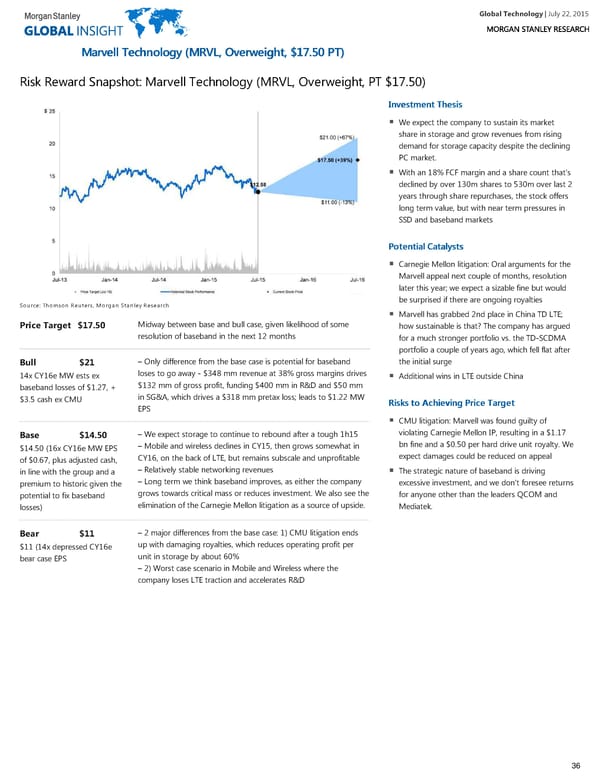

Global Technology| July 22, 2015 MMaarrvveellll TTeecchhnnoollooggyy ((MMRRVVLL,, OOvveerrwweeiigghhtt,, $$1177..5500 PPTT)) Risk Reward Snapshot: Marvell Technology (MRVL, Overweight, PT $17.50) IInnvveessttmmeenntt TThheessiiss We expect the company to sustain its market share in storage and grow revenues from rising demand for storage capacity despite the declining PC market. With an 18% FCF margin and a share count that’s declined by over 130m shares to 530m over last 2 years through share repurchases, the stock offers long term value, but with near term pressures in SSD and baseband markets PPootteennttiiaall CCaattaallyyssttss Carnegie Mellon litigation: Oral arguments for the Marvell appeal next couple of months, resolution later this year; we expect a sizable fine but would be surprised if there are ongoing royalties Source: Thomson Reuters, Morgan Stanley Research Marvell has grabbed 2nd place in China TD LTE; Midway between base and bull case, given likelihood of some Price Target $17.50 how sustainable is that? The company has argued resolution of baseband in the next 12 months for a much stronger portfolio vs. the TD-SCDMA portfolio a couple of years ago, which fell flat after – Only difference from the base case is potential for baseband the initial surge Bull $21 loses to go away - $348 mm revenue at 38% gross margins drives 14x CY16e MW ests ex Additional wins in LTE outside China $132 mm of gross profit, funding $400 mm in R&D and $50 mm baseband losses of $1.27, + in SG&A, which drives a $318 mm pretax loss; leads to $1.22 MW $3.5 cash ex CMU RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett EPS CMU litigation: Marvell was found guilty of violating Carnegie Mellon IP, resulting in a $1.17 – We expect storage to continue to rebound after a tough 1h15 Base $14.50 bn fine and a $0.50 per hard drive unit royalty. We – Mobile and wireless declines in CY15, then grows somewhat in $14.50 (16x CY16e MW EPS expect damages could be reduced on appeal CY16, on the back of LTE, but remains subscale and unprofitable of $0.67, plus adjusted cash, – Relatively stable networking revenues The strategic nature of baseband is driving in line with the group and a – Long term we think baseband improves, as either the company excessive investment, and we don’t foresee returns premium to historic given the grows towards critical mass or reduces investment. We also see the for anyone other than the leaders QCOM and potential to fix baseband elimination of the Carnegie Mellon litigation as a source of upside. Mediatek. losses) – 2 major differences from the base case: 1) CMU litigation ends Bear $11 up with damaging royalties, which reduces operating profit per $11 (14x depressed CY16e unit in storage by about 60% bear case EPS – 2) Worst case scenario in Mobile and Wireless where the company loses LTE traction and accelerates R&D 36

Global Technology Page 35 Page 37

Global Technology Page 35 Page 37