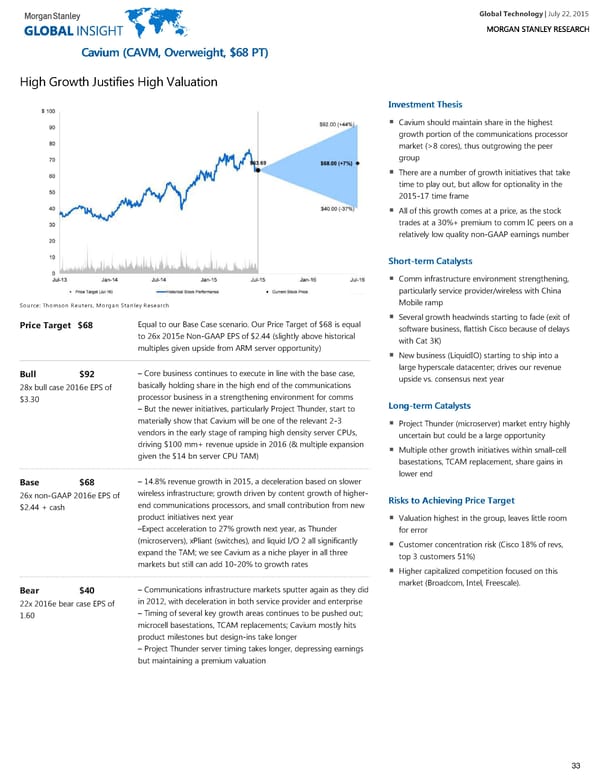

Global Technology| July 22, 2015 CCaavviiuumm ((CCAAVVMM,, OOvveerrwweeiigghhtt,, $$6688 PPTT)) High Growth Justifies High Valuation IInnvveessttmmeenntt TThheessiiss Cavium should maintain share in the highest growth portion of the communications processor market (>8 cores), thus outgrowing the peer group There are a number of growth initiatives that take time to play out, but allow for optionality in the 2015-17 time frame All of this growth comes at a price, as the stock trades at a 30%+ premium to comm IC peers on a relatively low quality non-GAAP earnings number SShhoorrtt--tteerrmm CCaattaallyyssttss Comm infrastructure environment strengthening, particularly service provider/wireless with China Mobile ramp Source: Thomson Reuters, Morgan Stanley Research Several growth headwinds starting to fade (exit of Equal to our Base Case scenario. Our Price Target of $68 is equal Price Target $68 software business, flattish Cisco because of delays to 26x 2015e Non-GAAP EPS of $2.44 (slightly above historical with Cat 3K) multiples given upside from ARM server opportunity) New business (LiquidIO) starting to ship into a large hyperscale datacenter; drives our revenue – Core business continues to execute in line with the base case, Bull $92 upside vs. consensus next year basically holding share in the high end of the communications 28x bull case 2016e EPS of processor business in a strengthening environment for comms $3.30 LLoonngg--tteerrmm CCaattaallyyssttss – But the newer initiatives, particularly Project Thunder, start to materially show that Cavium will be one of the relevant 2-3 Project Thunder (microserver) market entry highly vendors in the early stage of ramping high density server CPUs, uncertain but could be a large opportunity driving $100 mm+ revenue upside in 2016 (& multiple expansion Multiple other growth initiatives within small-cell given the $14 bn server CPU TAM) basestations, TCAM replacement, share gains in lower end – 14.8% revenue growth in 2015, a deceleration based on slower Base $68 wireless infrastructure; growth driven by content growth of higher- 26x non-GAAP 2016e EPS of RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett end communications processors, and small contribution from new $2.44 + cash product initiatives next year Valuation highest in the group, leaves little room –Expect acceleration to 27% growth next year, as Thunder for error (microservers), xPliant (switches), and liquid I/O 2 all significantly Customer concentration risk (Cisco 18% of revs, expand the TAM; we see Cavium as a niche player in all three top 3 customers 51%) markets but still can add 10-20% to growth rates Higher capitalized competition focused on this market (Broadcom, Intel, Freescale). – Communications infrastructure markets sputter again as they did Bear $40 in 2012, with deceleration in both service provider and enterprise 22x 2016e bear case EPS of – Timing of several key growth areas continues to be pushed out; 1.60 microcell basestations, TCAM replacements; Cavium mostly hits product milestones but design-ins take longer – Project Thunder server timing takes longer, depressing earnings but maintaining a premium valuation 33

Global Technology Page 32 Page 34

Global Technology Page 32 Page 34