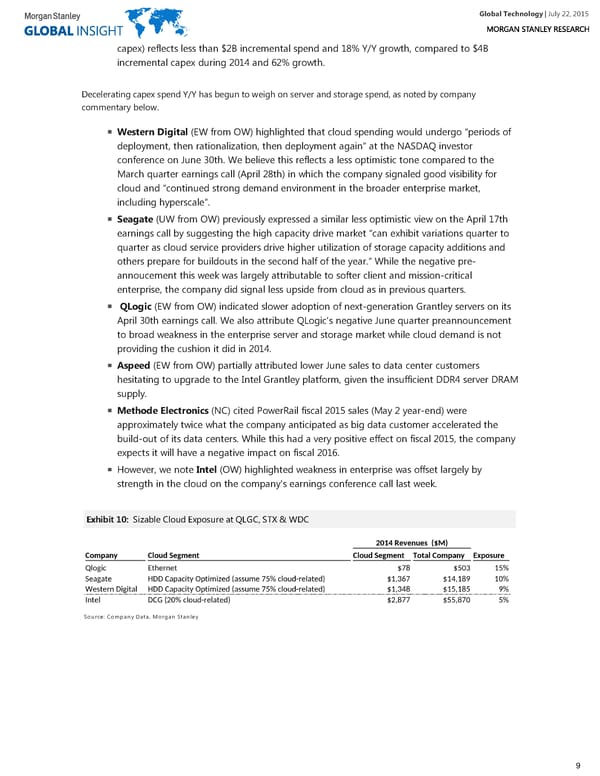

Global Technology| July 22, 2015 capex) reflects less than $2B incremental spend and 18% Y/Y growth, compared to $4B incremental capex during 2014 and 62% growth. Decelerating capex spend Y/Y has begun to weigh on server and storage spend, as noted by company commentary below. Western Digital (EW from OW) highlighted that cloud spending would undergo “periods of deployment, then rationalization, then deployment again” at the NASDAQ investor conference on June 30th. We believe this reflects a less optimistic tone compared to the March quarter earnings call (April 28th) in which the company signaled good visibility for cloud and “continued strong demand environment in the broader enterprise market, including hyperscale”. Seagate (UW from OW) previously expressed a similar less optimistic view on the April 17th earnings call by suggesting the high capacity drive market “can exhibit variations quarter to quarter as cloud service providers drive higher utilization of storage capacity additions and others prepare for buildouts in the second half of the year.” While the negative pre- annoucement this week was largely attributable to softer client and mission-critical enterprise, the company did signal less upside from cloud as in previous quarters. QLogic (EW from OW) indicated slower adoption of next-generation Grantley servers on its April 30th earnings call. We also attribute QLogic's negative June quarter preannouncement to broad weakness in the enterprise server and storage market while cloud demand is not providing the cushion it did in 2014. Aspeed (EW from OW) partially attributed lower June sales to data center customers hesitating to upgrade to the Intel Grantley platform, given the insufficient DDR4 server DRAM supply. Methode Electronics (NC) cited PowerRail fiscal 2015 sales (May 2 year-end) were approximately twice what the company anticipated as big data customer accelerated the build-out of its data centers. While this had a very positive effect on fiscal 2015, the company expects it will have a negative impact on fiscal 2016. However, we note Intel (OW) highlighted weakness in enterprise was offset largely by strength in the cloud on the company's earnings conference call last week. EExxhhiibbiitt 1100:: Sizable Cloud Exposure at QLGC, STX & WDC Source: Company Data, Morgan Stanley 9

Global Technology Page 8 Page 10

Global Technology Page 8 Page 10