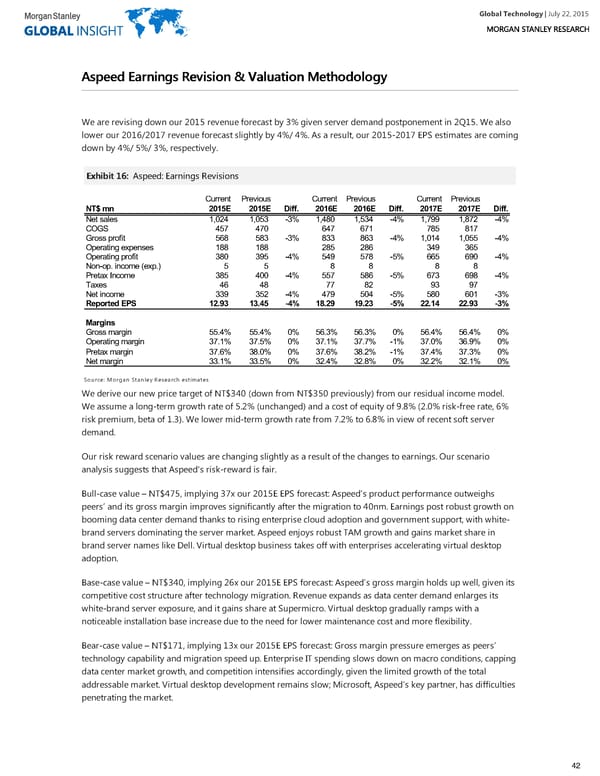

Global Technology| July 22, 2015 AAssppeeeedd EEaarrnniinnggss RReevviissiioonn && VVaalluuaattiioonn MMeetthhooddoollooggyy We are revising down our 2015 revenue forecast by 3% given server demand postponement in 2Q15. We also lower our 2016/2017 revenue forecast slightly by 4%/ 4%. As a result, our 2015-2017 EPS estimates are coming down by 4%/ 5%/ 3%, respectively. EExxhhiibbiitt 1166:: Aspeed: Earnings Revisions Current Previous Current Previous Current Previous NT$ mn 2015E 2015E Diff. 2016E 2016E Diff. 2017E 2017E Diff. Net sales 1,024 1,053 -3% 1,480 1,534 -4% 1,799 1,872 -4% COGS 457 470 647 671 785 817 Gross profit 568 583 -3% 833 863 -4% 1,014 1,055 -4% Operating expenses 188 188 285 286 349 365 Operating profit 380 395 -4% 549 578 -5% 665 690 -4% Non-op. income (exp.) 5 5 8 8 8 8 Pretax Income 385 400 -4% 557 586 -5% 673 698 -4% Taxes 46 48 77 82 93 97 Net income 339 352 -4% 479 504 -5% 580 601 -3% Reported EPS 12.93 13.45 -4% 18.29 19.23 -5% 22.14 22.93 -3% Margins Gross margin 55.4% 55.4% 0% 56.3% 56.3% 0% 56.4% 56.4% 0% Operating margin 37.1% 37.5% 0% 37.1% 37.7% -1% 37.0% 36.9% 0% Pretax margin 37.6% 38.0% 0% 37.6% 38.2% -1% 37.4% 37.3% 0% Net margin 33.1% 33.5% 0% 32.4% 32.8% 0% 32.2% 32.1% 0% Source: Morgan Stanley Research estimates We derive our new price target of NT$340 (down from NT$350 previously) from our residual income model. We assume a long-term growth rate of 5.2% (unchanged) and a cost of equity of 9.8% (2.0% risk-free rate, 6% risk premium, beta of 1.3). We lower mid-term growth rate from 7.2% to 6.8% in view of recent soft server demand. Our risk reward scenario values are changing slightly as a result of the changes to earnings. Our scenario analysis suggests that Aspeed's risk-reward is fair. Bull-case value – NT$475, implying 37x our 2015E EPS forecast: Aspeed’s product performance outweighs peers’ and its gross margin improves significantly after the migration to 40nm. Earnings post robust growth on booming data center demand thanks to rising enterprise cloud adoption and government support, with white- brand servers dominating the server market. Aspeed enjoys robust TAM growth and gains market share in brand server names like Dell. Virtual desktop business takes off with enterprises accelerating virtual desktop adoption. Base-case value – NT$340, implying 26x our 2015E EPS forecast: Aspeed’s gross margin holds up well, given its competitive cost structure after technology migration. Revenue expands as data center demand enlarges its white-brand server exposure, and it gains share at Supermicro. Virtual desktop gradually ramps with a noticeable installation base increase due to the need for lower maintenance cost and more flexibility. Bear-case value – NT$171, implying 13x our 2015E EPS forecast: Gross margin pressure emerges as peers’ technology capability and migration speed up. Enterprise IT spending slows down on macro conditions, capping data center market growth, and competition intensifies accordingly, given the limited growth of the total addressable market. Virtual desktop development remains slow; Microsoft, Aspeed’s key partner, has difficulties penetrating the market. 42

Global Technology Page 41 Page 43

Global Technology Page 41 Page 43