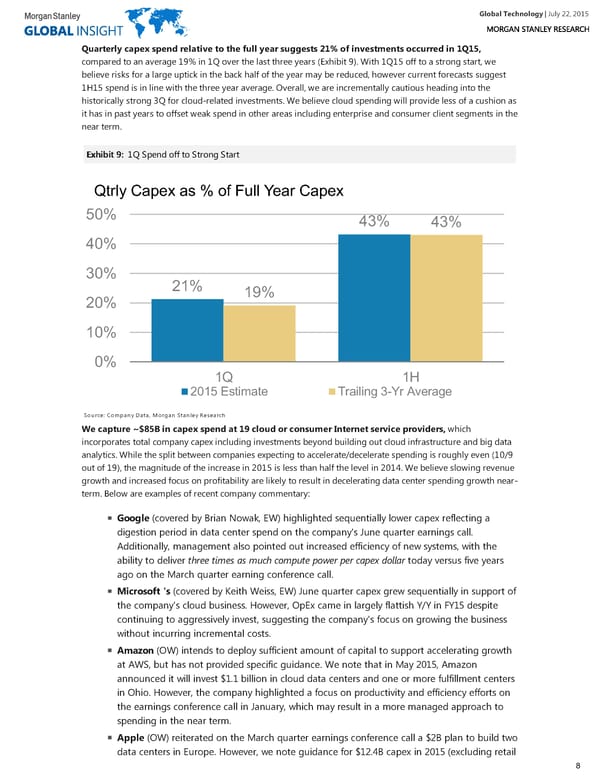

Global Technology| July 22, 2015 Quarterly capex spend relative to the full year suggests 21% of investments occurred in 1Q15, compared to an average 19% in 1Q over the last three years (Exhibit 9). With 1Q15 off to a strong start, we believe risks for a large uptick in the back half of the year may be reduced, however current forecasts suggest 1H15 spend is in line with the three year average. Overall, we are incrementally cautious heading into the historically strong 3Q for cloud-related investments. We believe cloud spending will provide less of a cushion as it has in past years to offset weak spend in other areas including enterprise and consumer client segments in the near term. EExxhhiibbiitt 99:: 1Q Spend off to Strong Start Qtrly Capex as % of Full Year Capex 50% 43% 43% 40% 30% 21% 19% 20% 10% 0% 1Q 1H 2015 Estimate Trailing 3-Yr Average Source: Company Data, Morgan Stanley Research We capture ~$85B in capex spend at 19 cloud or consumer Internet service providers, which incorporates total company capex including investments beyond building out cloud infrastructure and big data analytics. While the split between companies expecting to accelerate/decelerate spending is roughly even (10/9 out of 19), the magnitude of the increase in 2015 is less than half the level in 2014. We believe slowing revenue growth and increased focus on profitability are likely to result in decelerating data center spending growth near- term. Below are examples of recent company commentary: Google (covered by Brian Nowak, EW) highlighted sequentially lower capex reflecting a digestion period in data center spend on the company's June quarter earnings call. Additionally, management also pointed out increased efficiency of new systems, with the ability to deliver three times as much compute power per capex dollar today versus five years ago on the March quarter earning conference call. Microsoft 's (covered by Keith Weiss, EW) June quarter capex grew sequentially in support of the company's cloud business. However, OpEx came in largely flattish Y/Y in FY15 despite continuing to aggressively invest, suggesting the company's focus on growing the business without incurring incremental costs. Amazon (OW) intends to deploy sufficient amount of capital to support accelerating growth at AWS, but has not provided specific guidance. We note that in May 2015, Amazon announced it will invest $1.1 billion in cloud data centers and one or more fulfillment centers in Ohio. However, the company highlighted a focus on productivity and efficiency efforts on the earnings conference call in January, which may result in a more managed approach to spending in the near term. Apple (OW) reiterated on the March quarter earnings conference call a $2B plan to build two data centers in Europe. However, we note guidance for $12.4B capex in 2015 (excluding retail 8

Global Technology Page 7 Page 9

Global Technology Page 7 Page 9