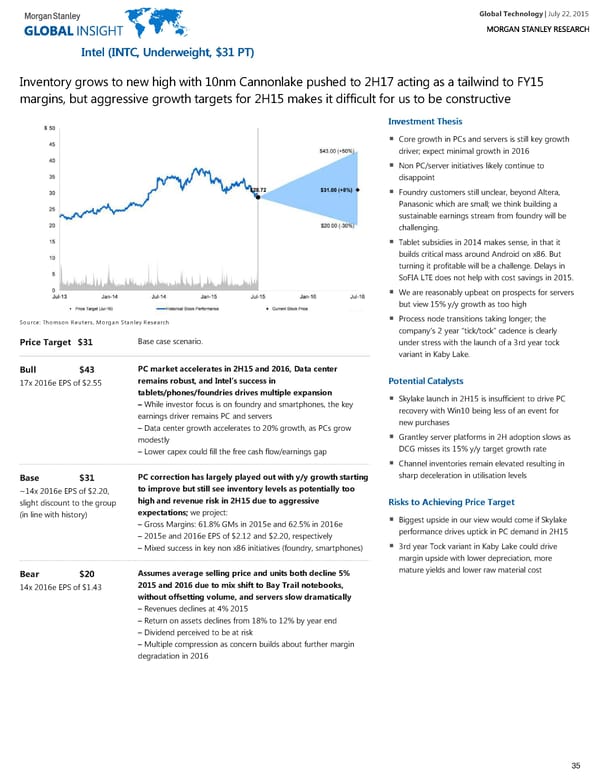

Global Technology| July 22, 2015 IInntteell ((IINNTTCC,, UUnnddeerrwweeiigghhtt,, $$3311 PPTT)) Inventory grows to new high with 10nm Cannonlake pushed to 2H17 acting as a tailwind to FY15 margins, but aggressive growth targets for 2H15 makes it difficult for us to be constructive IInnvveessttmmeenntt TThheessiiss Core growth in PCs and servers is still key growth driver; expect minimal growth in 2016 Non PC/server initiatives likely continue to disappoint Foundry customers still unclear, beyond Altera, Panasonic which are small; we think building a sustainable earnings stream from foundry will be challenging. Tablet subsidies in 2014 makes sense, in that it builds critical mass around Android on x86. But turning it profitable will be a challenge. Delays in SoFIA LTE does not help with cost savings in 2015. We are reasonably upbeat on prospects for servers but view 15% y/y growth as too high Process node transitions taking longer; the Source: Thomson Reuters, Morgan Stanley Research company’s 2 year “tick/tock” cadence is clearly Base case scenario. Price Target $31 under stress with the launch of a 3rd year tock variant in Kaby Lake. PC market accelerates in 2H15 and 2016, Data center Bull $43 remains robust, and Intel’s success in PPootteennttiiaall CCaattaallyyssttss 17x 2016e EPS of $2.55 tablets/phones/foundries drives multiple expansion Skylake launch in 2H15 is insufficient to drive PC – While investor focus is on foundry and smartphones, the key recovery with Win10 being less of an event for earnings driver remains PC and servers new purchases – Data center growth accelerates to 20% growth, as PCs grow Grantley server platforms in 2H adoption slows as modestly DCG misses its 15% y/y target growth rate – Lower capex could fill the free cash flow/earnings gap Channel inventories remain elevated resulting in sharp deceleration in utilisation levels PC correction has largely played out with y/y growth starting Base $31 to improve but still see inventory levels as potentially too ~14x 2016e EPS of $2.20, high and revenue risk in 2H15 due to aggressive RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett slight discount to the group expectations; we project: (in line with history) Biggest upside in our view would come if Skylake – Gross Margins: 61.8% GMs in 2015e and 62.5% in 2016e performance drives uptick in PC demand in 2H15 – 2015e and 2016e EPS of $2.12 and $2.20, respectively 3rd year Tock variant in Kaby Lake could drive – Mixed success in key non x86 initiatives (foundry, smartphones) margin upside with lower depreciation, more mature yields and lower raw material cost Assumes average selling price and units both decline 5% Bear $20 2015 and 2016 due to mix shift to Bay Trail notebooks, 14x 2016e EPS of $1.43 without offsetting volume, and servers slow dramatically – Revenues declines at 4% 2015 – Return on assets declines from 18% to 12% by year end – Dividend perceived to be at risk – Multiple compression as concern builds about further margin degradation in 2016 35

Global Technology Page 34 Page 36

Global Technology Page 34 Page 36