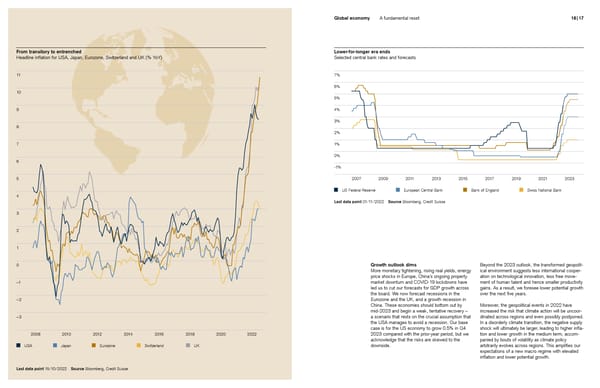

Global economy A fundamental reset 16 | 17 From transitory to entrenched Lower-for-longer era ends Headline inflation for USA, Japan, Eurozone, Switzerland and UK (% YoY) Selected central bank rates and forecasts 11 7% 6% 10 5% 9 4% 3% 8 2% 7 1% 0% 6 -1% 5 2007 2009 2011 2013 2015 2017 2019 2021 2023 US Federal Reserve European Central Bank Bank of England Swiss National Bank 4 Last data point 01/11/2022 Source Bloomberg, Credit Suisse 3 2 1 0 Growth outlook dims Beyond the 2023 outlook, the transformed geopolit- More monetary tightening, rising real yields, energy ical environment suggests less international cooper- price shocks in Europe, China’s ongoing property ation on technological innovation, less free move- –1 market downturn and COVID-19 lockdowns have ment of human talent and hence smaller productivity led us to cut our forecasts for GDP growth across gains. As a result, we foresee lower potential growth the board. We now forecast recessions in the over the next five years. – 2 Eurozone and the UK, and a growth recession in China. These economies should bottom out by Moreover, the geopolitical events in 2022 have mid-2023 and begin a weak, tentative recovery – increased the risk that climate action will be uncoor- – 3 a scenario that rests on the crucial assumption that dinated across regions and even possibly postponed. the USA manages to avoid a recession. Our base In a disorderly climate transition, the negative supply case is for the US economy to grow 0.5% in Q4 shock will ultimately be larger, leading to higher infla- 2008 2010 2012 2014 2016 2018 2020 2022 2023 compared with the prior-year period, but we tion and lower growth in the medium term, accom- acknowledge that the risks are skewed to the panied by bouts of volatility as climate policy USA Japan Eurozone Switzerland UK downside. arbitrarily evolves across regions. This amplifies our expectations of a new macro regime with elevated inflation and lower potential growth. Last data point 15/10/2022 Source Bloomberg, Credit Suisse

Credit Suisse Investment Outlook 2023 Page 8 Page 10

Credit Suisse Investment Outlook 2023 Page 8 Page 10