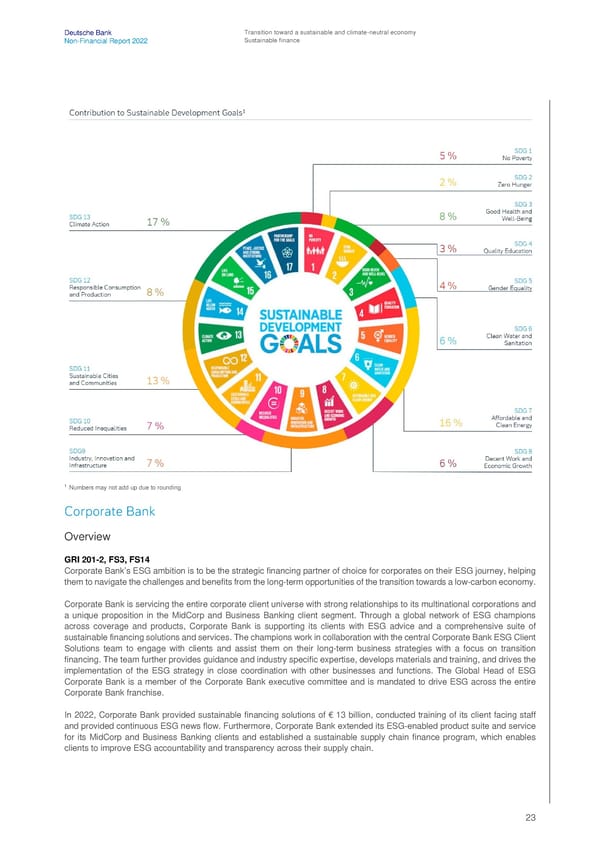

Deutsche Bank Transition toward a sustainable and climate-neutral economy Non-Financial Report 2022 Sustainable finance 1 Numbers may not add up due to rounding Corporate Bank Overview GRI 201-2, FS3, FS14 Corporate Bank’s ESG ambition is to be the strategic financing partner of choice for corporates on their ESG journey, helping them to navigate the challenges and benefits from the long-term opportunities of the transition towards a low-carbon economy. Corporate Bank is servicing the entire corporate client universe with strong relationships to its multinational corporations and a unique proposition in the MidCorp and Business Banking client segment. Through a global network of ESG champions across coverage and products, Corporate Bank is supporting its clients with ESG advice and a comprehensive suite of sustainable financing solutions and services. The champions work in collaboration with the central Corporate Bank ESG Client Solutions team to engage with clients and assist them on their long-term business strategies with a focus on transition financing. The team further provides guidance and industry specific expertise, develops materials and training, and drives the implementation of the ESG strategy in close coordination with other businesses and functions. The Global Head of ESG Corporate Bank is a member of the Corporate Bank executive committee and is mandated to drive ESG across the entire Corporate Bank franchise. In 2022, Corporate Bank provided sustainable financing solutions of € 13 billion, conducted training of its client facing staff and provided continuous ESG news flow. Furthermore, Corporate Bank extended its ESG-enabled product suite and service for its MidCorp and Business Banking clients and established a sustainable supply chain finance program, which enables clients to improve ESG accountability and transparency across their supply chain. 23

Deutsche Bank Non Financial Report Page 23 Page 25

Deutsche Bank Non Financial Report Page 23 Page 25