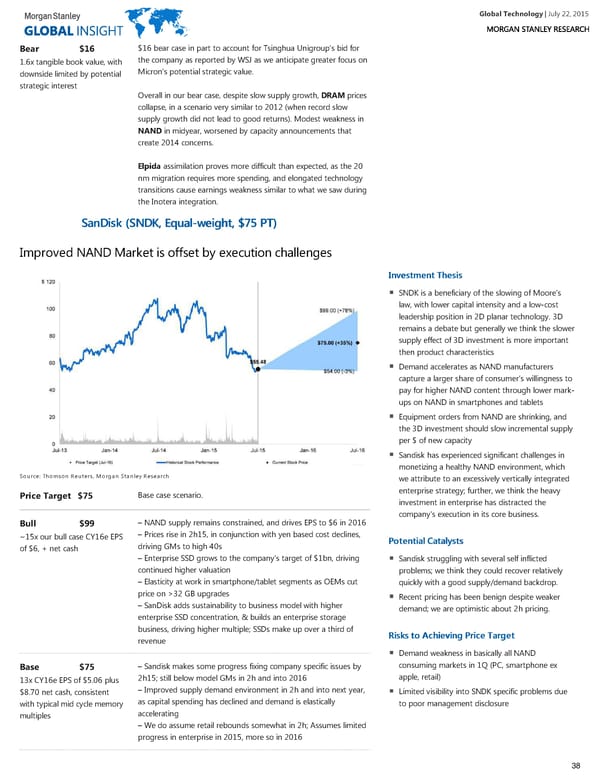

Global Technology| July 22, 2015 $16 bear case in part to account for Tsinghua Unigroup's bid for Bear $16 the company as reported by WSJ as we anticipate greater focus on 1.6x tangible book value, with Micron's potential strategic value. downside limited by potential strategic interest Overall in our bear case, despite slow supply growth, DRAM prices collapse, in a scenario very similar to 2012 (when record slow supply growth did not lead to good returns). Modest weakness in NAND in midyear, worsened by capacity announcements that create 2014 concerns. Elpida assimilation proves more difficult than expected, as the 20 nm migration requires more spending, and elongated technology transitions cause earnings weakness similar to what we saw during the Inotera integration. SSaannDDiisskk ((SSNNDDKK,, EEqquuaall--wweeiigghhtt,, $$7755 PPTT)) Improved NAND Market is offset by execution challenges IInnvveessttmmeenntt TThheessiiss SNDK is a beneficiary of the slowing of Moore’s law, with lower capital intensity and a low-cost leadership position in 2D planar technology. 3D remains a debate but generally we think the slower supply effect of 3D investment is more important then product characteristics Demand accelerates as NAND manufacturers capture a larger share of consumer’s willingness to pay for higher NAND content through lower mark- ups on NAND in smartphones and tablets Equipment orders from NAND are shrinking, and the 3D investment should slow incremental supply per $ of new capacity Sandisk has experienced significant challenges in monetizing a healthy NAND environment, which Source: Thomson Reuters, Morgan Stanley Research we attribute to an excessively vertically integrated enterprise strategy; further, we think the heavy Base case scenario. Price Target $75 investment in enterprise has distracted the company's execution in its core business. – NAND supply remains constrained, and drives EPS to $6 in 2016 Bull $99 – Prices rise in 2h15, in conjunction with yen based cost declines, ~15x our bull case CY16e EPS PPootteennttiiaall CCaattaallyyssttss driving GMs to high 40s of $6, + net cash – Enterprise SSD grows to the company’s target of $1bn, driving Sandisk struggling with several self inflicted continued higher valuation problems; we think they could recover relatively – Elasticity at work in smartphone/tablet segments as OEMs cut quickly with a good supply/demand backdrop. price on >32 GB upgrades Recent pricing has been benign despite weaker – SanDisk adds sustainability to business model with higher demand; we are optimistic about 2h pricing. enterprise SSD concentration, & builds an enterprise storage business, driving higher multiple; SSDs make up over a third of RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett revenue Demand weakness in basically all NAND consuming markets in 1Q (PC, smartphone ex – Sandisk makes some progress fixing company specific issues by Base $75 apple, retail) 2h15; still below model GMs in 2h and into 2016 13x CY16e EPS of $5.06 plus – Improved supply demand environment in 2h and into next year, Limited visibility into SNDK specific problems due $8.70 net cash, consistent as capital spending has declined and demand is elastically to poor management disclosure with typical mid cycle memory accelerating multiples – We do assume retail rebounds somewhat in 2h; Assumes limited progress in enterprise in 2015, more so in 2016 38

Global Technology Page 37 Page 39

Global Technology Page 37 Page 39