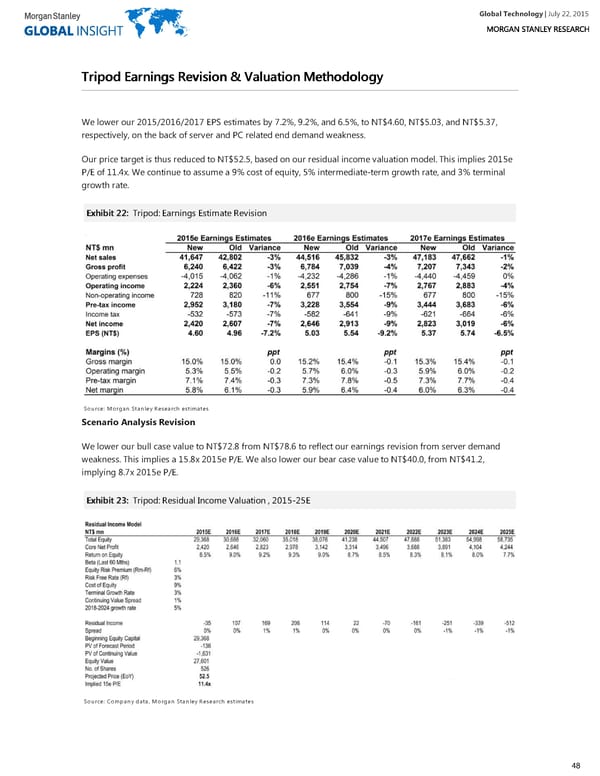

Global Technology| July 22, 2015 TTrriippoodd EEaarrnniinnggss RReevviissiioonn && VVaalluuaattiioonn MMeetthhooddoollooggyy We lower our 2015/2016/2017 EPS estimates by 7.2%, 9.2%, and 6.5%, to NT$4.60, NT$5.03, and NT$5.37, respectively, on the back of server and PC related end demand weakness. Our price target is thus reduced to NT$52.5, based on our residual income valuation model. This implies 2015e P/E of 11.4x. We continue to assume a 9% cost of equity, 5% intermediate-term growth rate, and 3% terminal growth rate. EExxhhiibbiitt 2222:: Tripod: Earnings Estimate Revision Source: Morgan Stanley Research estimates Scenario Analysis Revision We lower our bull case value to NT$72.8 from NT$78.6 to reflect our earnings revision from server demand weakness. This implies a 15.8x 2015e P/E. We also lower our bear case value to NT$40.0, from NT$41.2, implying 8.7x 2015e P/E. EExxhhiibbiitt 2233:: Tripod: Residual Income Valuation , 2015-25E Source: Company data, Morgan Stanley Research estimates 48

Global Technology Page 47 Page 49

Global Technology Page 47 Page 49