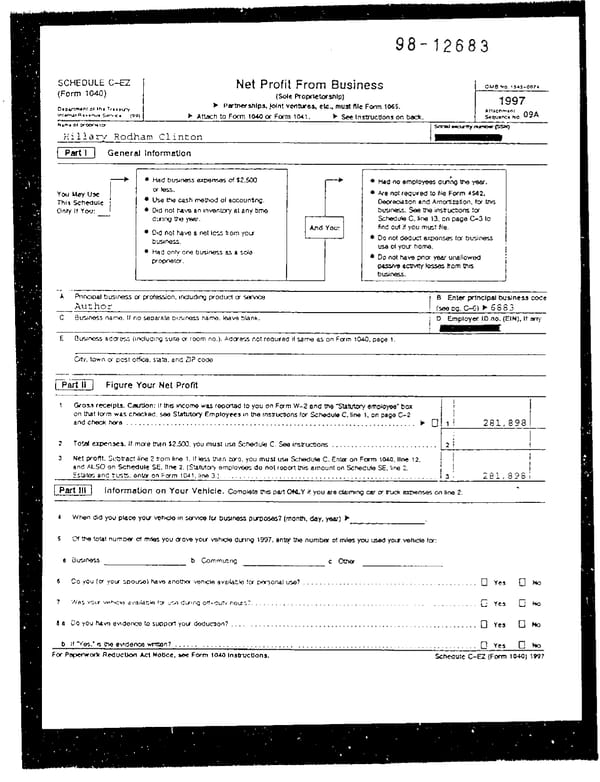

. 98- 12683 sCHEDULE C-Q , Net Profit From Business 1 OMB No. 1S43-0074 (Form 1040) (We h-opfktcxshlp) 1997 oloulm4nt of Ih. Tr0Isu-y b Patncrshlp*jcAnt zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAvmtwas,ctc.,mu~~~eForml065. Altrchmenl 09A Intwn4l Rovooua semcr PQl b Attach to Fcxm 10400~ Form 1041. Sequence zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBANo. ) See Inftructlo~s OfI lxbck. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA hap. of mcork!~r ==worrttl,~C=w tii1lar-v Rociham Clinton 1 * [ml General Information l Had no employees d&g the year. orless. l A/e not requred to file Form 4582, l Use ha cash mt?md of accounting. Decwciaborr and Amcrtirntion, fee this l Did not t-w% an inventcry at any time businass. see the inshx3ions fcu dting tbo year. Schedule C, lha 13, on page G-3 to And You: find out if you must file. l Did zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAnot Pwe zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAa net ICES from you bushes l 00 not deduct a>q>ew for bushes ‘,:: use of you home. 8 00 not have pnor year unallowed pssh actrwty losses from rn6 bushes. -- E 13uuncss admess (tndud~q sun0 cf room no.). &I~ES not roqwed if same as on Form 1040, page 1. city, town cr pest o#kx, SWB, and ZIP co@ piikT] Figure Your Net Profd 1 Gc0s.a recetptx Cwthn: If hs income was rwcrted to you on Form W-2 and the 3aMwy employee’ box I on Vrat form was checked, 9x3 Sbtut0q Employee3 in the rnsbucbons fw Scbdub C, line 1, on pege C-2 i andcfwcktie . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ) elf 28:.808i 2 Tofhf expen3t3. If mcxe ttLsn zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAS2$013, you must us3 Scbeduk C. See instrtiom . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Ket prom_ au ] c btract line 2 from line 1. If less than zor~, you must use Schedule C. Enter on Fcrm lo(o, llrtc 12. 1 snd ALSO on Sdcd~k SE, llnc 2. (%Mcq smoloyOes do not ropOrt this amount on Sctw~Vre SE. !ina 2_ 4s&tm anC !nms. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA ontrronhm 1041,iine3.)...........................................1............ 13 ; 281, 8% i I_Part] Information on Your Vehicle. Compkt43 this paR 0taY if YOU 8f0 dd7rq m u w mft935 on hf3 2. . 4 When did you place you whldo in m fu busfess pwpcws? (month, day, year) b . R Eluslness b Commubng COUW 6 00 you (CT you spot) have another veh1&3 avadablo fn pt~-~onal us07 . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . . =. . . -. . . . a 0 YC3 Is] m 7 ‘$/as YOU ~ha43 t.lvnh3ck-l 13 us3 cwry) OH--CU?‘t hOufS-7. . . . f . . . . . . . . . . . . L . l , . . . . . I . . . . . . . . . . . , . . , . . . . . ~. . . . . . G Ye3 (-j Ho 8a Qoyouha\mo~doncolosuQpcrtyoudoduc3on? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0 Yea 0 M b ffYss,‘r~ttr~evrd~wwntton? . . . . ..~..................................................................... 0 Yes 0 k~ For Pmti Reductlorr Act NoUce, see Form lolo Indructlons. Schtdule C-Q (Form 1010) 1997

1997 U.S. Individual Income Tax Return (B_Clinton_1997) Page 5 Page 7

1997 U.S. Individual Income Tax Return (B_Clinton_1997) Page 5 Page 7