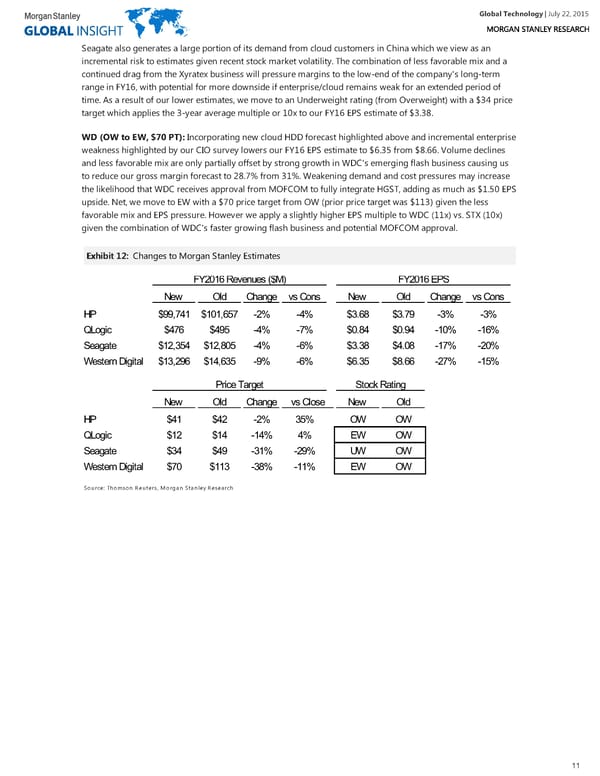

Global Technology| July 22, 2015 Seagate also generates a large portion of its demand from cloud customers in China which we view as an incremental risk to estimates given recent stock market volatility. The combination of less favorable mix and a continued drag from the Xyratex business will pressure margins to the low-end of the company's long-term range in FY16, with potential for more downside if enterprise/cloud remains weak for an extended period of time. As a result of our lower estimates, we move to an Underweight rating (from Overweight) with a $34 price target which applies the 3-year average multiple or 10x to our FY16 EPS estimate of $3.38. WD (OW to EW, $70 PT): Incorporating new cloud HDD forecast highlighted above and incremental enterprise weakness highlighted by our CIO survey lowers our FY16 EPS estimate to $6.35 from $8.66. Volume declines and less favorable mix are only partially offset by strong growth in WDC's emerging flash business causing us to reduce our gross margin forecast to 28.7% from 31%. Weakening demand and cost pressures may increase the likelihood that WDC receives approval from MOFCOM to fully integrate HGST, adding as much as $1.50 EPS upside. Net, we move to EW with a $70 price target from OW (prior price target was $113) given the less favorable mix and EPS pressure. However we apply a slightly higher EPS multiple to WDC (11x) vs. STX (10x) given the combination of WDC's faster growing flash business and potential MOFCOM approval. EExxhhiibbiitt 1122:: Changes to Morgan Stanley Estimates FY2016 Revenues ($M) FY2016 EPS New Old Change vs Cons New Old Change vs Cons HP $99,741 $101,657 -2% -4% $3.68 $3.79 -3% -3% QLogic $476 $495 -4% -7% $0.84 $0.94 -10% -16% Seagate $12,354 $12,805 -4% -6% $3.38 $4.08 -17% -20% Western Digital $13,296 $14,635 -9% -6% $6.35 $8.66 -27% -15% Price Target Stock Rating New Old Change vs Close New Old HP $41 $42 -2% 35% OW OW QLogic $12 $14 -14% 4% EW OW Seagate $34 $49 -31% -29% UW OW Western Digital $70 $113 -38% -11% EW OW Source: Thomson Reuters, Morgan Stanley Research 11

Global Technology Page 10 Page 12

Global Technology Page 10 Page 12