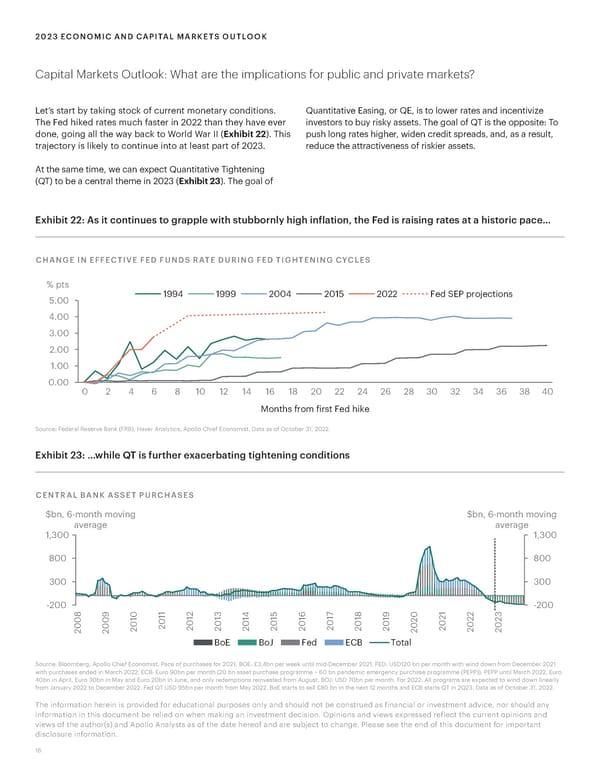

2023 ECONOMIC AND CAPITAL MARKETS OUTLOOK Capital Markets Outlook: What are the implications for public and private markets? Let’s start by taking stock of current monetary conditions. Quantitative Easing, or QE, is to lower rates and incentivize The Fed hiked rates much faster in 2022 than they have ever investors to buy risky assets. The goal of QT is the opposite: To done, going all the way back to World War II (Exhibit 22). This push long rates higher, widen credit spreads, and, as a result, trajectory is likely to continue into at least part of 2023. reduce the attractiveness of riskier assets. At the same time, we can expect Quantitative Tightening (QT) to be a central theme in 2023 (Exhibit 23). The goal of Exhibit 22: As it continues to grapple with stubbornly high inflation, the Fed is raising rates at a historic pace… CHANGE IN EFFECTIVE FED FUNDS RATE DURING FED TIGHTENING CYCLES % pts 5.00 1994 1999 2004 2015 2022 Fed SEP projetions 4.00 3.00 2.00 1.00 0.00 0 2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 Months from first Fed hike Source: Federal Reserve Bank (FRB), Haver Analytics, Apollo Chief Economist. Data as of October 31, 2022. Exhibit 23: …while QT is further exacerbating tightening conditions CENTRAL BANK ASSET PURCHASES $bn, 6-month moving $bn, 6-month moving average average 1,300 1,300 800 800 300 300 -200 1 2 5 7 1 2 -200 8 9 0 1 1 3 4 1 6 1 8 9 0 2 3 0 0 1 0 0 1 1 0 1 0 1 1 2 0 2 2 0 0 0 2 2 0 0 2 0 2 0 0 0 2 0 0 2 2 2 2 2 2 2 2 2 2 2 BoE BoJ Fed EB ota Source: Bloomberg, Apollo Chief Economist. Pace of purchases for 2021: BOE: £3.4bn per week until mid-December 2021, FED: USD120 bn per month with wind down from December 2021 with purchases ended in March 2022, ECB: Euro 90bn per month (20 bn asset purchase programme + 60 bn pandemic emergency purchase programme (PEPP)), PEPP until March 2022, Euro 40bn in April, Euro 30bn in May and Euro 20bn in June, and only redemptions reinvested from August. BOJ: USD 70bn per month. For 2022: All programs are expected to wind down linearly from January 2022 to December 2022. Fed QT USD 95bn per month from May 2022. BoE starts to sell £80 bn in the next 12 months and ECB starts QT in 2Q23. Data as of October 31, 2022. The information herein is provided for educational purposes only and should not be construed as financial or investment advice, nor should any information in this document be relied on when making an investment decision. Opinions and views expressed reflect the current opinions and views of the author(s) and Apollo Analysts as of the date hereof and are subject to change. Please see the end of this document for important disclosure information. 16

Apollo 2023 Economic and Capital Markets Outlook Page 15 Page 17

Apollo 2023 Economic and Capital Markets Outlook Page 15 Page 17