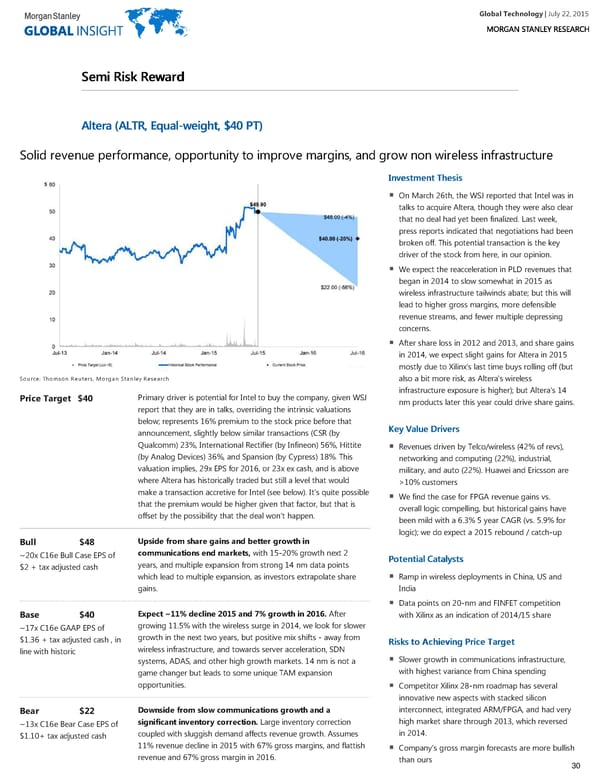

Global Technology| July 22, 2015 SSeemmii RRiisskk RReewwaarrdd AAlltteerraa ((AALLTTRR,, EEqquuaall--wweeiigghhtt,, $$4400 PPTT)) Solid revenue performance, opportunity to improve margins, and grow non wireless infrastructure IInnvveessttmmeenntt TThheessiiss On March 26th, the WSJ reported that Intel was in talks to acquire Altera, though they were also clear that no deal had yet been finalized. Last week, press reports indicated that negotiations had been broken off. This potential transaction is the key driver of the stock from here, in our opinion. We expect the reacceleration in PLD revenues that began in 2014 to slow somewhat in 2015 as wireless infrastructure tailwinds abate; but this will lead to higher gross margins, more defensible revenue streams, and fewer multiple depressing concerns. After share loss in 2012 and 2013, and share gains in 2014, we expect slight gains for Altera in 2015 mostly due to Xilinx's last time buys rolling off (but Source: Thomson Reuters, Morgan Stanley Research also a bit more risk, as Altera's wireless infrastructure exposure is higher); but Altera's 14 Primary driver is potential for Intel to buy the company, given WSJ Price Target $40 nm products later this year could drive share gains. report that they are in talks, overriding the intrinsic valuations below; represents 16% premium to the stock price before that KKeeyy VVaalluuee DDrriivveerrss announcement, slightly below similar transactions (CSR (by Qualcomm) 23%, International Rectifier (by Infineon) 56%, Hittite Revenues driven by Telco/wireless (42% of revs), (by Analog Devices) 36%, and Spansion (by Cypress) 18%. This networking and computing (22%), industrial, valuation implies, 29x EPS for 2016, or 23x ex cash, and is above military, and auto (22%). Huawei and Ericsson are where Altera has historically traded but still a level that would >10% customers make a transaction accretive for Intel (see below). It's quite possible We find the case for FPGA revenue gains vs. that the premium would be higher given that factor, but that is overall logic compelling, but historical gains have offset by the possibility that the deal won't happen. been mild with a 6.3% 5 year CAGR (vs. 5.9% for logic); we do expect a 2015 rebound / catch-up Upside from share gains and better growth in Bull $48 communications end markets, with 15-20% growth next 2 ~20x C16e Bull Case EPS of PPootteennttiiaall CCaattaallyyssttss years, and multiple expansion from strong 14 nm data points $2 + tax adjusted cash which lead to multiple expansion, as investors extrapolate share Ramp in wireless deployments in China, US and gains. India Data points on 20-nm and FINFET competition Expect ~11% decline 2015 and 7% growth in 2016. After Base $40 with Xilinx as an indication of 2014/15 share growing 11.5% with the wireless surge in 2014, we look for slower ~17x C16e GAAP EPS of growth in the next two years, but positive mix shifts - away from $1.36 + tax adjusted cash , in RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett wireless infrastructure, and towards server acceleration, SDN line with historic Slower growth in communications infrastructure, systems, ADAS, and other high growth markets. 14 nm is not a with highest variance from China spending game changer but leads to some unique TAM expansion opportunities. Competitor Xilinx 28-nm roadmap has several innovative new aspects with stacked silicon interconnect, integrated ARM/FPGA, and had very Downside from slow communications growth and a Bear $22 high market share through 2013, which reversed significant inventory correction. Large inventory correction ~13x C16e Bear Case EPS of in 2014. coupled with sluggish demand affects revenue growth. Assumes $1.10+ tax adjusted cash 11% revenue decline in 2015 with 67% gross margins, and flattish Company’s gross margin forecasts are more bullish revenue and 67% gross margin in 2016. than ours 30

Global Technology Page 29 Page 31

Global Technology Page 29 Page 31