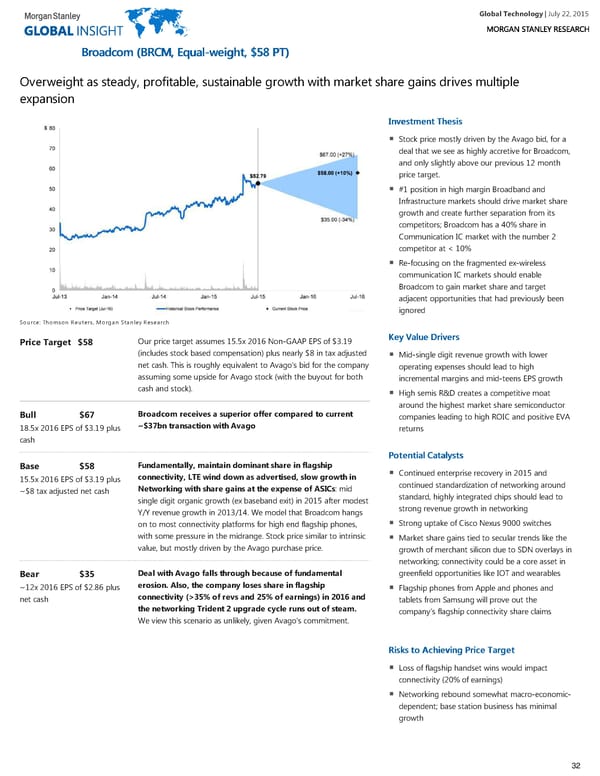

Global Technology| July 22, 2015 BBrrooaaddccoomm ((BBRRCCMM,, EEqquuaall--wweeiigghhtt,, $$5588 PPTT)) Overweight as steady, profitable, sustainable growth with market share gains drives multiple expansion IInnvveessttmmeenntt TThheessiiss Stock price mostly driven by the Avago bid, for a deal that we see as highly accretive for Broadcom, and only slightly above our previous 12 month price target. #1 position in high margin Broadband and Infrastructure markets should drive market share growth and create further separation from its competitors; Broadcom has a 40% share in Communication IC market with the number 2 competitor at < 10% Re-focusing on the fragmented ex-wireless communication IC markets should enable Broadcom to gain market share and target adjacent opportunities that had previously been ignored Source: Thomson Reuters, Morgan Stanley Research KKeeyy VVaalluuee DDrriivveerrss Our price target assumes 15.5x 2016 Non-GAAP EPS of $3.19 Price Target $58 (includes stock based compensation) plus nearly $8 in tax adjusted Mid-single digit revenue growth with lower net cash. This is roughly equivalent to Avago's bid for the company operating expenses should lead to high assuming some upside for Avago stock (with the buyout for both incremental margins and mid-teens EPS growth cash and stock). High semis R&D creates a competitive moat around the highest market share semiconductor Broadcom receives a superior offer compared to current Bull $67 companies leading to high ROIC and positive EVA ~$37bn transaction with Avago 18.5x 2016 EPS of $3.19 plus returns cash PPootteennttiiaall CCaattaallyyssttss Fundamentally, maintain dominant share in flagship Base $58 Continued enterprise recovery in 2015 and connectivity, LTE wind down as advertised, slow growth in 15.5x 2016 EPS of $3.19 plus continued standardization of networking around Networking with share gains at the expense of ASICs: mid ~$8 tax adjusted net cash standard, highly integrated chips should lead to single digit organic growth (ex baseband exit) in 2015 after modest strong revenue growth in networking Y/Y revenue growth in 2013/14. We model that Broadcom hangs Strong uptake of Cisco Nexus 9000 switches on to most connectivity platforms for high end flagship phones, with some pressure in the midrange. Stock price similar to intrinsic Market share gains tied to secular trends like the value, but mostly driven by the Avago purchase price. growth of merchant silicon due to SDN overlays in networking; connectivity could be a core asset in Deal with Avago falls through because of fundamental greenfield opportunities like IOT and wearables Bear $35 erosion. Also, the company loses share in flagship ~12x 2016 EPS of $2.86 plus Flagship phones from Apple and phones and connectivity (>35% of revs and 25% of earnings) in 2016 and net cash tablets from Samsung will prove out the the networking Trident 2 upgrade cycle runs out of steam. company’s flagship connectivity share claims We view this scenario as unlikely, given Avago's commitment. RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett Loss of flagship handset wins would impact connectivity (20% of earnings) Networking rebound somewhat macro-economic- dependent; base station business has minimal growth 32

Global Technology Page 31 Page 33

Global Technology Page 31 Page 33