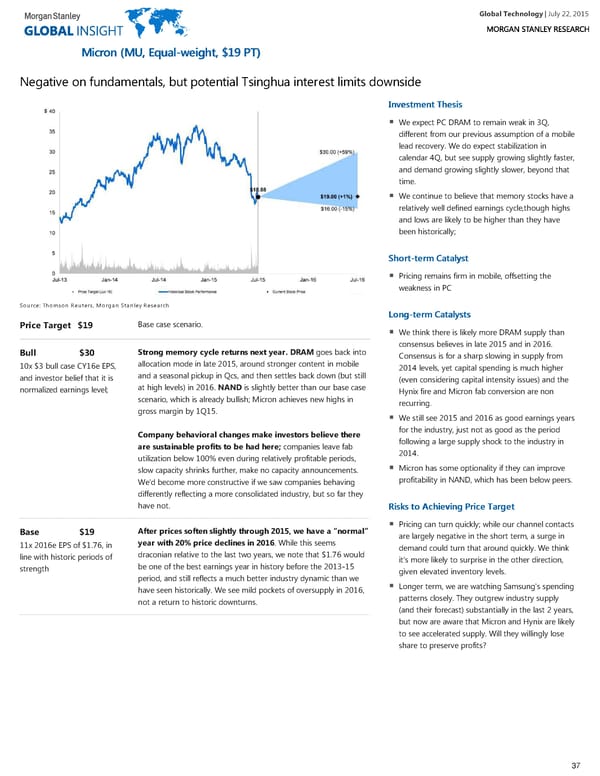

Global Technology| July 22, 2015 MMiiccrroonn ((MMUU,, EEqquuaall--wweeiigghhtt,, $$1199 PPTT)) Negative on fundamentals, but potential Tsinghua interest limits downside IInnvveessttmmeenntt TThheessiiss We expect PC DRAM to remain weak in 3Q, different from our previous assumption of a mobile lead recovery. We do expect stabilization in calendar 4Q, but see supply growing slightly faster, and demand growing slightly slower, beyond that time. We continue to believe that memory stocks have a relatively well defined earnings cycle,though highs and lows are likely to be higher than they have been historically; SShhoorrtt--tteerrmm CCaattaallyysstt Pricing remains firm in mobile, offsetting the weakness in PC Source: Thomson Reuters, Morgan Stanley Research LLoonngg--tteerrmm CCaattaallyyssttss Base case scenario. Price Target $19 We think there is likely more DRAM supply than consensus believes in late 2015 and in 2016. Strong memory cycle returns next year. DRAM goes back into Bull $30 Consensus is for a sharp slowing in supply from allocation mode in late 2015, around stronger content in mobile 10x $3 bull case CY16e EPS, 2014 levels, yet capital spending is much higher and a seasonal pickup in Qcs, and then settles back down (but still and investor belief that it is (even considering capital intensity issues) and the at high levels) in 2016. NAND is slightly better than our base case normalized earnings level; Hynix fire and Micron fab conversion are non scenario, which is already bullish; Micron achieves new highs in recurring. gross margin by 1Q15. We still see 2015 and 2016 as good earnings years for the industry, just not as good as the period Company behavioral changes make investors believe there following a large supply shock to the industry in are sustainable profits to be had here; companies leave fab 2014. utilization below 100% even during relatively profitable periods, Micron has some optionality if they can improve slow capacity shrinks further, make no capacity announcements. profitability in NAND, which has been below peers. We'd become more constructive if we saw companies behaving differently reflecting a more consolidated industry, but so far they have not. RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett Pricing can turn quickly; while our channel contacts After prices soften slightly through 2015, we have a “normal” Base $19 are largely negative in the short term, a surge in year with 20% price declines in 2016. While this seems 11x 2016e EPS of $1.76, in demand could turn that around quickly. We think draconian relative to the last two years, we note that $1.76 would line with historic periods of it's more likely to surprise in the other direction, be one of the best earnings year in history before the 2013-15 strength given elevated inventory levels. period, and still reflects a much better industry dynamic than we Longer term, we are watching Samsung's spending have seen historically. We see mild pockets of oversupply in 2016, patterns closely. They outgrew industry supply not a return to historic downturns. (and their forecast) substantially in the last 2 years, but now are aware that Micron and Hynix are likely to see accelerated supply. Will they willingly lose share to preserve profits? 37

Global Technology Page 36 Page 38

Global Technology Page 36 Page 38