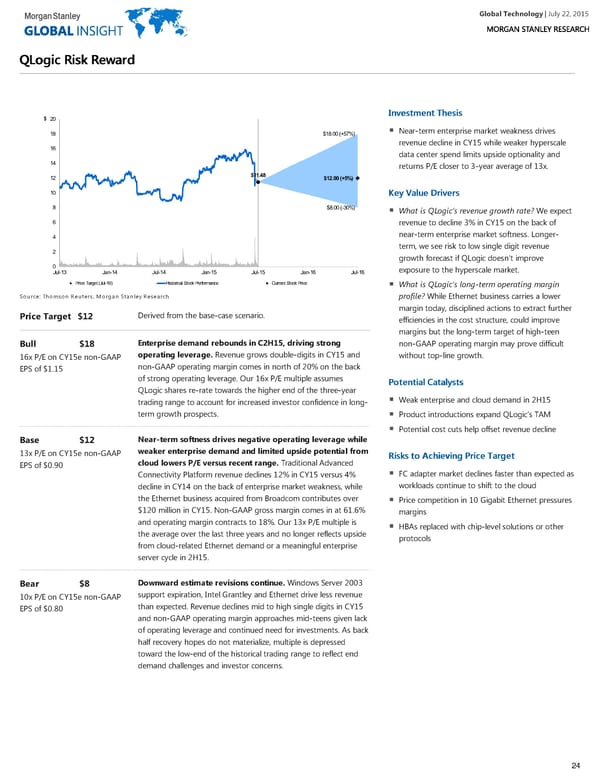

Global Technology| July 22, 2015 QQLLooggiicc RRiisskk RReewwaarrdd IInnvveessttmmeenntt TThheessiiss $ 20 Near-term enterprise market weakness drives 18 $18.00 (+57%) revenue decline in CY15 while weaker hyperscale 16 data center spend limits upside optionality and 14 returns P/E closer to 3-year average of 13x. $11.48 12 $12.00 (+5%) 10 KKeeyy VVaalluuee DDrriivveerrss 8 $8.00 (-30%) What is QLogic’s revenue growth rate? We expect 6 revenue to decline 3% in CY15 on the back of near-term enterprise market softness. Longer- 4 term, we see risk to low single digit revenue 2 growth forecast if QLogic doesn't improve 0 exposure to the hyperscale market. Jul-13 Jan-14 Jul-14 Jan-15 Jul-15 Jan-16 Jul-16 Price Target (Jul-16) Historical Stock Performance Current Stock Price WARNINGDONOTEDIT_RRS4RL~QLGC.O~ What is QLogic's long-term operating margin Source: Thomson Reuters, Morgan Stanley Research profile? While Ethernet business carries a lower margin today, disciplined actions to extract further Derived from the base-case scenario. Price Target $12 efficiencies in the cost structure, could improve margins but the long-term target of high-teen Enterprise demand rebounds in C2H15, driving strong non-GAAP operating margin may prove difficult Bull $18 operating leverage. Revenue grows double-digits in CY15 and without top-line growth. 16x P/E on CY15e non-GAAP non-GAAP operating margin comes in north of 20% on the back EPS of $1.15 of strong operating leverage. Our 16x P/E multiple assumes PPootteennttiiaall CCaattaallyyssttss QLogic shares re-rate towards the higher end of the three-year Weak enterprise and cloud demand in 2H15 trading range to account for increased investor confidence in long- term growth prospects. Product introductions expand QLogic’s TAM Potential cost cuts help offset revenue decline Near-term softness drives negative operating leverage while Base $12 weaker enterprise demand and limited upside potential from 13x P/E on CY15e non-GAAP RRiisskkss ttoo AAcchhiieevviinngg PPrriiccee TTaarrggeett cloud lowers P/E versus recent range. Traditional Advanced EPS of $0.90 FC adapter market declines faster than expected as Connectivity Platform revenue declines 12% in CY15 versus 4% workloads continue to shift to the cloud decline in CY14 on the back of enterprise market weakness, while the Ethernet business acquired from Broadcom contributes over Price competition in 10 Gigabit Ethernet pressures $120 million in CY15. Non-GAAP gross margin comes in at 61.6% margins and operating margin contracts to 18%. Our 13x P/E multiple is HBAs replaced with chip-level solutions or other the average over the last three years and no longer reflects upside protocols from cloud-related Ethernet demand or a meaningful enterprise server cycle in 2H15. Downward estimate revisions continue. Windows Server 2003 Bear $8 support expiration, Intel Grantley and Ethernet drive less revenue 10x P/E on CY15e non-GAAP than expected. Revenue declines mid to high single digits in CY15 EPS of $0.80 and non-GAAP operating margin approaches mid-teens given lack of operating leverage and continued need for investments. As back half recovery hopes do not materialize, multiple is depressed toward the low-end of the historical trading range to reflect end demand challenges and investor concerns. 24

Global Technology Page 23 Page 25

Global Technology Page 23 Page 25