2022 Global ESG Survey

Strengthening Value Through ESG

Creating Resilience Strengthening Value Through ESG SURVEY OF GLOBAL PROPERTY PROFESSIONALS CBRE RESEARCH FEBRUARY 2023

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Contents 01 ESG Priorities in Focus 05 02 Value of Environmental Building Features 17 03 Value of Social Building Features 30 04 Challenges 39 05 Key Considerations 42

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Introduction The real estate industry is uniquely positioned to positively impact our society and the value of the built environment through Environmental, Social and Governance (ESG) initiatives. How this is taking place was the subject of a recent CBRE survey of more than 500 commercial real estate professionals worldwide, revealing the most common and impactful ESG initiatives in their overall real estate strategies. Despite increased economic uncertainty since this survey was conducted in the fall of 2022, it’s clear that the value and importance of ESG will endure.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Key Findings Focus on ESG Intensified in 2022 CBRE’s ESG survey reveals the Nearly 70% of survey respondents reported a heightened focus on ESG strategies in 2022, mostly due to higher energy following trends among global real prices and government-imposed ESG disclosure requirements. This sentiment is more prevalent among investors, although occupiers plan to meet net-zero targets sooner and under a more robust set of principles. estate investors and occupiers: Reducing Energy Consumption a Priority Three-quarters of all respondents say that reducing energy consumption and carbon emissions is the top ESG consideration most likely to impact property value. Investors and occupiers are most often willing to pay a premium for buildings with on-site renewable energy generation and/or smart technology to monitor and adjust energy usage. Emphasis on Tenant/Employee Well-Being More than 80% of respondents indicate that proximity to public transit (or lack thereof) impacts property value because easier commutes are associated with better employee well-being. Nearly half are willing to pay a premium for buildings that support the physical and mental health of their employees. Lack of Data a Barrier to Achieving ESG Goals More than half of respondents say that lack of quality data is the most concerning impediment to achieving ESG goals. This is especially true among investors, who are focused on determining the most impactful cost benefit for their portfolio.

01 ESG Priorities in Focus

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Focus on ESG intensified in 2022 67% of all respondents increased their focus on ESG in 2022.

This is a modal window.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Sixty-seven percent of survey respondents reported more focus on ESG strategies in 2022. The two biggest reasons for this, particularly among investors, were government-imposed ESG disclosure requirements and higher energy prices. Government-mandated disclosure requirements was cited more often by those in Europe, where ESG-related regulation is advancing more quickly. FIGURE 1: Yes, our ESG focus intensified in 2022 FIGURE 2: Economic and geopolitical factors influencing focus on ESG Percent of Responses Percent of Responses 80% 80% 70% 70% 60% 60% 50% 50% 40% 40% 30% 30% 20% 20% 10% 10% 0% 0% U.S. Europe APAC Imposition of new Inflation in Increased global Post-pandemic Rising global ESG disclosure energy prices geopolitical supply shortages interest rates requirements uncertainty and or bottlenecks Investor Occupier All tension All Investor Occupier

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Globally, organizational ESG initiatives cited as most goals aligned important in organizational goals: 67% 58% 55% Reducing greenhouse Improving people's Reducing resource gas emissions health and well-being usage or waste

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Although there were no big regional differences in the ESG initiatives that companies are focused FIGURE 3: Major ESG initiatives within organizational goals on, differences between occupiers and investors were evident. Percent of Responses Giving Major Coverage Occupiers are focused on a more diverse set of ESG initiatives than investors. In addition to the 80% top-three initiatives, 53% of occupiers cite “reducing air, water or land pollution” and 62% 70% cite “improving social mobility, social justice, 60% equality and/or diversity” as very important. The range of ESG initiatives cited by occupiers 50% demonstrates commitment not only to environmental causes but also to bettering 40% employees and society. Additional ESG initiatives that are most 30% important for investors include reducing any association with companies that are socially 20% controversial (57%), reflecting their priority to reduce overall risk and preserve asset value in 10% any way possible. 0% Reducing Improving people's Reducing resource Reducing exposure Reducing air, water Improving social Increasing use of Increasing use of Increasing use of Protecting greenhouse gas health and well- usage or waste to controversial or land pollution mobility, social sustainable local suppliers and diverse suppliers biodiversity and emissions being firms, or firms in justice, equality procurement resources wildlife controversial and/or diversity economic sectors or countries All Investor Occupier

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Organizations often seek ways to “ make an impact and to measure the ensuing change. Accounting for greenhouse gas emissions is a straightforward approach to achieving this. Decarbonization is a top-down, bottom-up approach that organizations can take to reduce their carbon footprint and their environmental risk. —Sarah Spencer-Workman LEED AP & WELL AP, ” Global Director of Decarbonization, Global Workplace Solutions, CBRE 10

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Net-zero goals creating urgency 65% of respondents say their companies have made a public net-zero pledge.

This is a modal window.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Sixty-five percent of respondents reported that their companies have made a public net-zero pledge, making it no surprise that FIGURE 4: Which of the following commitments has your company made to reduce greenhouse gas emissions? reducing greenhouse gas emissions is most often cited as part of organizational goals. Occupiers plan to achieve their targets more quickly than investors, aided by the fact that lease terms are Made a public net-zero pledge generally shorter than the average holding period for investors. Half of occupier respondents said they are establishing science- Established and follow Science Based Targets (SBT) based targets (SBTs) versus 39% of investors. The Science-Based Target initiative (SBTi) has developed an ambitious guide for companies to reduce greenhouse gas emissions. Setting SBTs Joined the United Nations Global Compact aligns with what the latest climate science deems necessary to meet the goals of the Paris Agreement, which seeks to limit global warming to no more than 1.5°C above pre-industrial levels. 0% 10% 20% 30% 40% 50% 60% 70% Percent of Responses Occupier Investor FIGURE 5: If you have a public net-zero pledge, which year have you set for achieving it? 2030 2040 2050 Occupiers 53% Occupiers 16% Occupiers 19% Investors 29% Investors 28% Investors 29%

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Tracking emissions not uniform 56% of respondents categorize their emissions into scopes.

This is a modal window.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals The Greenhouse Gas Protocolhas established a widely adopted framework to measure and manage greenhouse gas emissions, FIGURE 6: What categories or “scopes” of emissions does your organization track? categorized by “scopes.” Most occupiers (62%) and investors (53%) say they use these categories. More than half of occupiers categorize emissions into scopes 1 or 2, which are emissions that Scope 1 the company can most directly control. Less than 40% categorize emissions into scope 3, which are more difficult to measure. Not Scope 2 all companies that have made public net-zero pledges categorize their emissions into scopes, suggesting that further best Scope 3 practices could be adopted to truly commit to reaching net zero. We don't use scope categories 0% 10% 20% 30% 40% 50% 60% There is a big divergence in occupier understanding Percent of Responses Occupier Investor of their carbon footprint as it relates to real estate “ and options to cost-effectively mitigate this. Mapping emissions to real estate and in some cases relocating to lower-emission premises will send a What are scopes? 1 Scope 1 Scope 2 Scope 3 strong signal of ambition. Carbon emitted Carbon emitted Carbon emitted directly from a indirectly through indirectly through company's building electricity or fuel the products and —Sameer Chopra systems and consumption for services provided by vehicle fleets. heating and/or building suppliers. Head of Pacific Research & cooling buildings. ” Asia-Pacific ESG Research, CBRE 1 “Decarbonizing Commercial Real Estate” CBRE, Nov. 11, 2022.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Organizational ethics and values Top cited drivers of ESG goals : still set the tone 63% 47% 43% Aligns with our Customer or shareholder Compliance with relevant own ethics, values demand for more ethical regulations or government or purpose investment or products targets

This is a modal window.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Although government regulation and higher energy prices are contributing external factors, FIGURE 7: What are the three main drivers of your organization’s stated ESG goals? one internal factor—company ethics, values or purpose—remains the main driver behind ESG Percent of Responses priorities (63%). Customer or shareholder demand 70% for more ethical investment or products and compliance with government regulations or targets round out the top three drivers for 60% occupiers and investors. For investors, the fourth and fifth biggest drivers 50% are reducing risk and protecting profitability. This suggests investors also see ESG commitments as 40% a means to achieve better performance and maintain profit and returns. 30% x Occupiers, on the other hand, cite employee well- being and enhanced brand image or reputation as 20% their fourth and fifth biggest drivers, respectively. Improving employee well-being was almost three 10% times as important for occupiers than investors. Occupiers see opportunities in ESG strategies to attract and retain customers and a quality 0% workforce. Give effect to our own ethics, Customer or shareholder Compliance with relevant Reduce risks in our business Enhance brand image or Maintain our profits or returns Attract or retain staff / values or purpose demand for more ethical regulations or government model reputation / staying competitive employee well-being investment or products targets All Investor Occupier

02 Value of Environmental Building Features

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals CBRE’s survey revealed the importance of certain environmental building features on property values and transaction decisions. Our goal was to determine what features that occupiers and investors would pay a premium for, or the absence of which would cause them to seek a discount or reject a transaction altogether. FIGURE 8: How environmental building features impact a real estate transaction Pay a Premium Seek a Discount Reject Building Total Impact (if present) (if absent) (if absent) Features that reduce energy consumption 35% 31% 18% 84% Green building certification 45% 21% 13% 79% On-site renewable energy generation 58% 15% 4% 77% Smart technology that adjusts building operations to reduce environmental impact 53% 18% 5% 76% Superior resilience to effects of climate change (e.g., flooding) 37% 22% 16% 75% Features that reduce building water consumption 41% 20% 7% 68% Uses a green or renewable electricity tariff 38% 16% 9% 63% Electric vehicle charging points 38% 17% 7% 62% On-site facilities to reduce and recycle waste 36% 20% 6% 62% Use of sustainably sourced building materials (e.g., timber) 44% 13% 4% 61% Green lease clauses to enforce action 33% 17% 8% 58% On-site biodiversity or protection of local wildlife 32% 13% 3% 48% Building is refurbished, renovated or converted rather than brand new 30% 12% 5% 47% Note: Total Impact = If present, we’d consider paying a premium + If absent, we’d seek a discount + If absent, we’d exit from or reject the building.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Reducing energy consumption a priority 84% of respondents cite features that reduce energy consumption as having an impact on real estate decisions. Almost half of respondents would seek a discount or walk away from a deal altogether if a building lacked these features.

This is a modal window.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Features that reduce energy consumption are most important FIGURE 9: How would the presence or absence of the following energy-related green when evaluating a property transaction. Investor and occupier building features change your company’s real estate decisions? sentiment is somewhat split between respondents who would pay a premium vs. seek a discount if a building had or lacked features that reduce energy consumption. Occupiers appear most likely to Percent of Responses reject buildings without such features, likely because of less 70% ability to demand them once a lease is signed. Features that reduce Smart technology to adjust building On-site renewable More than half of survey respondents are willing to pay a 60% energy consumption operations and reduce energy generation premium for buildings that already have on-site renewable energy environmental impact generation and/or smart technology that adjusts building 50% operations to reduce environmental impact. This sentiment is led by investors who might have to invest significant capital to make 40% these improvements if they were not already present. As they did for instituting ESG initiatives, rising energy prices and 30% government regulation most likely influenced respondents’ 20% choices of which environmental features they consider most important when valuing a transaction. 10% 0% If present, we’d If absent, we’d seek a If absent, we’d exit If present, we’d If absent, we’d seek a If absent, we’d exit If present, we’d If absent, we’d seek a If absent, we’d exit consider paying a discount from or reject the consider paying a discount from or reject the consider paying a discount from or reject the premium building premium building premium building All Investor Occupier

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Over 85% of the EU existing buildings “ will still be in use in 2050. Renovating the existing building stock is an essential action to meet Paris Agreement goals. To ensure assets remain desirable in the future, owners need to plan on the renovation of their assets. Renovation will reduce the carbon emissions of their properties and will enhance the quality of life for occupants. —LudovicChambe ”Head of ESG & Sustainability Services, CBRE, Continental Europe

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Green building certifications draw premiums 79% of respondents cite green building certifications as having an impact on real estate decisions. Almost half of respondents would pay a premium for green certified buildings.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Green building certification is cited as a top factor that could positively impact a real estate transaction. This is especially FIGURE 10: How would the presence or absence of green building certification change your organization’s true in Europe and Asia-Pacific, where green certification is real estate decisions? also required for regulatory purposes. In the U.S. these certifications result in buildings commanding office rent Percent of Responses premiums. After controlling for age, size, renovation and 50% location, LEED-certified buildings generally earn a 3.7% rent premium over their non-LEED-certified peers. In Europe 45% , the premium is 5.5% for office buildings with sustainability 40% certifications. 35% 30% 25% 20% 15% 10% 5% 0% If present, we’d consider paying a premium If absent, we’d seek a discount If absent, we’d exit from or reject the building All Investor Occupier

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Role of sustainability certifications FIGURE 11: Sustainability certifications across the globe United Kingdom Building Research Establishment Environmental Assessment Method (BREEAM) Mainland China Leadership in Energy and Korea Japan United States Environmental Design (LEED) Green Standard for Energy and Comprehensive Assessment System for Leadership in Energy and Environmental Design (G-SEED) Built Environment Efficiency (CASBEE) Environmental Design (LEED) India Hong Kong SAR Indian Green Building Council (IGBC) Building Environmental Green Building Rating Systems Assessment Method (BEAM Plus) Leadership in Energy and Singapore Environmental Design (LEED) Green Mark Global General Australia Leadership in Energy and Environmental Design (LEED) Green Star Building Research Establishment Environmental Assessment Method (BREEAM) National Australian Built Environment Rating System (NABERS) New Zealand Green Star National Australian Built Environment Rating System (NABERS)

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Seventy-one percent of investors and 58% of occupiers say that green building certification programs are important to benchmark FIGURE 12: How do you use sustainability certification programs (e.g., LEED, BREEAM, NABERS) in your decisions? building performance. Investors also reported using these certifications to enhance their building’s brand and marketability to prospective tenants. Asian and European respondents more heavily rely on these certifications for regulatory purposes. To understand the sustainability credentials or potential of a building To help with marketing or branding with our customers or tenants To meet a voluntary screening requirement we have for buildings we will consider To ensure we collect data consistently across the portfolio To meet a regulatory requirement To inform the price we will pay in a transaction or deal We don't use certification in our real estate decisions 0% 10% 20% 30% 40% 50% 60% 70% 80% Percent of Responses Investor Occupier

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Building resilience to climate change 75% of respondents cite a building's resilience to effects of climate change as having an impact on real estate decisions. Nearly 40% would pay a premium for a building with superior resiliency.

This is a modal window.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Three-quarters of respondents said that they would consider the FIGURE 13: How would a building’s resilience to effects of climate change impact your organization’s real estate decisions? effect of climate change on a building they were investing in or leasing. Nearly 40% would pay a premium for a building with superior resiliency, while 22% would seek a discount for a building without superior resiliency. With natural disasters becoming more Percent of Responses Superior resilience to effects of climate change (e.g., flooding) of a common occurrence, building resiliency is a growing concern. 45% 40% Investors need to take a holistic approach to climate 35% change by incorporating both transition and physical 30% “ climate risks into their strategies; otherwise, they will 25% likely incur a substantive financial impact on their 20% real estate investments. 15% 10% —Dennis A.J. Schoenmaker 5% PhD, Executive Director and Principal Economist, ” 0% CBRE, Econometric Advisors & Global Research If present, we’d consider paying a premium If absent, we’d seek a discount If absent, we’d exit from or reject the building All Investor Occupier

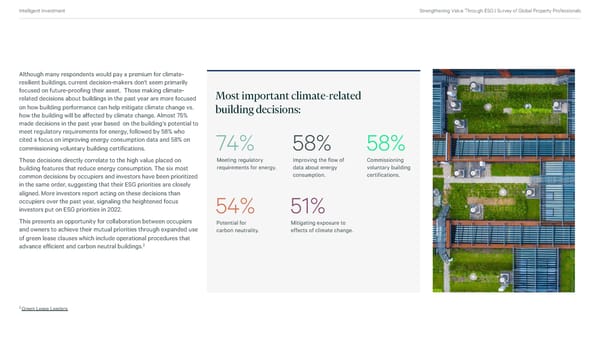

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Although many respondents would pay a premium for climate- resilient buildings, current decision-makers don't seem primarily focused on future-proofing their asset. Those making climate- Most important climate-related related decisions about buildings in the past year are more focused on how building performance can help mitigate climate change vs. building decisions: how the building will be affected by climate change. Almost 75% made decisions in the past year based on the building’s potential to meet regulatory requirements for energy, followed by 58% who cited a focus on improving energy consumption data and 58% on commissioning voluntary building certifications. 74% 58% 58% These decisions directly correlate to the high value placed on Meeting regulatory Improving the flow of Commissioning building features that reduce energy consumption. The six most requirements for energy. data about energy voluntary building common decisions by occupiers and investors have been prioritized consumption. certifications. in the same order, suggesting that their ESG priorities are closely aligned. More investors report acting on these decisions than occupiers over the past year, signaling the heightened focus investors put on ESG priorities in 2022. 54% 51% This presents an opportunity for collaboration between occupiers Potential for Mitigating exposure to and owners to achieve their mutual priorities through expanded use carbon neutrality. effects of climate change. of green lease clauses which include operational procedures that 2 advance efficient and carbon neutral buildings. 2 Green Lease Leaders

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals FIGURE 14: Regarding climate change, which of the following types of decisions about buildings has your organization made in the past year? Percent of Responses 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Whether the building can Improving the flow of data Commissioning voluntary Whether the building has Whether the building might Legal Whether the building will Creating an internal meet regulatory about energy consumption building certifications the potential to become be affected by a changing agreement/collaboration be insurable in future "carbon price" to analyze requirements for energy carbon neutral climate with suppliers/customers costs and benefits to reduce emissions All Investor Occupier

03 Value of Social Building Features

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals CBRE's survey reveals which social building features that occupiers and investors would pay a premium for, or the absence of which would cause them to seek a discount or reject a transaction altogether. FIGURE 15: How social building features impact a real estate transaction Pay a Premium Seek a Discount Reject Building Total Impact (if present) (if absent) (if absent) Proximity to public transport 43% 20% 19% 82% Features that improve physical and mental health of building users 49% 12% 6% 67% Facilities that support cycling and walking 40% 19% 7% 66% Health and well-being certifications (e.g., WELL) 47% 14% 2% 63% Inclusive building design (e.g., accommodating ability, age or neurodiversity) 37% 15% 6% 58% Proximity to an area that the organization can assist socially or economically 31% 9% 4% 44% Note: Total Impact = If present, we’d consider paying a premium + If absent, we’d seek a discount + If absent, we’d exit from or reject the building.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Proximity to public transit important 82% of respondents cited proximity to public transport as having an impact on real estate decisions.

This is a modal window.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Buildings with convenient access to public transportation systems Buildings that support cycling and walking and those with inclusive led the list. Nearly 40% of respondents would seek a discount or design that meet the needs of all employees also made the top five walk away from a deal altogether if a building is not near public list. Nearly half of respondents are willing to pay a premium for transport. This is likely due to less tolerance for long commute building features that improve the physical and mental health of times, especially from suburban to downtown locations.3 employees and for buildings that have health and well-being certifications. FIGURE 16: Proximity to public transport Percent of Responses 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% If present, we’d consider paying a premium If absent, we’d seek a discount If absent, we’d exit from or reject the building It wouldn’t impact our decision All Investor Occupier 3 “Cross-Generational Attitudes That Will Transform the Built Environment,” CBRE Research, Nov. 28, 2022.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Social building features focus on tenant benefits 60% respondents agreed on the top five social building features that impact the value of real estate transactions—all focused on tenant health and well-being.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals While investors and occupiers appear aligned on the top social features of buildings, occupiers more commonly agree on the importance of features that promote employee health, wellness and inclusiveness. FIGURE 17: Building-related social features with most impact on real estate decisions Percent of Responses 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% Proximity to public transport Facilities that support cycling and Features that improve physical and Health and well-being certifications Inclusive building design (e.g., Proximity to an area that the walking mental health of building users (e.g., WELL) reflecting ability, age or organization can assist socially or neurodiversity) economically All Investor Occupier

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals We’re finding that investors and “ occupiers are now increasingly seeking to ensure that the buildings they own or occupy deliver employee health, well-being and engagement, alongside a broader benefit to their local communities. We believe that socially responsible real estate addresses not just reputational risk but establishes how best to deliver positive impact. . —Kaela Fenn-Smith Managing Director, ” Sustainability & ESG Consultancy, UK & Ireland

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Threat of controversy has significant impact 49% of respondents would reject a building involved in any controversy.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Social controversy is also a top consideration in all regions, with 49% of all respondents indicating FIGURE 18: Some owners, tenants or building uses can be socially they would reject a building involved in any controversial. How are your real estate decisions typically controversy.4 This is significantly higher than the affected by any controversy? percentage of respondents who would reject a building for the presence or absence of any other social feature. 49% Exit from or reject a building outright because of the presence of controversy. 16% 12% 11% It wouldn’t change our Ask for a price or rent Be willing to pay a decision. discount because of the price or rent presence of controversy. premium for a building without controversy. 4 Note: What investors and occupiers consider “controversial” is subjective and likely impacted by their location and industry type.

04 Challenges

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals ESG benefits unclear due to lack of data Lack of quality data and uncertainty about benefits are the biggest Top three challenges for challenges for ESG goal implementation. Lack of data was the most common challenge across all regions. Costs exceeding benefits and implementing ESG goals: benefits being unknown or uncertain were the second and third most common challenges. The opinion that costs exceed benefits may be driven by the lack of data. The most likely reason why investors ranked ”lack of data” as their 1 Poor availability or quality of data (53%) top challenge is because they are highly concerned about returns, protection of capital and disclosure regulations that make access to Costs exceed benefit, making it difficult quality building data very important. 2to justify action (47%) Occupiers also ranked ”lack of data” as their top challenge. Nearly one-quarter of occupier respondents also said their ESG goals didn’t have clear real estate implications. This could suggest a lack 3Benefits are unknown or uncertain (36%) of awareness and understanding by occupiers about the role real estate can play in achieving their ESG goals.

This is a modal window.

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals FIGURE 19: What are the main challenges in implementing your organization’s ESG goals? Percent of Responses 70% 60% 50% 40% 30% 20% 10% 0% Poor availability or quality Costs exceed benefits, Benefits are unknown or Lack of expertise Costs are unknown or Partners/stakeholders Complexity of decisions Complexity or Our ESG goals don't have of data making it difficult to uncertain uncertain have different priorities that need to be taken uncertainty surrounding clear real estate justify action government regulations implications or targets All Investor Occupier

05 Key Considerations

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals ESG initiatives present an “ opportunity for investors, owners and occupiers to focus on value creation and mitigate risks. Much of this opportunity is centered around the management, retrofit and refurbishment of existing real estate assets. —Carl Brooks ”Global Head of ESG, Property Management , CBRE

Intelligent Investment Strengthening Value Through ESG | Survey of Global Property Professionals Survey results indicate four key ESG elements that need improvement: Dialogue and transparency with counterparties It’s not just about emissions Occupier and investor priorities and timeframes for ESG goals ESG strategies should cover all issues relevant to real estate can differ substantially. Be clear with your stakeholders and decision-making. Reducing greenhouse gas emissions was the top counterparties about your objectives to find common ground ESG priority for survey respondents. However, it is demonstrably for collaboration. Widespread use of green lease clauses will clear that other issues such as health and well-being, pollution support both transparency and improved sharing of relevant and exposure to controversial companies are very important to data. Alignment on ESG priorities can help mitigate the risk of real estate decision-makers. Therefore, the best performing real buildings becoming obsolete and undesirable to occupants. estate likely will incorporate features covering a range of both environmental and social issues supported by clear governance. Data collection and performance measurement Retrofitting vs. new build High-quality building data is required to show progress toward Just 15% of real estate assets worldwide currently align with the many ESG goals and is critical to many of the issues cited as Paris Agreement’s goal of net-zero emissions to limit global having the most impact on transactions. Both investors and warming to no more than 1.5°C above pre-industrial levels by 5 occupiers are eager for more information, so leveraging 2050. Assessing building data can help identify which assets operational building performance data to offer insight into the are candidates for retrofitting versus those that are nearing costs and benefits of green building features should be a obsolescence. While the carbon offset of new construction and priority. Utilizing technology and digital solutions to automate retrofits can vary greatly, retrofitting a building generally saves data collection is becoming essential. over 50% of embodied carbon, according to the Institute for Market Transformation. 5 ”Building Performance Standards aim to reduce carbon emissions across the U.S.," CBRE Econometric Advisors, Nov. 3, 2022.

This is a modal window.

Contacts Report Contact: Contributors: Research Leadership: Julie Whelan Miles Gibson Vincent Planque Richard Barkham Global Head of Occupier Thought Leadership Executive Director, UK Research Senior ESG Analyst, Econometric Advisors Global Chief Economist & julie.whelan@cbre.com miles.gibson @cbre.com vincent.planque@cbre.com Head of Americas Research richard.barkham@cbre.com Stephanie Marthakis Felix Lee Toby Radcliffe Research Engagement Director Research Manager, Asia Pacific Senior Analyst, UK Research Henry Chin & ESG Task Force Lead felix.lee@cbre.com toby.radcliffe@cbre.com Global Head of Investor Thought stephanie.marthakis @cbre.com Leadership & Head of Research, DraganaMarina Ben Wurtzel Asia Pacific Head of Research & Data Intelligence,, Senior Analyst, Tri-State Research henry.chin@cbre.com.hk Denmark & Sustainability Research Lead, ben.wurtzel@cbre.com Continental Europe Julie Whelan dragana.marina @cbre.com Global Head of Occupier Thought Leadership julie.whelan@cbre.com ©Copyright 2023. All rights reserved. This report has been prepared in good faith, based on CBRE’s current anecdotal and evidence based views of the commercial real estate market. Although CBRE believes its views reflect market conditions on the date of this presentation, they are subject to significant uncertainties and contingencies, many of which are beyond CBRE’s control. In addition, many of CBRE’s views are opinion and/or projections based on CBRE’s subjective analyses of current market circumstances. Other firms may have different opinions, projections and analyses, and actual market conditions in the future may cause CBRE’s current views to later be incorrect. CBRE has no obligation to update its views herein if its opinions, projections, analyses or market circumstances later change. Nothing in this report should be construed as an indicator of the future performance of CBRE’s securities or of the performance of any other company’s securities. You should not purchase or sell securities—of CBRE or any other company—based on the views herein. CBRE disclaims all liability for securities purchased or sold based on information herein, and by viewing this report, you waive all claims against CBRE as well as against CBRE’s affiliates, officers, directors, employees, agents, advisers and representatives arising out of the accuracy, completeness, adequacy or your use of the information herein.