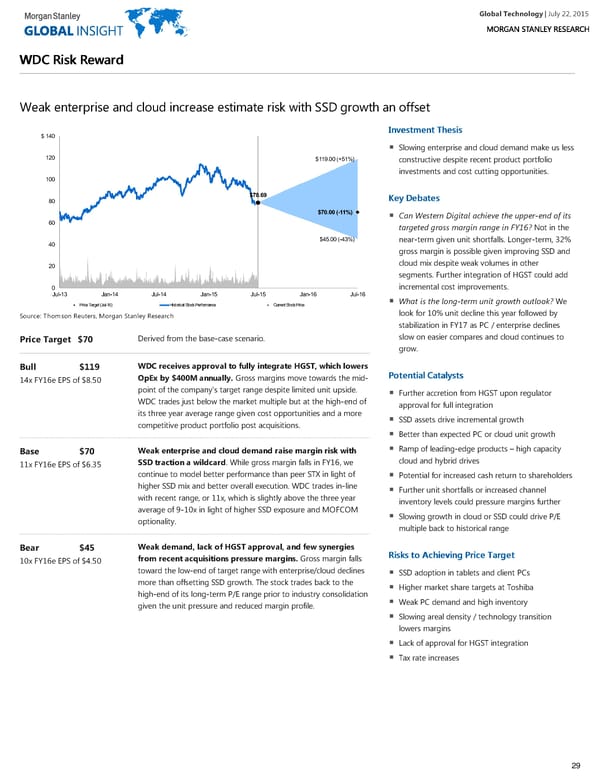

Global Technology| July 22, 2015 WWDDCC RRiisskk RReewwaarrdd Weak enterprise and cloud increase estimate risk with SSD growth an offset IInnvveessttmmeenntt TThheessiiss $140 Slowing enterprise and cloud demand make us less 120 $119.00 (+51%) constructive despite recent product portfolio investments and cost cutting opportunities. 100 $78.69 KKeeyy DDeebbaatteess 80 $70.00 (-11%) Can Western Digital achieve the upper-end of its 60 targeted gross margin range in FY16? Not in the $45.00 (-43%) near-term given unit shortfalls. Longer-term, 32% 40 gross margin is possible given improving SSD and cloud mix despite weak volumes in other 20 segments. Further integration of HGST could add incremental cost improvements. 0 Jul-13 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 What is the long-term unit growth outlook? We Price Target (Jul-16) Historical Stock Performance Current Stock Price WARNINGDONOTEDIT_RRS4RL~WDC.O~ look for 10% unit decline this year followed by Source: Thomson Reuters, Morgan Stanley Research stabilization in FY17 as PC / enterprise declines slow on easier compares and cloud continues to Derived from the base-case scenario. Price Target $70 grow. WDC receives approval to fully integrate HGST, which lowers Bull $119 PPootteennttiiaall CCaattaallyyssttss OpEx by $400M annually. Gross margins move towards the mid- 14x FY16e EPS of $8.50 point of the company’s target range despite limited unit upside. Further accretion from HGST upon regulator WDC trades just below the market multiple but at the high-end of approval for full integration its three year average range given cost opportunities and a more SSD assets drive incremental growth competitive product portfolio post acquisitions. Better than expected PC or cloud unit growth Ramp of leading-edge products – high capacity Weak enterprise and cloud demand raise margin risk with Base $70 cloud and hybrid drives SSD traction a wildcard. While gross margin falls in FY16, we 11x FY16e EPS of $6.35 continue to model better performance than peer STX in light of Potential for increased cash return to shareholders higher SSD mix and better overall execution. WDC trades in-line Further unit shortfalls or increased channel with recent range, or 11x, which is slightly above the three year inventory levels could pressure margins further average of 9-10x in light of higher SSD exposure and MOFCOM Slowing growth in cloud or SSD could drive P/E optionality. multiple back to historical range Weak demand, lack of HGST approval, and few synergies Bear $45 RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett from recent acquisitions pressure margins. Gross margin falls 10x FY16e EPS of $4.50 toward the low-end of target range with enterprise/cloud declines SSD adoption in tablets and client PCs more than offsetting SSD growth. The stock trades back to the Higher market share targets at Toshiba high-end of its long-term P/E range prior to industry consolidation Weak PC demand and high inventory given the unit pressure and reduced margin profile. Slowing areal density / technology transition lowers margins Lack of approval for HGST integration Tax rate increases 29

Global Technology Page 28 Page 30

Global Technology Page 28 Page 30