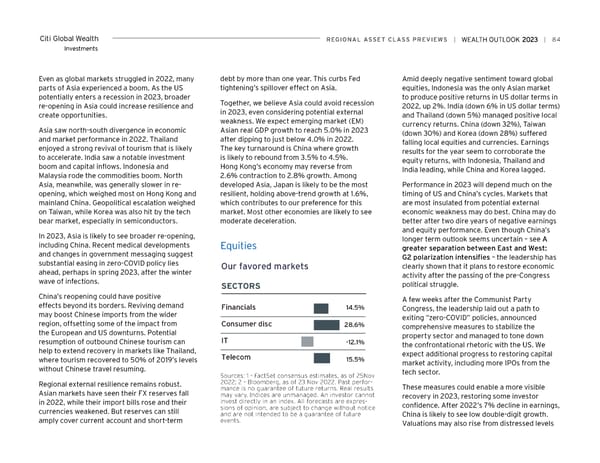

Citi Global Wealth reGioNAL ASSeT CLASS PreviewS | | 84 Investments Even as global markets struggled in 2022, many debt by more than one year. This curbs Fed Amid deeply negative sentiment toward global parts of Asia experienced a boom. As the US tightening’s spillover effect on Asia. equities, Indonesia was the only Asian market potentially enters a recession in 2023, broader to produce positive returns in US dollar terms in re-opening in Asia could increase resilience and Together, we believe Asia could avoid recession 2022, up 2%. India (down 6% in US dollar terms) create opportunities. in 2023, even considering potential external and Thailand (down 5%) managed positive local weakness. We expect emerging market (EM) currency returns. China (down 32%), Taiwan Asia saw north-south divergence in economic Asian real GDP growth to reach 5.0% in 2023 (down 30%) and Korea (down 28%) suffered and market performance in 2022. Thailand after dipping to just below 4.0% in 2022. falling local equities and currencies. Earnings enjoyed a strong revival of tourism that is likely The key turnaround is China where growth results for the year seem to corroborate the to accelerate. India saw a notable investment is likely to rebound from 3.5% to 4.5%. equity returns, with Indonesia, Thailand and boom and capital inflows. Indonesia and Hong Kong’s economy may reverse from India leading, while China and Korea lagged. Malaysia rode the commodities boom. North 2.6% contraction to 2.8% growth. Among Asia, meanwhile, was generally slower in re- developed Asia, Japan is likely to be the most Performance in 2023 will depend much on the opening, which weighed most on Hong Kong and resilient, holding above-trend growth at 1.6%, timing of US and China’s cycles. Markets that mainland China. Geopolitical escalation weighed which contributes to our preference for this are most insulated from potential external on Taiwan, while Korea was also hit by the tech market. Most other economies are likely to see economic weakness may do best. China may do bear market, especially in semiconductors. moderate deceleration. better after two dire years of negative earnings and equity performance. Even though China’s In 2023, Asia is likely to see broader re-opening, longer term outlook seems uncertain – see A including China. Recent medical developments Equities greater separation between East and West: and changes in government messaging suggest G2 polarization intensifies – the leadership has substantial easing in zero-COVID policy lies Our favored markets clearly shown that it plans to restore economic ahead, perhaps in spring 2023, after the winter activity after the passing of the pre-Congress wave of infections. SECTORS political struggle. China’s reopening could have positive A few weeks after the Communist Party effects beyond its borders. Reviving demand Financials 14.5% Congress, the leadership laid out a path to may boost Chinese imports from the wider exiting “zero-COVID” policies, announced region, offsetting some of the impact from Consumer disc 28.6% comprehensive measures to stabilize the the European and US downturns. Potential property sector and managed to tone down resumption of outbound Chinese tourism can IT -12.1% the confrontational rhetoric with the US. We help to extend recovery in markets like Thailand, expect additional progress to restoring capital where tourism recovered to 50% of 2019’s levels Telecom 15.5% market activity, including more IPOs from the without Chinese travel resuming. tech sector. Sources: 1 - FactSet consensus estimates, as of 25Nov Regional external resilience remains robust. 2022; 2 - Bloomberg, as of 23 Nov 2022. Past perfor- These measures could enable a more visible Asian markets have seen their FX reserves fall mance is no guarantee of future returns. Real results may vary. Indices are unmanaged. An investor cannot recovery in 2023, restoring some investor in 2022, while their import bills rose and their invest directly in an index. All forecasts are expres- confidence. After 2022’s 7% decline in earnings, currencies weakened. But reserves can still sions of opinion, are subject to change without notice and are not intended to be a guarantee of future China is likely to see low double-digit growth. amply cover current account and short-term events. Valuations may also rise from distressed levels

Citi Wealth Outlook 2023 Page 83 Page 85

Citi Wealth Outlook 2023 Page 83 Page 85