2024 Cobra Benefits Guide

The health and financial security of our employees is important to us. Our benefits program provides a variety of plans that can enhance the lives of you and your family – both now and in the future.

COBRA BENEFITS GUIDE 2024

COBRA Enrollment & Benefit Highlights What To Know For 2024 The health and financial security of our employees is important to us. Our benefits program provides a variety of plans that can enhance the lives of you and your family – both now and in the future. As an eligible employee, you will be asked to make decisions about the employee benefits described in this booklet. This guide provides information to enable you to effectively enroll in your benefits. Take time to carefully read the guide and use the available resources to ensure you make decisions that are right for you and your family. The annual Open Enrollment period is the only time during the year that you are eligible to make benefit plan changes, without a qualifying life event (marriage, birth, divorce, death, loss of other coverage, etc.). November 1 – November 15, is the annual open enrollment period for 2024 and any changes made during open enrollment will be effective January 1 - December 31, 2024. • IRS mandated $3200 minimum deductible for embedded HSA plans. Deductible for HSA Buy-Up plan is increasing. Medical • Addition of premiums for Surest PPO plan. • Deductible is reset for 2024 calendar year. Plan • UMR remains HSA medical plan administrator with Surest as a new PPO plan option for January 1, 2024. • Epiphany pharmacy benefits manager for UMR plans • Navitus pharmacy benefit manager for Surest plan. Dental • No plan design changes. Plan • No employee premium changes. • Delta Dental remains dental carrier. Vision • No plan design changes Plan • Slight increase to COBRA premium • Guardian remains vision carrier Page 2 | ACME | Plan Year 2024 Open Enrollment This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

Terms You Should Know All full-time employees working an average of at least 30 hours per week are eligible for benefits. For Benefit Eligible new hires, you are eligible as of your date of hire. For Medical, Dental and Vision your qualified dependents include your legal spouse and children to age 26. For Voluntary Dependent Life, your covered dependents include your spouse and children to age 25. Deductible The amount you pay for covered health care expenses before your insurance starts to pay. For example, with a $0,000 plan year deductible, you pay the first $0,000 covered services. Coinsurance The percentage of costs of a covered health care service you pay (for example 20%), after you have paid your plan year deductible. Out-of-Pocket The most you must pay for covered services in a plan year. After you spend this amount on Maximum deductibles, copayments, and coinsurance, your health plan pays 100% of the costs of covered benefits. In-Network In network providers agree to accept the UMR approved amount for their services. You will see these savings listed as the “discounted amount” on your Explanation of Benefits statements. Doctors or hospitals who are not in the network do not accept the UMR approved amount. You will Out-of-Network be responsible for paying the difference between the provider’s full charge and your plan’s approved amount. This is called balance billing. Preventive care is the care you receive to prevent illnesses or diseases. Providing these services at no Preventive Care cost is based on the idea that getting preventive care, such as screenings and immunizations, can help you and your family stay healthy. Services will be paid at 100% when you use a participating provider. Under family coverage, an embedded deductible plan means that each family member has an Embedded individual deductible in addition to the total family deductible. Everyone's deductible is much lower deductible plans than the total family deductible. When an individual meets their respective out-of-pocket total, the insurer begins to pay for that person's covered medical services, regardless of whether the family deductible has been fulfilled. Employees may add/remove/make benefit changes during the Open Enrollment period which is held annually. However, we understand that life happens. Employees have 30 days from the date of the Qualified Life qualified life event to make changes/updates. Examples of a life events include birth or adoption of a Status Changes child; marriage or divorce; death; loss of coverage; and employment status change. As the employee, you will log into the Paycom portal to request change(s). In addition, you will also need to provide documentation that reflects need for change(s) and must be submitted to HR before workflow can be approved. Federal required Notices including but not limited to the HIPAA Privacy and Security, Certificate of Plan Compliance Creditable Coverage for Medicare and Market “Exchange” Notices. Health Care Reform Notices are Notifications available online on the human resources internet site or via paper, free of charge, upon request. Please contact human resources with questions. Health Care Reform Notices are available on Paycom ESS under Benefit Forms & Links. Page 3 | ACME | Plan Year 2024 Open Enrollment This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

Overview of Cobra Benefit Costs 2024 Plan Year Details UMR Medical Monthly Premiums Base Buy-Up Surest PPO Employee Only $0,00 $0,00 $0,00 Employee + Spouse $0,00 $0,00 $0,00 Employee + Child(ren) $0,00 $0,00 $0,00 Family $0,00 $0,00 $0,00 Delta Dental Monthly Premiums Base Buy-Up Employee Only $0,00 $0,00 Employee + Spouse $0,00 $0,00 Employee + Child(ren) $0,00 $0,00 Family $0,00 $0,00 Guardian Vision Monthly Premiums Base Buy-Up (Davis Network) (VSP Network) Employee Only $0,00 $0,00 Employee + Spouse $0,00 $0,00 Employee + Child(ren) $0,00 $0,00 Family $0,00 $0,00 Page 4 | ACME | Plan Year 2024 Open Enrollment This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

2024 Medical Benefit Overview Medical Plan In-Network Base Plan Buy-Up Plan Surest Calendar Year Deducible (EEO/Family) $0,00 $0,00 $0 Your Coinsurance Percentage 20% 20% NA Type of Deductible Embedded Embedded NA Medical Out of Pocket Max (EEO/Family) $0,00 $0,00 $0,00 Physician Visit (PCP/Specialist) Deductible, then coinsurance Deductible, then coinsurance $0,00 Preventive Care Services Covered 100% Covered 100% $0 Emergency Room Visit Deductible, then coinsurance Deductible, then coinsurance $0,00 Urgent Care Visit Deductible, then coinsurance Deductible, then coinsurance $50 Out-of-Network Base Plan Buy-Up Plan Surest Calendar Year Deducible (EEO/Family) $0,00 $0,00 $0 Your Coinsurance Percentage 20% 20% NA Medical Out of Pocket Max (EEO/Family) $0,00 $0,00 $0,00 Deductible year runs on the calendar year. Coinsurance kicks in once the calendar year deductible is met. Preventive care services include but are not limited to routine wellness exams, pelvic exams, pap testing, PSA tests, immunizations, annual diabetic eye exam, routine vision and hearing exams. Covers preventive care services rendered in a physician's office and outpatient service centers PHARMACY BENEFITS Base Plan Buy-Up Plan Surest Retail Pharmacy : Preventive You pay $0 You pay $0 NA Retail Pharmacy Tier One: Generic Deductible, then $0 Deductible, then $0 $0 copay (30-day copay copay supply) Retail Pharmacy Tier Two: Brand Name Formulary Deductible, then $0 Deductible, then $0 $0 copay (30-day copay copay supply) Retail Pharmacy Tier Three: Brand Name Non-Formulary Deductible, then $0 Deductible, then $0 $0 copay (30-day copay copay supply) Retail Pharmacy Tier Four: Specialty Medication Deductible, then 25% Deductible, then 25% max N/A max $0 $0 Mail Order Tier One: Generic Deductible, then $0 Deductible, then $0 $0 copay (90-day copay copay supply) Mail Order Tier Two: Brand Name Formulary Deductible, then $0 Deductible, then $0 $0 copay (90-day copay copay supply) Mail Order Tier Three: Brand Name Non-Formulary Deductible, then $0 Deductible, then $0 $0 copay (90-day copay copay supply) Mail Order Tier Four: Specialty Medication Deductible, then 25% Deductible, then 25% max $0 -$0 copay max $0 $0 You are responsible for the copay amount until your total expenses have reached the out-of-pocket maximum. Specialty medications are limited to a 30-day supply, regardless of whether they are retail or mail order. The Preventive Drug Plan is an in-network benefit that only covers preventive drugs included in the Preventive Drug List at 100%. Any preventive drug purchased that is not on the Preventive Drug List will have the deductible and coinsurance applied. Please refer to the Preventive Drug List for a complete listing of drugs covered under this benefit. Navitus is the pharmacy manager for Surest participants. Contact Surest at the number on the back of your member ID card for assistance with mail-order pharmacy.

Pharmacy Partner for UMR & Surest plans: EpiphanyRX is a dedicated partner in pharmacy management for UMR HDHP plans. While the Surest PPO plan partners with Navitus, as PMB for its prescription coverage. For UMR plans, you will have access to pharmacy services and information using web page, mobile app or on demand. Surest enrollees should contact Surest at the number or website on the back of their medical ID card for pharmacy related questions. Provide your UMR or Surest Medical ID card when you fill or refill your RX at the pharmacy. Don’t forget to update your mail order provider to EpiphanyRX. The Expanded Preventive RX listing for UMR members includes commonly prescribed preventive or maintenance medications with no cost to you. For a complete listing of Expanded Preventive medications, please log onto: https://www.epiphanyrx.com Costco Mail Order Pharmacy Services are for UMR Members only. Surest Members should contact Surest for information and to set up Mail Order Pharmacy services. Page 6 | ACME | Plan Year 2024 Open Enrollment This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

Your Medical Provider UMR – A UnitedHealthcare Company UnitedHealthcare Choice Plus Network Web Services - Services at your Fingertips • Register for web services at https://umr.com Just a Click Away – 24/7 Access • Benefit Plan Details ket Accumulations • Deductible and Out-of-Poc • ID Cards • Paid Claims for you and your insured dependents • Medical PPO Network providers using the United Healthcare Choice Plus Network • Health and Wellness Tools, including: o Plan Cost Estimator o Healthy “U” Presentations o Health Education Library Log onto the UMR website to find: Physician meets Premium Program criteria for quality and cost-efficient care. Physician meets program criteria for providing quality care. Program criteria does not evaluate physicians in this specialty, or the physician does not have enough data to be evaluated for quality. Physician does not meet program criteria for providing quality care Page 7 | ACME | Plan Year 2024 Open Enrollment This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

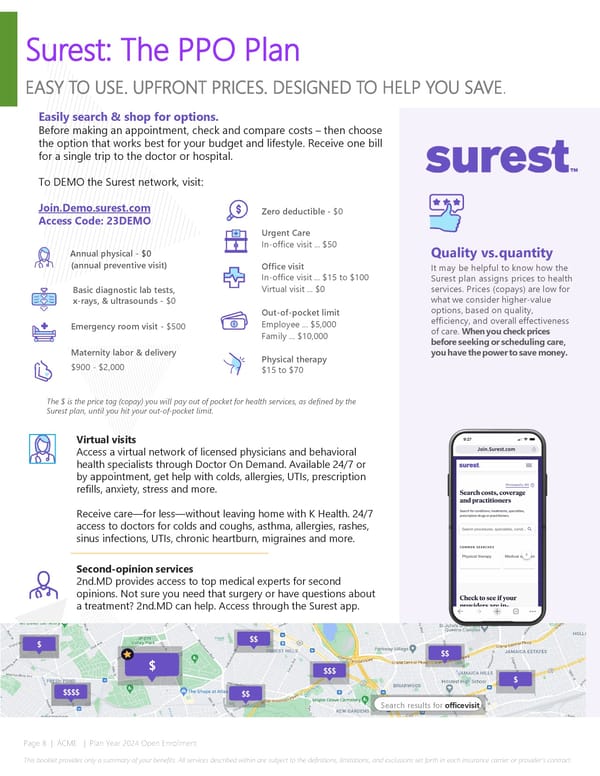

Surest: The PPO Plan EASY TO USE. UPFRONT PRICES. DESIGNED TO HELP YOU SAVE. Easily search & shop for options. Before making an appointment, check and compare costs – then choose the option that works best for your budget and lifestyle. Receive one bill for a single trip to the doctor or hospital. To DEMO the Surest network, visit: Join.Demo.surest.com Zero deductible - $0 Access Code: 23DEMO Urgent Care Annual physical - $0 In-office visit ... $50 Quality vs. quantity (annual preventive visit) Office visit It may be helpful to know how the In-office visit ... $15 to $100 Surest plan assigns prices to health Basic diagnostic lab tests, Virtual visit ... $0 services. Prices (copays) are low for x-rays, & ultrasounds - $0 what we consider higher-value Out-of-pocket limit options, based on quality, Emergency room visit - $500 Employee ... $5,000 efficiency, and overall effectiveness Family ... $10,000 of care. When you check prices Maternity labor & delivery before seeking or scheduling care, Physical therapy you have the power to save money. $900 - $2,000 $15 to $70 The $ is the price tag (copay) you will pay out of pocket for health services, as defined by the Surest plan, until you hit your out-of-pocket limit. Virtual visits Access a virtual network of licensed physicians and behavioral health specialists through Doctor On Demand. Available 24/7 or by appointment, get help with colds, allergies, UTIs, prescription refills, anxiety, stress and more. Receive care—for less—without leaving home with K Health. 24/7 access to doctors for colds and coughs, asthma, allergies, rashes, sinus infections, UTIs, chronic heartburn, migraines and more. Second-opinion services 2nd.MD provides access to top medical experts for second opinions. Not sure you need that surgery or have questions about a treatment? 2nd.MD can help. Access through the Surest app. $ $$ $ $$ $$$ $ $$$$ $$ Search results for office visit Page 8 | ACME | Plan Year 2024 Open Enrollment This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

Your care. Your way. Access your Teladoc Health benefits anytime. General Medical Talk to a board-certified doctor or pediatrician 24/7 for non- emergency conditions. Prescription refills • sinus infections • allergies • stomach bug • COVID-19 advice • and more Dermatology Upload images and details of your skin issue in the Teladoc Health app. A dermatologist will review them and provide a treatment plan within 24 hours. Follow up via in-app messaging for 7 days after your results. Eczema • psoriasis • poison ivy • rashes • rosacea • and more Set up your account or log in to get started today Visit Teladoc.com Call 1-800-TELADOC (800-835-2362) | Download the app Refer to your employee booklet at umr.com for Teladoc benefits © Teladoc Health, Inc. 2 Manhattanville Rd. Ste 203, Purchase, NY 10577. All rights reserved. The marks and logos of Teladoc Health and Teladoc Health wholly owned subsidiaries are trademarks of Teladoc Health, Inc. All programs and services are subject to applicable terms and conditions. Group ID: 486539 10E-211B_1812851_G_08182022_PC

Mental Health Feel like yourself again Is therapy right for you? Scan this QR code to take the 60- second quiz and find out. Build a relationship with an experienced therapist or psychiatrist of your choice by phone or video Our experts provide support for: •Anxiety, stress, depression •Relationship conflicts •Mood swings •Trauma and PTSD •Not feeling like yourself •Medication management Start making progress 1.Set up your account and fill out a brief medical history 2.Choose the expert you think will be the best fit for you 3.Pick the preferred dates and times that fit your schedule 4.Make progress from wherever you’re most comfortable Get started—it’s already part of your benefits Visit Teladoc.com Call 1-800-TELADOC (835-2362) | Download the app | Refer to your employee booklet at umr.com for Teladoc benefits © 2022 Teladoc Health, Inc. All rights reserved. Teladoc and the Teladoc logo are registered trademarks of Teladoc Health, Inc. All programs and services are subject to applicable terms and conditions. 10E-216_700593688_07072021 Group ID: 162667

Dental & Vision Benefit Summary Dental Plan In-Network Base Plan Buy Up Plan Calendar year Deductible (EEO/Family) $0,00 $0,00 Annual Maximum per Person $0,00 $0,00 Dental Maximum Rollover $0,00 $0,00 Preventive Dental Services Covered 100%, no deductible Covered 100%, no deductible Basic Dental Services 80% after deductible is satisfied 80% after deductible is satisfied Major Dental Services 50% after deductible is satisfied 50% after deductible is satisfied Covered 50% with lifetime max of Orthodontia Services Not covered $0 per person; this service is not subject to the deductible Network = Delta Dental PPO and Delta Dental Premier. You will pay the least amount out of your pocket, and your annual maximum dollars will stretch further when you see a Dental Dental PPO provider. The primary difference in benefits between the Base Plan and Buy-Up Plan is the annual maximum available under the plan and orthodontic services (only available under the Buy-Up plan). With the Maximum Carryover Provision, you may carryover a portion of maximum to the next calendar maximum payment. You will qualify if you have at least one covered service paid in a calendar year and the benefit paid does not exceed $500 in the calendar year. If you use Delta Dental PPO providers, the amount you are eligible to carryover increases to $350 in a calendar year. If you use Premier or Non-participating providers, the amount you are eligible to carryover is reduced to $250 in a calendar year. This amount automatically accumulates from one calendar year to the next but will not exceed $1,000. *Note: if no covered services are paid in a calendar year all carryover dollars from previous years will be forfeited. Please review your certificate of coverage for a complete list of services covered by the plan. Vision Plan In-Network Frequency Base (Davis) Plan Buy Up (VSP) Plan Vision Exam Services Once per calendar year $0 copay $0 copay Glasses Lenses Once per calendar year $0 copay $0 copay (Single/Bifocal/Trifocal/Lenticular) $0 retail frame $0 retail frame Glasses Frames Once per calendar year allowance +20% off allowance +20% off remaining balance remaining balance Contact Lenses (Medically $0 copay/$25 $0 copay/$0 retail Necessary/Elective) Once per calendar year copay with $0 allowance retail allowance Page 11 | ACME | Plan Year 2024 Open Enrollment This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

Contact Information Medical – UMR Claims Payer Phone: (800) 826-9781 Website: www.umr.com Important Contact 1 Medical - Surest PPO Information: Phone: (866) 683-6440 Please utilize the website resources for Website: www.surest.com provider information, pharmacy information, and general claims Dental – Delta Dental information. 2 Phone: (800) 524-0149 The Customer Service phone numbers can Website: www.deltadentalin.com assist you with benefits and specific claims Dental Network: Delta Dental PPO questions. 3 Vision - Guardian Phone: (800) 541-7846 Website: www.guardiananytime.com Additional education pieces Human Resources and resources are available. Marcia Maria – 000-000-0000 Talk to your HR team for more 4 [email protected] information. John Doe – 000-000-0000 [email protected] 5 Paycom – COBRA Paycom COBRA: (800) 580-4505 [email protected] Page 12 | ACME | Plan Year 2024 Open Enrollment This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

ACME Cobra Election Form 2024 Last Name: First: M.I.: Social Security Number: I elect: Buy Up MEDICAL DENTAL-Delta Dental VISION HDHP Base HDHP Surest Buy Up Base Buy Up Base (Davis) Employee Only $0,00 $0,00 $0,00 $0,00 $0,00 $0,00 $0,00 Employee + Spouse $0,00 $0,00 $0,00 $0,00 $0,00 $0,00 $0,00 Employee + Child(ren) $0,00 $0,00 $0,00 $0,00 $0,00 $0,00 $0,00 Employee + Family $0,00 $0,00 $0,00 $0,00 $0,00 $0,00 $0,00 : : Signature Date NOTE: If you are still in your election period and have not elected COBRA continuation, you must complete the COBRA continuation form you received from Paycom. If you no longer have the form, please contact Paycom at 800-580-4505. Please return this form to ACME within 10 days. Page 13 | ACME | Plan Year 2024 Open Enrollment This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.

Notes Date: Page 14 | ACME | Plan Year 2024 Open Enrollment This booklet provides only a summary of your benefits. All services described within are subject to the definitions, limitations, and exclusions set forth in each insurance carrier or provider’s contract.