’ . . . . . . --mm-----------_a ---------- -v-w ‘I.’ .:,.y,:: : .‘I.. .‘. .: . . . ‘.’ ‘.’ -a-----a-a------a -c----w-w -----. .’ . * .. ‘. . . ‘: . . tic ., : ::. --mm--a------ -a _-me--v---e- ----) ( .' ‘Cf SW.Al : :. . *. . . . . :: Iltret! IS mm--------a-w---e_ __------LI I---, 11 .I’.. ._. :,~~ ‘~ ‘I Of 12 Pocnts not reported on hrn 1098. %a page A-3.. . . . . . . . . . . . . . . . . . 12 : : :. . :. eauc:lole. . ..“. . ” 13 Investment rntwst AUch Form 4952, if requkd. . .‘.. :. . :,‘* . . . .,: .. .I (~pageA-3)...........................,................. 13 . . . 4 ? : 14 14 Addlines 1OthfouQh 13.............................................................. 14 I - I - ‘. . . . . ‘2 15 Gifts by cash cr check. ll any gift of $250 o( moTe, see pg. A-3 . . . . . . . . 15 I 2 7 0 ) 7 2 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA5 I.. . . . . . . . 16 aher than by CaSh 01 check. If any gift of $250 or more, see page A-3. t . :. : . . .: . .’ :. .’ you fl>r 3c a . ., . ,:. . . You h~USTattachForm8283ifove,3500 . . . . . . . . . . . . . . . . . . . . . . . . . 16 ! .:. . . ‘.‘... If1 mc pr a ‘. . ::. .Yj .i'..::.: enof If rcr If. 17 Carjovw tiomprroryfw.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 1 75, c; 4 9 i fe page A-3. 18 2w.756 Add lines 15 !hrou$h 17 . . . . . . . . .Carrwxex l Lo. next. xeaa.. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA. . . . , . .-a ,.x_a 1 18 I &sualty and 19 kualty OT theft Ioss(es). Attach Form 4684. heft Lossta !SeepageA-4.)...................................... . . . . . . . . ..a................... 0 Umembwsed emplow senses - fob bawd, unron zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAdues, job educa$on, : :A,, etc. YOU MUST attach Fwm 2lC6 or 2lOCEZ if required. (See page AA.) :,‘, 1: . I I .: ...... 201 : .......... -----e-w----- --_-- ---a-e--d-- -- ......... 21 ...... . . I Taxpreparabonfoes..............,........,......,.... l ***** 22 Ohr expenses - Inwstmnt safe deposit box. etc. List type and amount . . . . . ) I. Investinen'i Exp. from K-l 2 . .‘: : -----------&----- --------a----- l T .:. . Pell Xudman Trust: ComDanv 3.6 ’ -_-------- s-m-- ---L-d--- --_- ‘A,-- ” ?ii:( Pre9. Sr Acctns Ser;. I I -------L-- ------& I__----L__--_--_--__--- MdI~rm2CHhrough22 . . . . . . . . . . . . . . . . ..M................... ] 23 t C6” Enw amount from km 1040, lrne 33. . . . 1 24 1 _ _ , k? 11 I L A M~WYy ho 24 nbwe by 296 C.02). . . . II , . . . . , , . , . . . . . , . . . . . . . . . . [ 25 i Subbect line 25 from lrno 23. If Itno 25 is mew than line 23. ontot -O- . . . . . . . . . . . . . . . . . . . . . . , . . . . 26 1 -_ ulex 27 cxhcv - tram ltst on page A-S. Lst type and amount ) ---w-w----- Ixe~tantous v-w----_ ----CL--- --L-I w-w- --(111------ ------ we--e-w ------_--_ -- ----------- -- 3------ c 27 1 0 Is km 1040. hne 33, ovw $121,2CXI~,GOO if manrej filrng seoaratety)? Reduction i 28 NO. Your coduct~on 6 not Imvted. Add the amounb tn the far right cdumn for 11ncz~ 4 through 27. Also, ontm on Form 1030, ltne 35, the larw of mrs a,,., :??,::“/ 26 1 297,?43 amount or your standard doducbon. > YES. Your coducbon may be limbed. %e page A-S for the amount to mtn. -_

. 98-12683 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA ;‘3ecjulet A&O ~CYTI !013) 1997 OMfi No. 1545-0074 pap 2 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA damys) shown on ccrm zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA1043 00 noI enlcr name ana scxul secutty numbof 11 shown on other sloe. YWWCeJrnartty~ William 2. and Killarv i?odham Clinton Schedule 6 - Interest and Dividend Income Attachment 08 Saquencc NO. Nok: If you had OW $400 in taxable intwest income, you must also complete Part Ill. T ‘art I . I I Amount ntertst ncome 1 List name of payw. If any inbred is from a seller-financed mortgage and !h~ buyer uwd the plopwty ;ecprQcs 12 as a personal rtidencx, see page 8-l and list this i&rest hrst Also, show that buyer’s so&l secw~ty nd 8-r.) numb@ and ad&ess F --------w---w-- ----------a----- -c--M zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA ~~~~~_~_~_________‘_____________________________~ e InvesmenLs NaZi_~_nsBa~~_------------___-- ______ - ____ ______i I 291 -- ~ati_~~sBa~~_cD_______________-________________ I 1 l 537 ‘6c If YeJ Gati_o~.Ba~k_ chec..._-G I _- _ - _ _ _ - _ _ _ -_ _ _- - _ _ _ _ _ _ __ _ rCbrvea a F ofm 199-INT, F rym ~00-013. cf I 3 l 067 JdftltUtC ---a----- --I-------- --------- --- Atemenl from I Xo%ofage frm. -_-__--_----_----- __---_ _--_-_-__- __________+ I f! the frm’r -- -_-----------_---- --- -------a--------- __I_ t cme AS Ihc I dyer and en~ef ----_-------- -_-L------- --------------- -_---_-w4 ‘e totat lnlcfcsl -- ---------------- _---_------------ --_-------~ I ‘Own orl rnr: I rm -----_I_-_-_-_-__-__----- -_---------_--L ----- I --------L------ -----me----- -c--~----~~---~-~ 2 Add t!!eamounrsonl~ne 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Exc!uCable interest on ties EE U.S. satins bonds issuec afkw 1989 from Form 8815, line 14. You hWSTatttchFocm8815toForm lodo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Subtract line 3 tom line 2. Enter the result here and on Form IWO, line 8a . . . . . . . . . . . . . . . . . . . . . . . . , . b xt II Note: If you hati over WXI in gross dividends and/w other distributions on stock, you must also cornpIe@ Part Ill. IvMend Come 5 Lfst name of cay=. Include gross dividends and/of other distr-lbutions on stock here. Any caortal gam ecorgcr 1; d~str~buSons and nontaxable dtstrtbutions will be deductmj on lrnes 7 and 8 0 9-l.) b Tic&J j_ ET,- i 1st . Sank Trusteg_ -a_-_-_--d-----_-,,, -u-a---------__- -a-----i - .a ?!?I I 3ldrr;dfi Trust ComDanv, LA. i I 4,106 ----_-_------_-__ -a - 4. ___----_____--_ ---_--___ -------m--m-- _---- --- ---------e-m- ----------d r ------m--w -----------w ---------------- e-w- -- 5 la: II you I :e~eo A Fcr-m ---------I__ -_-- -v-----e-- ------------ N---w 9%OIV CT ------ --I-------____ w--w 1 3stltufr ---------------- -r--r4 .I emenl from ---I----- _----_-_ --we------ ----ti-CI--- _- W-M COK wage n. IlSl lhs em------ __---__-__ --------------- ----------~ i n’s rumc as I I- loonas --- a_-------------me_ -----~---~---~~-~~ 6 &XWwamountsonl~neS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 &MA gain dtsblbubons. Enter here and on Schedule 0 . . . . . . . . . . . . . . . . . . ’ a fJont?xaD10 dIsVlbubons. C%e :ha Inst. f= Form 1040, lino 9.) . . . . . . . . . . . . 9 ~ddl~~os7and8..........................................,............................. I 9 w f 7,764 10 Subtract llne 9 from hw 6. Entnr the result hew and on Form 1040. line 9 . . . , . . , . . . . . . . . , . . . . . . . . . , . b i 10 1 _~~~ ~- -- d ill You must camp@@ thus part rf you (a) had ovw $4X of intorest or dw%nds: (b) had a fw@gn account: 01 reign (?) wcefvod a Clshbubon from, cf wore a gantcr of, or a transferor to, a fore@ bust Ye3 No COunt.3 - d 1 la At dny bm zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAdur-mg 1997, dfd you have an tntorest rn or a scgnatue or 0th~ authody ovw a financral amount m a fcfeqn 1313 county, Such 115 d bank amount. sectbIb= account. of othw financwl rtccoun?? !f& pago 8-2 for exccobons anti filq ‘! ~~~u~emo~~~fcr~~mTDF~~22.~.........................,...................................,~......... 3 !S .c e-2.1 b II Wx,’ en& tb nnme 01 lorolgn counby b ---- --- ---------------I B-M-- _-w--- 12 Ouflng 1%7, dud you rKO(ve a CeitntwQon from, or WOW you the grantor of, or transfacw 10, a knX$n bus?? i-- I \’ ~~~ec,,‘voumayhavotohloF~m35~or92fi.~oago8-2 . . . . . . . . . . . . , . . . . . . . . . . . . . I C- ‘*

. 98- 12683 sCHEDULE C-Q , Net Profit From Business 1 OMB No. 1S43-0074 (Form 1040) (We h-opfktcxshlp) 1997 oloulm4nt of Ih. Tr0Isu-y b Patncrshlp*jcAnt zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAvmtwas,ctc.,mu~~~eForml065. Altrchmenl 09A Intwn4l Rovooua semcr PQl b Attach to Fcxm 10400~ Form 1041. Sequence zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBANo. ) See Inftructlo~s OfI lxbck. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA hap. of mcork!~r ==worrttl,~C=w tii1lar-v Rociham Clinton 1 * [ml General Information l Had no employees d&g the year. orless. l A/e not requred to file Form 4582, l Use ha cash mt?md of accounting. Decwciaborr and Amcrtirntion, fee this l Did not t-w% an inventcry at any time businass. see the inshx3ions fcu dting tbo year. Schedule C, lha 13, on page G-3 to And You: find out if you must file. l Did zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAnot Pwe zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAa net ICES from you bushes l 00 not deduct a>q>ew for bushes ‘,:: use of you home. 8 00 not have pnor year unallowed pssh actrwty losses from rn6 bushes. -- E 13uuncss admess (tndud~q sun0 cf room no.). &I~ES not roqwed if same as on Form 1040, page 1. city, town cr pest o#kx, SWB, and ZIP co@ piikT] Figure Your Net Profd 1 Gc0s.a recetptx Cwthn: If hs income was rwcrted to you on Form W-2 and the 3aMwy employee’ box I on Vrat form was checked, 9x3 Sbtut0q Employee3 in the rnsbucbons fw Scbdub C, line 1, on pege C-2 i andcfwcktie . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ) elf 28:.808i 2 Tofhf expen3t3. If mcxe ttLsn zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAS2$013, you must us3 Scbeduk C. See instrtiom . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Ket prom_ au ] c btract line 2 from line 1. If less than zor~, you must use Schedule C. Enter on Fcrm lo(o, llrtc 12. 1 snd ALSO on Sdcd~k SE, llnc 2. (%Mcq smoloyOes do not ropOrt this amount on Sctw~Vre SE. !ina 2_ 4s&tm anC !nms. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA ontrronhm 1041,iine3.)...........................................1............ 13 ; 281, 8% i I_Part] Information on Your Vehicle. Compkt43 this paR 0taY if YOU 8f0 dd7rq m u w mft935 on hf3 2. . 4 When did you place you whldo in m fu busfess pwpcws? (month, day, year) b . R Eluslness b Commubng COUW 6 00 you (CT you spot) have another veh1&3 avadablo fn pt~-~onal us07 . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . . =. . . -. . . . a 0 YC3 Is] m 7 ‘$/as YOU ~ha43 t.lvnh3ck-l 13 us3 cwry) OH--CU?‘t hOufS-7. . . . f . . . . . . . . . . . . L . l , . . . . . I . . . . . . . . . . . , . . , . . . . . ~. . . . . . G Ye3 (-j Ho 8a Qoyouha\mo~doncolosuQpcrtyoudoduc3on? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Yea 0 M b ffYss,‘r~ttr~evrd~wwntton? . . . . ..~..................................................................... 0 Yes 0 k~ For Pmti Reductlorr Act NoUce, see Form lolo Indructlons. Schtdule C-Q (Form 1010) 1997

98-72683 . SCHEDULE 0 - OMB NO. 1545-0074 .Form 1040) Capital Gains and Losses zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA 1997 b AUch to Form 1040. ) See ~nstrucUon~ for zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBASchedule 0 (Form lOUI), Itoutmcnt of The Tfecsuy Atf2ChmCnt ~tefrul Revenue Sofvst (991 b Ux Schedule&l twmcxcs~aceto~~stbans~ctlonstarlJnes land 8. SeauenCe HO 12 drmys) mown on F crm zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA1040 YOUU3Wrrrcrrtyrvnbs William ;I'. ark %_liarv Rodham Clinton Short-Term Gains and Losses - Assets Held One Year or Less (0) cost of (r) UN ar&oss) ;.,. I ;. . e, DrsoOtlm of CYooerry [ @) D~rercaureo )c) 011~ solo (CY) Sites ortc . . ,. ‘. *: :. . . (Eumole. 100 rn ‘rccz CC.) 1 WD.. dry. V.) (Sea Dl9c O-3) Olhef BlSlJ FORENlmEYEAA ,‘Y .,. . ‘: . . . . . . . (MO.. my. V.) (tee or* O-4) subtract (e) from (CT) .:“;:.A ‘. ,.’ ,.&. J’. : ‘.‘._ ;. .._; ,,.‘. .‘_‘... . ._‘. . ‘. . . . . . . ; ‘.. / I . . :.. . . .:.. I ! ] ‘. . . . <.‘.. -_. __ .*- : . . I 1 I I . ‘. ‘_. 1 1 I 1. _’ . . . I 1 I I I 1 ‘. . 1 ! ! . . .., .: * -- . . ‘.. . . . . . . . . . * .’ : ‘. : .‘. i :. ., . . . . . I -. : I ... :. ,. ’ , .. : . i -- I 4 Entm you shcfl-&m tctals. 11 any, zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAfrom Scmdule D-1, Ilne 2.. . . . . . . . . . . . . . . . . . . . . . . . . . . zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA :r . ;: ,. . . . ;; . . :: ‘.. 1,’ . . .‘, ..;.*. , .. ..: :., . . . .‘*:. I>,:“. . . . r. . . t. . ., . . ToCal shod-tmrn We3 pdce 8mount.x :... .‘!I:’ 4 .: 1. ‘.., . ‘.. : * * . . . ., . . ;, . . I. .‘a . . . .’ : . ‘. . . . . . . . * . . . . . . . *. . . .:. .:::.v: . ‘..,‘...*.. . ,.. : . Add column (d) of hx 1 and 2.. . , . . . . . . . . . . . . . . . 3 ,. . .,:* ‘1 _’ :. Short-km ga!n from Fwms 2119 and 6252, and shcrt-term garn or (Iczss) homFoms~,6781,anb&324 . . . . . . . . . . . . . . . . . . .._......................... . . . . . . I 1 . PELL RUDbl.AN TRUST COMPANY kt Smrt-Wm C;aln Y (lc-ss) kern pWwshps, S ccfporabons, estatBS, and trusts h-am sChedu@(q K-l . SMrWfxm capital lcrr ctvryow. Entsr the amount, r! any, ?Cm 11~ 5 Of your 19% b~fbid ~S.S &~OWX WockshM . . . . . . . . . . . . , . . . Net ati-term cnpttal gdn w (lo=). Combine lines i through 6 in column (f). . . . . . . . . . . . . . , . . . 471 Part, It. 1 Long-Term Capital Gains and Losses - Assets Held More Than One Year faj 02scrIOIrcm Of rGce~‘y ! (?I) Dale accurec (c) Oate SOid (d) sales Dfcc (a) cost c* O~N-6oss) (glm%RAlEGAln (-Exlrclc. 130 sn n; CC.) I (MO.. my. F.) (see w9e D-3) 01ncf CUSIS FORErnM ecrossl , lNO.. -Y* Yr.) i free 029~ 0-r) Suotfrct (e) from /a) l (see tnsV 3eiow) I I I I I I . . . . . . . :, :* ‘e.. 4. .::. . : :. *::.:.. :::..:. . . . d’:.:.i:-;.*-.‘ .: *.. ::. *: .:a: : 1.1 ::. . : .,. .. . .,...,.,. . . . ., Ento, you long-mm totak, if any, from . . . ‘.’ ’ . . . . . .’ .: :::: . . ..:::.: **. a. . : ‘a. . . . . . . . .l. ‘... . . . . . -* :’ ‘.‘.‘.‘.Y.‘. *:. :; : .: ‘. ~.~.**.:‘: ,.* . ,**I. :. . .:.. .::._I ‘.I . . . . Sc~duk D-L IIne 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 : .‘. .‘.‘.~.~.‘. . . ..‘, . . * ~ ‘;ii’,..’ : . . . . I . ,.. : . . . . ._ . . . :. . . . . : . ..’ . . . .:*:. , . . . . ._ ;_ ,.:I ..*. ‘.I.; ..,.’ .“. .: . . . . . . . . .,..A,.,...~ _~., . . . . ..: : <:::.; .y+;.:;.:.),:‘.:‘: :. . . . . . . . . . , . : . . ...* .’ : .:‘.*; ..:’ .:. . . . . ‘, .. . _..‘.L. . . .:: ‘.‘.’ .:::. . ‘..... .‘.*I . . . , ‘ . . . I. . . . :: ., ., . . . . . . ,.. ..,...;*,..... ., . . . . . . . . . . *.. . . .; II . ;. *.*;. ,... . . To!nl lono_term de3 plct ufnoun’j, . . . . . .’ :. . :, , . . . .:;.. . . . . . ( , ,: .g.y* :. ‘***. ..‘i‘..: I~.‘...., .‘.4*.“. . . :. . . .I . .‘.: : : . . ,. . ..:* ‘. *. *” . . ’ ‘. .. *. ., . . . . . , . . . . . . . .I. r.y ‘. .‘.$..’ . ..‘. . . . . . , .*... : :. ‘.‘.‘. ‘<. Add cdumn (d) of I1r6 8 and 9.. . . . . . . . . . . . . . . . . . 10 . . :. . ,,. . . . . . . . . . .,.. LL Gain horn Fotm 4797, part I: long-term pan from Fcrms 2119, 2439. and 6252; and hg-tO’m Gain cy (kxs) from Fo,ms 4684.6781, and 8824.. -. . . . . . .*. . . . . . . . . . . . . . . . . . . . , , . ?ELL RUDMAN TRUST COMPANY NoI long-Lwm gafn of (loss) from partnorshrps, S ccxpcxabons, estates. and trusts tram sCMure(s) K-l. - C&W cpn OtsZbu3cns ............................................................ Lonptcrm ca~f%I kx c3/rcser . t’ma in both columns (I) and (6) the amount, ~f~ny,bom~~not~o~ycw :~~prtnlLossCa/ryovorW~kShOOt .............................. Comblrw be5 8 thfcugh 14 In column (g) ................................................. Net toflg_tHm CWcw pajn 01 (10~3;. Combw lws 8 tfrofJqh 14 In column (f) , . . . , . , . . . . . . . , . . b 16 I .! / 57,99E 1 28% Rnle Cdn 0, LOSS Indudss all gains and lows In fkt 11, column (I) tram saIes, zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAexchanges, or convwsons (Inciudtng lnstnllmcn? psymonts rwowd) ‘StY: l fkttxe May 7,1957,01 l Aftcf July 28, 1997, ICY asso& Md more mn t yw but not mwo than 18 months, lko ~Wudt)~ ALL ‘coMcbb& garns and loss& (OS dehnod on pago O-4), f Pqxwti RcQuct)on Act NoUcc, stt Form 1040 InstrucU~~. Schedule 0 (Form 10Ml 1997 4

............................................................. I19 I Ent~ zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAyou taxa3le income horn Fcrm 104, line 38 En& the smaller of tlne 16 gr IIW 17 ................................................ 20 ........................ 211 1 I~youare~lingF~m~952,en~theamounttromForm~952.line~. 2 %b?aclline21 tromline2C).IfcecoorI~,enter~. .................................... 3 ~mbtnelin~7andlS.Ifzaroor~,en~~. ....................................... I 4 Entert~~allcrofI)nelS~lino23,butnotlsssVlan;r;ero ................................ 24 s Entn your unrwxotured sec~cn 1250 gain, if any (see paw 0-i). ........................... 25 f 6 Addllnes24andZE: ............................................................... Sub~3~?l~r~e~trcnltne22.Iftorc~IssS.en’~3-. .......................................................... 1271 11,102 ........................................................... 28 I 260,465 a $ubbac:llne 27 tromhne zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA19.11~~C0r~S.entEv3- 9 Entn t>e mailer of Irne 19 gr 91 .xX> (424,650 if sm@o: $x),GX rf mamed filing separatdy; $33.053 of nead of household) .............................................................................. Enterthewnalkr~~line28OrII~~. ....................................................................... Subtract line 22 from line 19. If 21~0 w kss. en&If +. .......................................................... Ente,theltqef o~llne30crline31.......................................................................~ . ............ : ...... ) Figure the tax on the amount on ltne 32. lJse the Tax Table or Tax Rate Schedules, whicheve, a@es 34. 41,200 EnWtMamoun:froml~wZ9 ............................................................................. I 1 Entrrthe amounttronlme2~ ............................................................................. Subtact line 35 tram line 34 If &‘t~o of Isis, en&~ a ........................................................... 7 MuftKAy line 36 Ly 1cx (JO) ............................................................................ ) Entcrmx.m!iJkf o!!tne 19cYllrwj 27....................................................................~ ... EfWtheamouCfrGmhw36 ............................................................................. Subtrac:line 39 trcmline38.If~oOr~.en~~ ........................................................... Mu~pry~ne40byX)%(.X)).......................................................................~ .... ) En~me~~lerofline22ocllne25 ........................................................................ Addhnes 22snd32 ............................................................... L3 271,568 Subtractline 45 fr~~11~42.11~~~00rkK~.ent~r-O- .......................................................... ~adIrr~32.~.~.a~c~b .............................................................................. AdblrrwK33.37.41.47.andSl ............................................................................ &~JW the tax on the amount on line 19. Uw the Tax Tabk or T~J Rate ~hodulos, whtchmm appbs ..................... T . 75, 305 b Tax. Entn the smaller of llnc) 52 c)r hnr) 53 hrvo and on Form lG40. /InO 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . --

98-12683 SCHEDULE E Supplemental Income and Loss . OM8 No. rSG-0074 (Form ION) (From rental red caatc, royafth., fllamcf*fps, 1997 Ooprrlrn4+-1 of rnr frrrslry s CwpofaUons, cstate~, trust& REMfCs, etc.) Atlrcnment 13 h1Whll Fi,*awa Smrcr WI_ bAttact~ to Form 1044 ot Form 1041. b See tnstrucUon~ kx Schedule E (Form 1010). SoQuence No. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA -._ - k4unofS) anr>wn cn rrtun zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA Y’arS=WDUHTyWllW William J. and Hillary Rodham Clinton 1 -_. [..Gpd 1,~ [ home or Loss From Redal Real Eabte and Royalties NC&: Regort income and t3~ens~s 80~1 YOU bvsim otrenting pwsona~ propsty on Scheduk C OT C-Q (sea page E-1). Retort farm rental income 01 loss from Form 4835 on page 2, Ihe 39. 11 Shcw be krnd and locabon of each rental rccL( esbtc popety: 2 For each rental real estate pcaDerty Yu( No L- - listed~fne 1,didyoucryou , A Mxjllfe Investments --....--_--e-e --------------- &-------- rrr__rrr_d zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA famrly us43 R during the ‘ax yorv b * __c__ ._...- ’ p43sonal puposes for mere than the ’ %_ --------~------------------~---~~-~~~~ greater c7t -. I - l 14days.w 8 c a- _----__----_- __c___ --__-I-__-- ______ _,’ l 10$601thetota’daysre”ted at fa3 rental value? CL zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA -_- _ ..- (see orgr E-1.) i progert)u , TOWS A B (Add cdumns zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAA, 8, & zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAC.) i I I c zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA 3 aen& r I c3cxwv0d............................. 3 131 1 I 1 4 Romr3os rQcefvt3C * , . . , . . . . . . . . . . . . . . . . . . . . . I J I 1 I I 141 : Expennes: 5 AcwQsI~~................................ 5 1 L 6 AuVrndtravel(soepageE-2) . . . . . . . . . . . . . . . . 6) 1 : 7 Clrm-mg and mafntfwance.. . . . . *. . . . . . . . . . . . . 7 1 8 C0mmfs,yom . . . . . . . . . . . . . . . . . . . . . , . . . . . . . . 8 t 9 Iftsuanca................................. p-L._ 10 Legal and 0m0f pcof~5.5rona.l fess. . . . . . . . . . . . . . . 101 11 Managarrd3nt 60s. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA. . . . . . . . . . . . . . . . . . . . . . . . . . 11 12 Mccgage tntorest patd to banks, etc. (see page E-2) .12 1 ahe, lnte,sst . Rmaas.. . . . . Supplies. . . . . Taxes . . . . . . . . 161 1 ! LYJhY# ” I . . . . . 171 I I . r -~~--- - . :9 XUdt~rwKSUvou()h la....................... 19 I 1 !I91 I xl D~ecx~bon SZ=DO~ 0, cmobt~o~ (5% wgo E.-Z) . ?0 1 1 !20/ i- I1 Total t~pmsxi. Add tms 19 and 20 . . . . . . . . . . . . ! I I 1 , 2 Dtv-%-vL SutJtrl3cs: Ilno 21 horn 3 (rents) cr 4 (royalbos). If U~SUI! n (bss), *ma page E-3 to find out if you must must hk, Form 6198.. . . . . . . . . . . . . . . . . . . . . . . . 22 kmr:. Add podwe amounts shown on tine 22. Da not ‘-tiudo any bss ......................................... ] 24 i 1 Lossa Add royalty ~SOS born he Z? and mMt~f mal es&W bsses horn Ime 23. En& thy total locsss he,, ............... 12s I( Otf~-wx tncfuda thr amount In fho total on km 40 on pago 2 . , . , . . , , . , . . . . , . . . , , , , , . . . . . . . --. - -- . _,- -.

984268.3 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA %hodule E (Fmm UXl) 1997 ~lsn*s) snown onrotun William J. and Hillary Rodham Clinton BC_ zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA E 1 -- I I I i Pas&a Income and LOU T Icp P8ratvr ioar rlbowra (h) fhr~fvvr vrcm rrm @ MW#8)w rcwr ffcm soclkn 170 uvui8o Oaducllcr @J zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBANcnourm ryana Iran (r1tKn Farr a582 If rrqurrd) - K-1 - K-l - zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAK-1 LrorrFan4aa A I ! , 1 ~ ! _ ! I 8 1 1 1 1 I 1 Cl I 1 i I J _ 0 ! i l ! -- E I ! I 1 1 I .” . ‘. . . . :T :’ ‘. : .. .: . . *” .’ ::,. .*: ::.:, . . . . . . ;; .‘.‘... :. . :. :: *‘*::.“:.‘. . ,.*;, :,,. . . ::.. . . . . .:. ... .*.I:.:~ *‘.,*I.:. -;;. . :, :.7 ‘.‘.: . . . . ‘.... . I .I’ ,. . . . . . ‘.,‘.~..“.~.’ . .*.,’ .,. . .,. :. ; ..L,...* ;i:~:.:~:~‘?:,..‘,,...,*. . . . . ‘f,. .,. . . . . . . .:. . . . . ~1.‘. I . . . . I . :. . , . .::. . s . . . . . . . 1 1 i . ;, . ..: ‘..+;::~,. .I:: ., .I _ - ~ _ ~~ :..: . . . . :.,.:‘:” .’ ., : ..: ..‘.‘.’ :. b Tctak . ! ! :. . . : 29 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAACCcczlumns(h)and(k)olijne~ . . . . . zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA+ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 291 I . . . . . . . . . r i 30 xddcdumns(~).(i),andCj)ofling~ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...*. 3ol< t 1 I T 31 Total caftmn~~2 and S ccmo,abcn mom3 cf (bss). Combine lines 29 and 30. Enter the muIt nOre and irdude in the total on Iina do Mow.. . . . . . . . . , . . , . . 37 . . . . . . . . . . . . . . . ,....*...*..... hart IW 1 Income or Loss From &states and Truds zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA 8 1 i c I I i 0 I I 99 hm I I A 1 I ! 1 8 t ! I I c I ! 1 I ; q- ! 1 1 T 1 . I : * ; ss* ..*,+/. .I. .; j~+~~<_*~<.. . :. a,* . <..*.a; i* .:*_*jI+,* _ ,.., 2.; *>*g,;;. .;.:.*. *...~&q..v::” ‘$‘.\‘, I* .* ‘: ‘%,.. . 334 Tobk :yy:?I.:I. ‘,‘.‘,~‘.!~,“~’ ,’ -;;,: .,I- ,. . . . ..,, a... ‘. 1 .p. .r*‘.v .*... hi. : ’ . . .~:L.~.2.:‘.‘ii..,~.~~.~. 1 . ‘,.’ ‘.’ ‘A?.:_ .:. A.. :.*. ‘.?.:‘. . :A-. . . ..A A 1.. i . J;:::. . . ., *.,. . *, .,.,‘,~.. . _.wt.?:., ,. . . . . ..’ . . * .,w,., ,. . . . .,. . . . . . . ...‘. , ;,. . . . ., I .: . . . . .?J.:*:: t t . . . . . . . ,. .*‘.’ . . . . . . . . ..t..‘+ . . . . ;..‘:.:.:.’ . . . . . . . <.I:.* . . .,. ., . . . ,. - . i 1 ,:$+..::::i’;~.~ . . . . ,I;~.~~.:_...:?*.... . . . . . . . . . . . . . . . . . ::.,.i.:._ . . . . . :: .:, ._.:.: ..: :2.:.Ii*. .~.;~:~.*::.~:~~;“~~.::f,.,. *’ . ‘. . . . . . . ..q........ .-..::.:. I .,. . . . . . . q.‘.‘.’ *:-.‘., ‘a’ ‘.‘.‘“&.~.::.:.‘. .‘.‘,‘. , .*. . . : . ‘.‘.‘.~.‘,~~‘.~.’ .: : : ‘****.: .:“..‘i:.‘:.... +:... :.:.... -**.., . . ... . . . _ b Wars . . . . . . ..““.....,...‘.‘. , . . . . . . 3.4 MC:c31umn5(d)and(f)ofh33a . . . . . . . . . . . . , . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 . 35 ACU cdumm (cl and (0) of Ihe 3%. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . . . . , . . . . . . . . . . . . . . 35 d 36 TcW estate and bust income or (Its). Combine tina 34 rnd 35. - Ente.mer~ultnereanUindudeintt\etotalonlind40beCow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36 I J i Pti IV 1 Income or Loss From Real Estete Mortgaq~ lnvestm& Condulb (REMIC8) - Residual Holder 1 T 38 Ccmblm cdumm (cl) zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAam (01 cntv. En- the rsufi here rnd irsdube In VW, total on Iirn U) MOW . . . , . , . . . . , , . . . . . , ] m 1 I [ Part V / Summary

98-12683 OMB NO. l%s-ootr Self-Employment Tax zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA 1997 b See In3trucUorrs fxx Schedule SE (Form 1W). zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA ) Attach to Fwn 1040. Attxhmont 17 t-- ~qu~nce NO. H4mo of ~U8cm wtth mrl4Hpwy-M tKome (11 mown on F m 1040) Hiliary Rodham Clinton Who Must File Schedule SE You must Ma ktwdule SE it: l YOU had net wnqs from W-smployment from oUw ti chmh employee income (line 4 al Shod Schedule SE Q tine 4c of Long zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAWwdule SE) of WXI of more. OR l You had chuch emplo- incomo of SWL28 or mcfe. Income from m you pertcfm& as a minkter cx a membfx zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAof a religious order Is not chuch employs rn~ome. %a paQe s-1. &tt: Even if YOU hod a Ia cr a small amount of lncomo from self-employment. it my be to you benefit to fik Scheduk !X and us8 &her ‘0pbonaJ mathocf in Part II of Low Wwduk SE. See page Z-3. bp~: of YOU ov,ty x+empioyrwnt incomo was from sarnings as a minister, member of a rdigious or&w, 01 Chirstian sden~e practMnor. ad YOU fired Fcrm 4361 and receiw IRS approval not to be tax& on those earnings, do not file Schedule SE. Instead, write zBemot-form a361’ on Form 1040, line 47. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA May I Use Short Schedule SE or MUST I Use Long Schedule SE? v l ------------_tDID YOU RECEIVE WAGES OR TIPS IN zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA1Wn 1 No I . YCS em-- f 1 I Aa zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAyou a rnmfs*sr, membfx of a Mgtous ofdw, cr Churn Saence practionar who recewd IRS Ye3 1 Was be total of you wages and tips subject to s&al YeS approval not to be taxed on 98.fnrngs from the56 soclrces, I scow gr railroad retkement tax plus you net but yoc owe setf-9m~loyment tax on otkr sarncngr? hi I wnlngs kom wlf-employm9nt mere than S6S,GO? h I 1 J I I L I J I t I I r YtS I ml you using one o! the optional me~ods to figue you Na net earnings (see pege SE-3)? c . ‘! -!A Ho No Did you rectawe tips subject to sodal sectnty or Medicare , yea +( I t tax that you dld not report to you employer? ( Did you roc=stw church employee income rmorted on & 1 Form W-2 of $108-28 or moro7 t YU 1 1 YOU MAY zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAUSE zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBASHORT SCHEDUX SE sa.ow CHEDUESEONTHE0ACK l 1 l---y YOU MusT USE LONG s J Section A - Short Schedule SE. Cautkm: Retid abow ta see it you cm ~38 Short Scheduk s. 1 Nat farm profit or (loss) from Schedule F, Ihe 36, and farm partnerships, Schedule K-1 (Form NE), fine ISa.. . . . . . . 1 2 ~st ptofrt O, (I-) horn Schedule C, line 31; Schedule GE2 line 3: and Schedule K-l (form 1065). Ihe 1Sa (other I I I zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA than farming). Ministsrs and member UI rehgious orders ~88 page SE-l for amounts to repat on this line. & page SE-2foro~incometor~ort.....................................,.....,.,...................... 3 f.kmbtne1w6 land2....................................,..,.....,......,.,..,......,,......... 4 Met aanlnp from ~-~mpcoYmef?C Muttipty line 3 by 9235% (.9235). If less than $400, do not file this scheduka: you do not owe self-emp@yment tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . . . . . . . . b 5 !%f-empcOyrnef7ttax.Ifth amount on line 4 6: . %5,400 o, ks, mUbpty lrne 4 by 15.3% (. 153). Enter Uw mutt hero and on Form 1040, llne 47. . . . . . . . . . . . 0 Mom than StS,GXl, mutipIy lha 4 by 2.9% (.029). Then, add WJO9.60 to the resuk Enter the total We and on Form 1010, llne 47. 6 Deductlorrtu~ of sdf-emp(oymmt taX. Multiply line S by 5096 (.S). . . Entnt?wmufthemando~Fom loIo,tlnt26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 1 For Paperwork Rcductba Act NoUce, 3ec Form lo(o InstructIons.