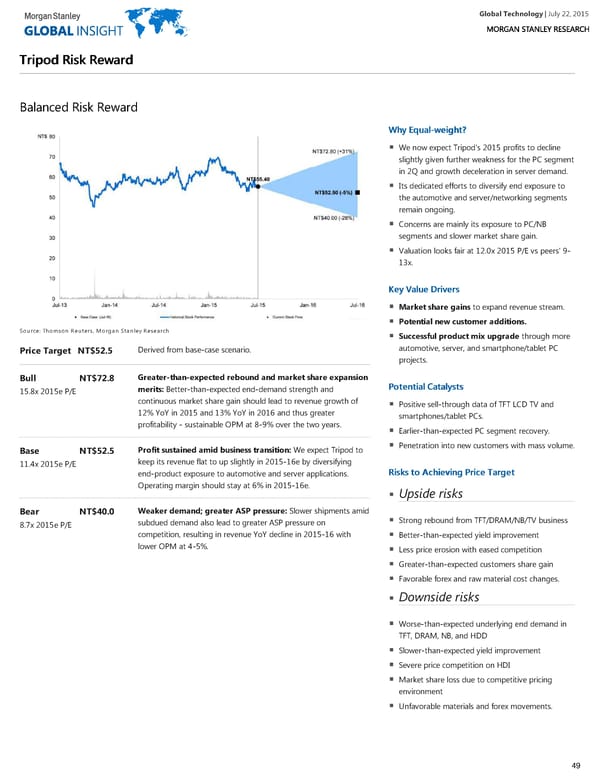

Global Technology| July 22, 2015 TTrriippoodd RRiisskk RReewwaarrdd Balanced Risk Reward WWhhyy EEqquuaall--wweeiigghhtt?? We now expect Tripod's 2015 profits to decline slightly given further weakness for the PC segment in 2Q and growth deceleration in server demand. Its dedicated efforts to diversify end exposure to the automotive and server/networking segments remain ongoing. Concerns are mainly its exposure to PC/NB segments and slower market share gain. Valuation looks fair at 12.0x 2015 P/E vs peers' 9- 13x. KKeeyy VVaalluuee DDrriivveerrss Market share gains to expand revenue stream. Potential new customer additions. Source: Thomson Reuters, Morgan Stanley Research Successful product mix upgrade through more automotive, server, and smartphone/tablet PC Derived from base-case scenario. Price Target NT$52.5 projects. Greater-than-expected rebound and market share expansion Bull NT$72.8 PPootteennttiiaall CCaattaallyyssttss merits: Better-than-expected end-demand strength and 15.8x 2015e P/E continuous market share gain should lead to revenue growth of Positive sell-through data of TFT LCD TV and 12% YoY in 2015 and 13% YoY in 2016 and thus greater smartphones/tablet PCs. profitability - sustainable OPM at 8-9% over the two years. Earlier-than-expected PC segment recovery. Penetration into new customers with mass volume. Profit sustained amid business transition: We expect Tripod to Base NT$52.5 keep its revenue flat to up slightly in 2015-16e by diversifying 11.4x 2015e P/E RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett end-product exposure to automotive and server applications. Operating margin should stay at 6% in 2015-16e. Upside risks Weaker demand; greater ASP pressure: Slower shipments amid Bear NT$40.0 Strong rebound from TFT/DRAM/NB/TV business subdued demand also lead to greater ASP pressure on 8.7x 2015e P/E competition, resulting in revenue YoY decline in 2015-16 with Better-than-expected yield improvement lower OPM at 4-5%. Less price erosion with eased competition Greater-than-expected customers share gain Favorable forex and raw material cost changes. Downside risks Worse-than-expected underlying end demand in TFT, DRAM, NB, and HDD Slower-than-expected yield improvement Severe price competition on HDI Market share loss due to competitive pricing environment Unfavorable materials and forex movements. 49

Global Technology Page 48 Page 50

Global Technology Page 48 Page 50