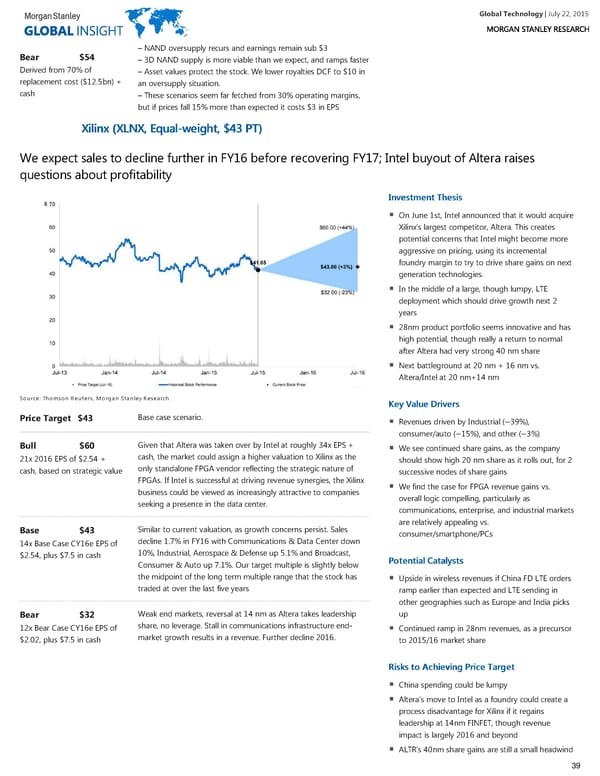

Global Technology| July 22, 2015 – NAND oversupply recurs and earnings remain sub $3 Bear $54 – 3D NAND supply is more viable than we expect, and ramps faster Derived from 70% of – Asset values protect the stock. We lower royalties DCF to $10 in replacement cost ($12.5bn) + an oversupply situation. cash – These scenarios seem far fetched from 30% operating margins, but if prices fall 15% more than expected it costs $3 in EPS XXiilliinnxx ((XXLLNNXX,, EEqquuaall--wweeiigghhtt,, $$4433 PPTT)) We expect sales to decline further in FY16 before recovering FY17; Intel buyout of Altera raises questions about profitability IInnvveessttmmeenntt TThheessiiss On June 1st, Intel announced that it would acquire Xilinx's largest competitor, Altera. This creates potential concerns that Intel might become more aggressive on pricing, using its incremental foundry margin to try to drive share gains on next generation technologies. In the middle of a large, though lumpy, LTE deployment which should drive growth next 2 years 28nm product portfolio seems innovative and has high potential, though really a return to normal after Altera had very strong 40 nm share Next battleground at 20 nm + 16 nm vs. Altera/Intel at 20 nm+14 nm Source: Thomson Reuters, Morgan Stanley Research KKeeyy VVaalluuee DDrriivveerrss Base case scenario. Price Target $43 Revenues driven by Industrial (~39%), consumer/auto (~15%), and other (~3%) Given that Altera was taken over by Intel at roughly 34x EPS + Bull $60 We see continued share gains, as the company cash, the market could assign a higher valuation to Xilinx as the 21x 2016 EPS of $2.54 + should show high 20 nm share as it rolls out, for 2 only standalone FPGA vendor reflecting the strategic nature of cash, based on strategic value successive nodes of share gains FPGAs. If Intel is successful at driving revenue synergies, the Xilinx We find the case for FPGA revenue gains vs. business could be viewed as increasingly attractive to companies overall logic compelling, particularly as seeking a presence in the data center. communications, enterprise, and industrial markets are relatively appealing vs. Similar to current valuation, as growth concerns persist. Sales Base $43 consumer/smartphone/PCs decline 1.7% in FY16 with Communications & Data Center down 14x Base Case CY16e EPS of 10%, Industrial, Aerospace & Defense up 5.1% and Broadcast, $2.54, plus $7.5 in cash PPootteennttiiaall CCaattaallyyssttss Consumer & Auto up 7.1%. Our target multiple is slightly below the midpoint of the long term multiple range that the stock has Upside in wireless revenues if China FD LTE orders traded at over the last five years ramp earlier than expected and LTE sending in other geographies such as Europe and India picks Weak end markets, reversal at 14 nm as Altera takes leadership up Bear $32 share, no leverage. Stall in communications infrastructure end- 12x Bear Case CY16e EPS of Continued ramp in 28nm revenues, as a precursor market growth results in a revenue. Further decline 2016. $2.02, plus $7.5 in cash to 2015/16 market share RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett China spending could be lumpy Altera’s move to Intel as a foundry could create a process disadvantage for Xilinx if it regains leadership at 14nm FINFET, though revenue impact is largely 2016 and beyond ALTR’s 40nm share gains are still a small headwind 39

Global Technology Page 38 Page 40

Global Technology Page 38 Page 40