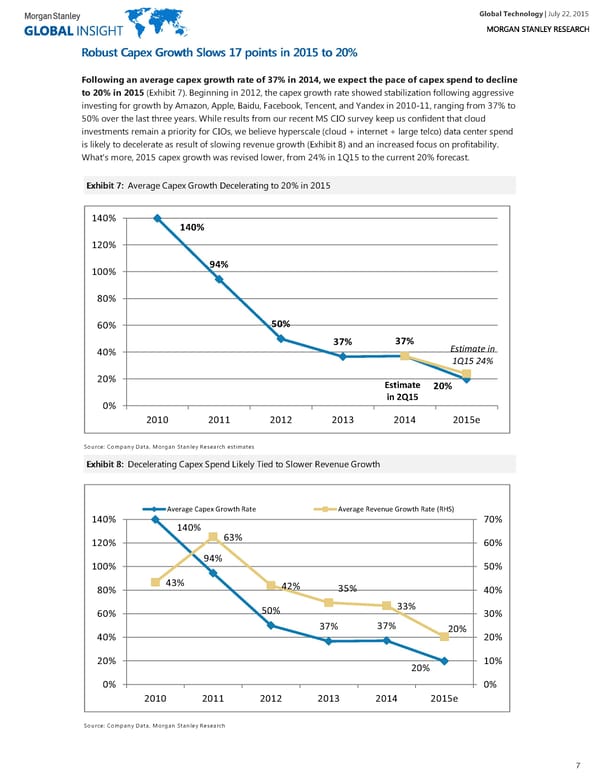

Global Technology| July 22, 2015 RRoobbuusstt CCaappeexx GGrroowwtthh SSlloowwss 1177 ppooiinnttss iinn 22001155 ttoo 2200%% Following an average capex growth rate of 37% in 2014, we expect the pace of capex spend to decline to 20% in 2015 (Exhibit 7). Beginning in 2012, the capex growth rate showed stabilization following aggressive investing for growth by Amazon, Apple, Baidu, Facebook, Tencent, and Yandex in 2010-11, ranging from 37% to 50% over the last three years. While results from our recent MS CIO survey keep us confident that cloud investments remain a priority for CIOs, we believe hyperscale (cloud + internet + large telco) data center spend is likely to decelerate as result of slowing revenue growth (Exhibit 8) and an increased focus on profitability. What's more, 2015 capex growth was revised lower, from 24% in 1Q15 to the current 20% forecast. EExxhhiibbiitt 77:: Average Capex Growth Decelerating to 20% in 2015 140% 140% 120% 94% 100% 80% 50% 60% 37% 37% Estimate in 40% 1Q15 24% 20% Estimate 20% in 2Q15 0% 2010 2011 2012 2013 2014 2015e Source: Company Data, Morgan Stanley Research estimates EExxhhiibbiitt 88:: Decelerating Capex Spend Likely Tied to Slower Revenue Growth Average Capex Growth Rate Average Revenue Growth Rate (RHS) 140% 70% 140% 63% 120% 60% 94% 100% 50% 43% 42% 35% 80% 40% 33% 50% 60% 30% 37% 37% 20% 40% 20% 20% 10% 20% 0% 0% 2010 2011 2012 2013 2014 2015e Source: Company Data, Morgan Stanley Research 7

Global Technology Page 6 Page 8

Global Technology Page 6 Page 8