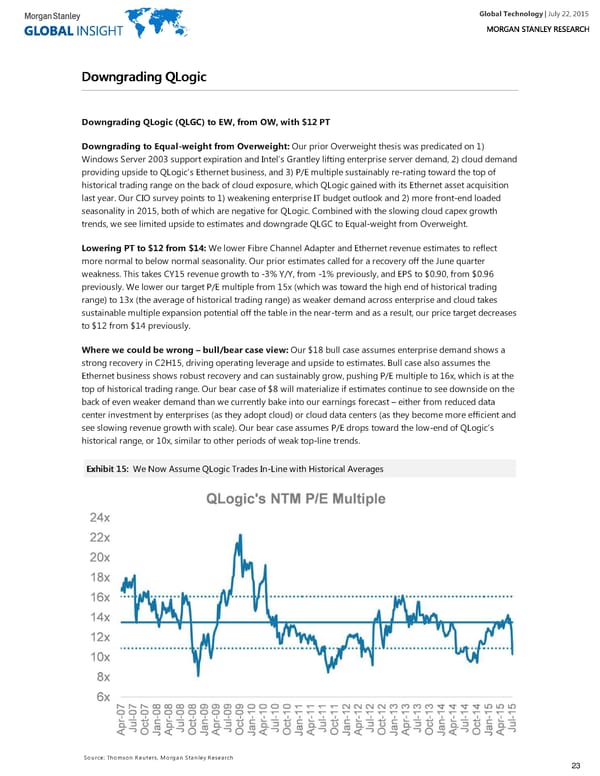

Global Technology| July 22, 2015 DDoowwnnggrraaddiinngg QQLLooggiicc Downgrading QLogic (QLGC) to EW, from OW, with $12 PT Downgrading to Equal-weight from Overweight: Our prior Overweight thesis was predicated on 1) Windows Server 2003 support expiration and Intel’s Grantley lifting enterprise server demand, 2) cloud demand providing upside to QLogic’s Ethernet business, and 3) P/E multiple sustainably re-rating toward the top of historical trading range on the back of cloud exposure, which QLogic gained with its Ethernet asset acquisition last year. Our CIO survey points to 1) weakening enterprise IT budget outlook and 2) more front-end loaded seasonality in 2015, both of which are negative for QLogic. Combined with the slowing cloud capex growth trends, we see limited upside to estimates and downgrade QLGC to Equal-weight from Overweight. Lowering PT to $12 from $14: We lower Fibre Channel Adapter and Ethernet revenue estimates to reflect more normal to below normal seasonality. Our prior estimates called for a recovery off the June quarter weakness. This takes CY15 revenue growth to -3% Y/Y, from -1% previously, and EPS to $0.90, from $0.96 previously. We lower our target P/E multiple from 15x (which was toward the high end of historical trading range) to 13x (the average of historical trading range) as weaker demand across enterprise and cloud takes sustainable multiple expansion potential off the table in the near-term and as a result, our price target decreases to $12 from $14 previously. Where we could be wrong – bull/bear case view: Our $18 bull case assumes enterprise demand shows a strong recovery in C2H15, driving operating leverage and upside to estimates. Bull case also assumes the Ethernet business shows robust recovery and can sustainably grow, pushing P/E multiple to 16x, which is at the top of historical trading range. Our bear case of $8 will materialize if estimates continue to see downside on the back of even weaker demand than we currently bake into our earnings forecast – either from reduced data center investment by enterprises (as they adopt cloud) or cloud data centers (as they become more efficient and see slowing revenue growth with scale). Our bear case assumes P/E drops toward the low-end of QLogic’s historical range, or 10x, similar to other periods of weak top-line trends. EExxhhiibbiitt 1155:: We Now Assume QLogic Trades In-Line with Historical Averages Source: Thomson Reuters, Morgan Stanley Research 23

Global Technology Page 22 Page 24

Global Technology Page 22 Page 24