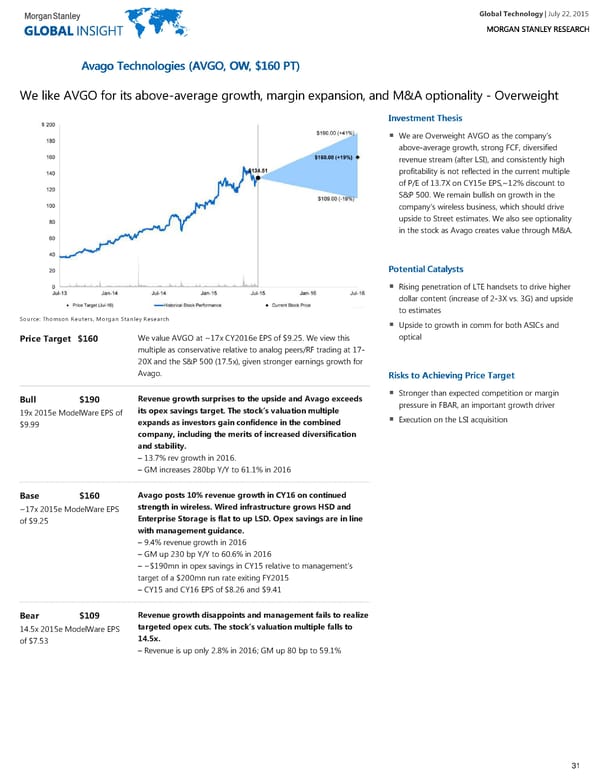

Global Technology| July 22, 2015 AAvvaaggoo TTeecchhnnoollooggiieess ((AAVVGGOO,, OOWW,, $$116600 PPTT)) We like AVGO for its above-average growth, margin expansion, and M&A optionality - Overweight IInnvveessttmmeenntt TThheessiiss We are Overweight AVGO as the company’s above-average growth, strong FCF, diversified revenue stream (after LSI), and consistently high profitability is not reflected in the current multiple of P/E of 13.7X on CY15e EPS,~12% discount to S&P 500. We remain bullish on growth in the company's wireless business, which should drive upside to Street estimates. We also see optionality in the stock as Avago creates value through M&A. PPootteennttiiaall CCaattaallyyssttss Rising penetration of LTE handsets to drive higher dollar content (increase of 2-3X vs. 3G) and upside to estimates Source: Thomson Reuters, Morgan Stanley Research Upside to growth in comm for both ASICs and optical We value AVGO at ~17x CY2016e EPS of $9.25. We view this Price Target $160 multiple as conservative relative to analog peers/RF trading at 17- 20X and the S&P 500 (17.5x), given stronger earnings growth for Avago. RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett Stronger than expected competition or margin Revenue growth surprises to the upside and Avago exceeds Bull $190 pressure in FBAR, an important growth driver its opex savings target. The stock’s valuation multiple 19x 2015e ModelWare EPS of Execution on the LSI acquisition expands as investors gain confidence in the combined $9.99 company, including the merits of increased diversification and stability. – 13.7% rev growth in 2016. – GM increases 280bp Y/Y to 61.1% in 2016 Avago posts 10% revenue growth in CY16 on continued Base $160 strength in wireless. Wired infrastructure grows HSD and ~17x 2015e ModelWare EPS Enterprise Storage is flat to up LSD. Opex savings are in line of $9.25 with management guidance. – 9.4% revenue growth in 2016 – GM up 230 bp Y/Y to 60.6% in 2016 – ~$190mn in opex savings in CY15 relative to management’s target of a $200mn run rate exiting FY2015 – CY15 and CY16 EPS of $8.26 and $9.41 Revenue growth disappoints and management fails to realize Bear $109 targeted opex cuts. The stock’s valuation multiple falls to 14.5x 2015e ModelWare EPS 14.5x. of $7.53 – Revenue is up only 2.8% in 2016; GM up 80 bp to 59.1% 31

Global Technology Page 30 Page 32

Global Technology Page 30 Page 32