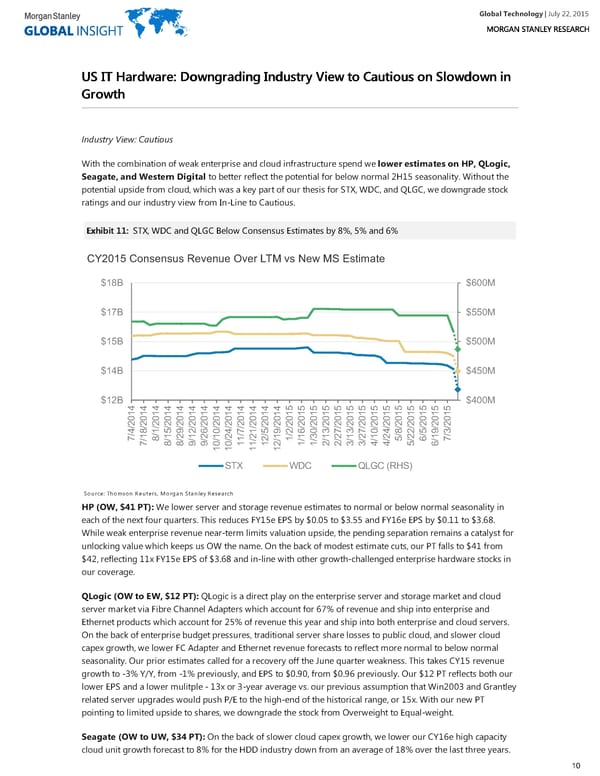

Global Technology| July 22, 2015 UUSS IITT HHaarrddwwaarree:: DDoowwnnggrraaddiinngg IInndduussttrryy VViieeww ttoo CCaauuttiioouuss oonn SSlloowwddoowwnn iinn GGrroowwtthh Industry View: Cautious With the combination of weak enterprise and cloud infrastructure spend we lower estimates on HP, QLogic, Seagate, and Western Digital to better reflect the potential for below normal 2H15 seasonality. Without the potential upside from cloud, which was a key part of our thesis for STX, WDC, and QLGC, we downgrade stock ratings and our industry view from In-Line to Cautious. EExxhhiibbiitt 1111:: STX, WDC and QLGC Below Consensus Estimates by 8%, 5% and 6% CY2015 Consensus Revenue Over LTM vs New MS Estimate $18B $600M $17B $550M $15B $500M $14B $450M $12B $400M 4 4 4 4 4 4 4 4 4 4 4 4 4 5 5 5 5 5 5 5 5 5 5 5 5 5 5 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 2 / / / / / / / / / / / / / / / / / / / / / / / / / / / 4 8 1 5 9 2 6 0 4 7 1 5 9 2 6 0 3 7 3 7 0 4 8 2 5 9 3 / / / / / / / / 1 1 2 1 2 1 2 2 1 1 3 1 2 1 2 1 2 2 1 7 / 8 / / / / / / 1 / 2 / 1 / / / / / / / / 5 / 6 / 7 7 8 8 9 9 0 0 1 1 1 2 1 1 2 2 3 3 4 4 5 6 1 1 1 1 STX WDC QLGC (RHS) Source: Thomson Reuters, Morgan Stanley Research HP (OW, $41 PT): We lower server and storage revenue estimates to normal or below normal seasonality in each of the next four quarters. This reduces FY15e EPS by $0.05 to $3.55 and FY16e EPS by $0.11 to $3.68. While weak enterprise revenue near-term limits valuation upside, the pending separation remains a catalyst for unlocking value which keeps us OW the name. On the back of modest estimate cuts, our PT falls to $41 from $42, reflecting 11x FY15e EPS of $3.68 and in-line with other growth-challenged enterprise hardware stocks in our coverage. QLogic (OW to EW, $12 PT): QLogic is a direct play on the enterprise server and storage market and cloud server market via Fibre Channel Adapters which account for 67% of revenue and ship into enterprise and Ethernet products which account for 25% of revenue this year and ship into both enterprise and cloud servers. On the back of enterprise budget pressures, traditional server share losses to public cloud, and slower cloud capex growth, we lower FC Adapter and Ethernet revenue forecasts to reflect more normal to below normal seasonality. Our prior estimates called for a recovery off the June quarter weakness. This takes CY15 revenue growth to -3% Y/Y, from -1% previously, and EPS to $0.90, from $0.96 previously. Our $12 PT reflects both our lower EPS and a lower mulitple - 13x or 3-year average vs. our previous assumption that Win2003 and Grantley related server upgrades would push P/E to the high-end of the historical range, or 15x. With our new PT pointing to limited upside to shares, we downgrade the stock from Overweight to Equal-weight. Seagate (OW to UW, $34 PT): On the back of slower cloud capex growth, we lower our CY16e high capacity cloud unit growth forecast to 8% for the HDD industry down from an average of 18% over the last three years. 10

Global Technology Page 9 Page 11

Global Technology Page 9 Page 11