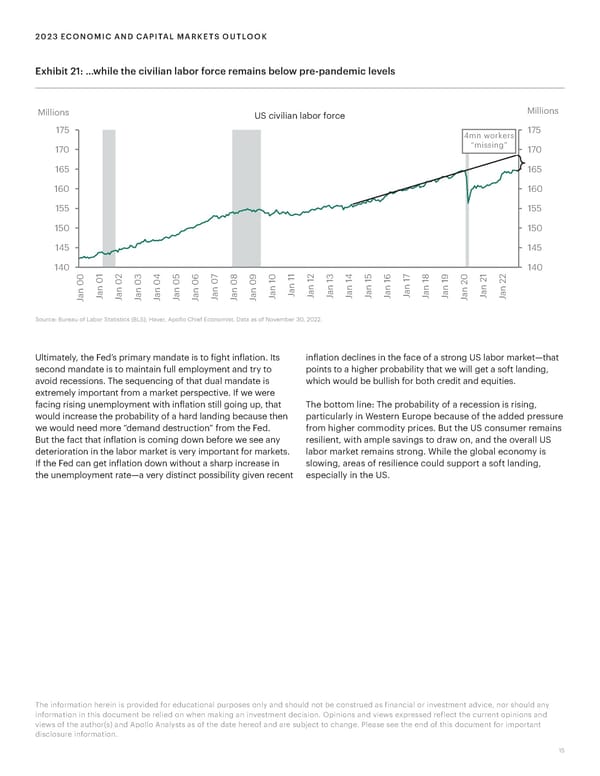

2023 ECONOMIC AND CAPITAL MARKETS OUTLOOK Exhibit 21: …while the civilian labor force remains below pre-pandemic levels Millions US civilian labor force Millions 175 4mn workers 175 170 “missin” 170 165 165 160 160 155 155 150 150 145 145 140 1 2 5 7 1 2 5 7 1 2 140 0 3 4 6 8 9 0 1 1 3 4 1 6 1 8 9 0 2 0 0 0 0 1 1 1 1 1 1 2 2 0 0 0 0 0 0 n n n n n n n n n n n n n n n n n n a n n n a n n a a a a a a a a a a a a a J a a a a a J a a J J J J J J J J J J a J J J J J J J J J J J Source: Bureau of Labor Statistics (BLS), Haver, Apollo Chief Economist. Data as of November 30, 2022. Ultimately, the Fed’s primary mandate is to fight inflation. Its inflation declines in the face of a strong US labor market—that second mandate is to maintain full employment and try to points to a higher probability that we will get a soft landing, avoid recessions. The sequencing of that dual mandate is which would be bullish for both credit and equities. extremely important from a market perspective. If we were facing rising unemployment with inflation still going up, that The bottom line: The probability of a recession is rising, would increase the probability of a hard landing because then particularly in Western Europe because of the added pressure we would need more “demand destruction” from the Fed. from higher commodity prices. But the US consumer remains But the fact that inflation is coming down before we see any resilient, with ample savings to draw on, and the overall US deterioration in the labor market is very important for markets. labor market remains strong. While the global economy is If the Fed can get inflation down without a sharp increase in slowing, areas of resilience could support a soft landing, the unemployment rate—a very distinct possibility given recent especially in the US. The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Apollo Analysts as of the date hereof and are subject to change. Please see the end of this document for important disclosure information. 15

Apollo 2023 Economic and Capital Markets Outlook Page 14 Page 16

Apollo 2023 Economic and Capital Markets Outlook Page 14 Page 16