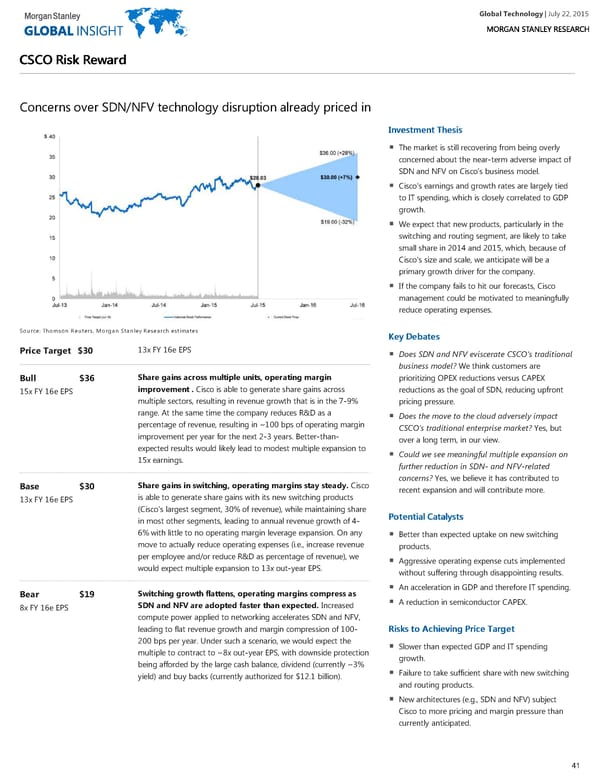

Global Technology| July 22, 2015 CCSSCCOO RRiisskk RReewwaarrdd Concerns over SDN/NFV technology disruption already priced in IInnvveessttmmeenntt TThheessiiss The market is still recovering from being overly concerned about the near-term adverse impact of SDN and NFV on Cisco’s business model. Cisco's earnings and growth rates are largely tied to IT spending, which is closely correlated to GDP growth. We expect that new products, particularly in the switching and routing segment, are likely to take small share in 2014 and 2015, which, because of Cisco's size and scale, we anticipate will be a primary growth driver for the company. If the company fails to hit our forecasts, Cisco management could be motivated to meaningfully reduce operating expenses. Source: Thomson Reuters, Morgan Stanley Research estimates KKeeyy DDeebbaatteess 13x FY 16e EPS Price Target $30 Does SDN and NFV eviscerate CSCO's traditional business model? We think customers are Share gains across multiple units, operating margin prioritizing OPEX reductions versus CAPEX Bull $36 improvement . Cisco is able to generate share gains across reductions as the goal of SDN, reducing upfront 15x FY 16e EPS multiple sectors, resulting in revenue growth that is in the 7-9% pricing pressure. range. At the same time the company reduces R&D as a Does the move to the cloud adversely impact percentage of revenue, resulting in ~100 bps of operating margin CSCO's traditional enterprise market? Yes, but improvement per year for the next 2-3 years. Better-than- over a long term, in our view. expected results would likely lead to modest multiple expansion to Could we see meaningful multiple expansion on 15x earnings. further reduction in SDN- and NFV-related concerns? Yes, we believe it has contributed to Share gains in switching, operating margins stay steady. Cisco Base $30 recent expansion and will contribute more. is able to generate share gains with its new switching products 13x FY 16e EPS (Cisco’s largest segment, 30% of revenue), while maintaining share PPootteennttiiaall CCaattaallyyssttss in most other segments, leading to annual revenue growth of 4- 6% with little to no operating margin leverage expansion. On any Better than expected uptake on new switching move to actually reduce operating expenses (i.e., increase revenue products. per employee and/or reduce R&D as percentage of revenue), we Aggressive operating expense cuts implemented would expect multiple expansion to 13x out-year EPS. without suffering through disappointing results. An acceleration in GDP and therefore IT spending. Switching growth flattens, operating margins compress as Bear $19 A reduction in semiconductor CAPEX. SDN and NFV are adopted faster than expected. Increased 8x FY 16e EPS compute power applied to networking accelerates SDN and NFV, leading to flat revenue growth and margin compression of 100- RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett 200 bps per year. Under such a scenario, we would expect the Slower than expected GDP and IT spending multiple to contract to ~8x out-year EPS, with downside protection growth. being afforded by the large cash balance, dividend (currently ~3% Failure to take sufficient share with new switching yield) and buy backs (currently authorized for $12.1 billion). and routing products. New architectures (e.g., SDN and NFV) subject Cisco to more pricing and margin pressure than currently anticipated. 41

Global Technology Page 40 Page 42

Global Technology Page 40 Page 42