Pitch Anything Blueprint

A proprietary method based on the book Pitch Anything by Oren Klaff

One-Page Pitch Blueprint Template 1-PAGE PITCHBLUEPRINT IDEAS DEALS PITCH ANYTHING RAISE MONEY SALES PROJECT COMPANY TEAM AND TRACK RECORD THE DIFFICULT OUR SOLUTION PROBLEM WE SOLVE ( HIGH LEVEL ) WHY IT’S HARD TO KEY FEATURES SOLVE THEPROBLEM MAJOR VALUE THE 5 BASIC FACTS THE WHAT IS CHANGING IN COMPANY DELIVERS BUYER SHOULD KNOW THE MARKET AND ONE GOOD REASON TO BELIEVE IT NOW DELIVERED IN LESS THAN 60 SECONDS AND HOW YOU NEED US TO SUCCEED SOCIAL PROOF SOCIAL PROOF SOCIAL PROOF detailed income projections are provided on page 4 ROI, KEY ECONOMICS AND MOST IMPORTANT NUMBERS 10% 20% 30% NEXT STEPS STARTING POINT FORECAST BY YEAR AND RATE Summary of next steps, time constraint and other control YEAR 1 YEAR 2 YEAR 3 elements. Why we think this forecast will hold true and what current trendlines are in the market CONTACT INFORMATION TELEPHONE EMAIL Pitch Anything Blueprint 2

THE BIG IDEA in 47 WORDS b FINDING A GREAT IDEA is easy. Selling it to customers and investors is a lot harder. If you don’t have a method to differentiate, break through the market clutter, capture imagination and attention and get buyers motivated about your offer, then you’re stuck and going no where. b Why does the method matter? Sometimes it doesn’t. When you are presenting a deal to people you know and have worked with before, then almost any pitch will do. They’ll talk to you long enough — hours if necessary — to understand your product and the value you deliver. A discussion is going to happen because you are known and trusted. But when you are trying to reach buyers you don’t know well, a different psychology is in effect. It’s harsh but true — the quality of a pitch and how fast you can deliver it will determine how many people will look at your offer, consider it, and invest. This is why I developed the 6-Minute Pitch. Hope you invest a few minutes to learn this method - the potential pay off is huge. Oren Klaff Pitch Anything Blueprint 3

THE PROBLEM WE ALL HAVE CONFUSING IDEAS AND LONG PRESENTATIONS There is a fundamental disconnect between the way a typical sales presentation is prepared and the way it is received by a buyer. As a result, at the crucial moment, when it is most important to be convincing, nine out of ten times we are not. Our most important information has a surprisingly low chance of getting through. You need to understand why this disconnect occurs in order to fix it, overcome it, and successfully sell your products and ideas. YOU MAY HAVE A STRONG OFFERING, BUT BECAUSE THE MARKET HAS OVERWHELMED buyers with too many of every kind of deal, it’s hard to get BORING AND COMPLEX attention. The bottom line: a weak pitch affects your ability to close a sale DEALS DON’T DO WELL IN and generate revenue. TODAY’S MARKET THE FIX There is a new standard: compelling content that is ruthlessly distilled and delivered with visual and narrative power. INTERSECTION CAPITAL DEAL REAL ESTATE FUND SUMMARY MAJOR METROS - CALIFORNIA CONSULTING AGREEMENT: SUMMARY OF CONTRACT KEY INVESTMENT MERITS DETAIL NET PROGRAM RESIDENTIAL REHAB MARKETING & AD PLACEMENT COST TO DEVELOP $2M MEDIA AND LAUNCH Actual COST in ROI MARKETING TARGET REDUCTION OF COSTS summarized OUR VALUE & METHOD CURRENT PERFORMANCE TARGET SPEND & ROI We are a digital marketing agency offering customer acquisition services for companies DOCUMENT PREPARATION WEEK 1 $470K looking to generate leads and sell products DIGITAL MARKETING $250K online. Everything we do is in support of the WEEK 1 final conversion delivering the right ANNUAL MINIMUM WEEK 2 28% message at the right time. $2,100,000 $6,440,000 AN OPPORTUNITY TO INVEST IN THE IC REAL ESTATE FUND 2018 FULL YR. We are focused on California areas in the southern CONTRACT PERIOD WEEK 3 population centers and growth regions. IN THE DEVELOPED MARKETS TARGET CPI WEEK 3 $1.25 COST REDUCTION TARGET ROI WEEK 4 3.15X Organic Search is like a snowball, or flywheel, the more you push and turn, the Based on five years experience in the syndication of assets with TOTAL SPEND Q1 WEEK 4 $1,700,000 greater the results. While search engines THERE ARE 250 MILLION VIDEO GAME PLAYERS evolve, the principles are still the same stabilized cash-flow to retail investors, primarily in residentiall assets, VOLUME REDUCTION WEEK 5 -18% $199,600,000 $139,150,000 Intersection has identified a green field opportunity in this market that today - answer questions & deliver the best Bryan Smith is an Internet Sarah Jones is CEO of possible user experience. MANY/MOST/ALOT WANT TO JOIN A COMPETITIVE TEAM, SO THERE entrepreneur with almost 400Q a top advertising CURRENT CLIENTS INCLUDE $12,100,000 $10,900,000 yield for investors, and significantly improved profitability for our 20 years of experience agency in the U.S. that has investors. pioneering digital compa- helped its clients capitalize SHOULD BE 50 MILLION TEAMS. BUT THERE ARE ONLY 1M. WHY? nies, and a track record for on industry changes. INTERSECTION CAPITAL TARGETS RESIDENTIAL UNITS FOR SHORT HOLD growing businesses in During her 12-year tenure U disruptive markets, Sarah has lead the agen- b Once your website is properly aligned with technical and optimization standards, the ongoing S M : I M N A While investor demand remains high, sellers are turning their product too slowly, eroding their O R I Y efforts focus on growing the voice and authority of your business. T cy’s adaptability, building C including the meteoric rise E margins. Both the velocity and volume of equity absorption in the market has slowed over the S HOW ARE 49M+ PLAYERS FAILING TO JOIN COMPETITIVE TEAM PLAY? last 14 months. Driving this slowdown is the change in the rate of income that is being offered to of 400Q as a top digital best in class practices WE SOLVE THIS PROBLEM CORE SOLUTION ELEMENTS investors: cap rates have been steadily decreasing and there has been a corresponding drop in agency. across creative and media. yields. In the market for Exchange retail investors, income is a priority. S Organic search is excellent for Our technology creates fast access 5 WEEKS JOIN A 70% FAILURE 1 driving traffic, but very difficult to 2 to page 1 organic search results. HERE’S THE CREATIVE MEDIA BUY SETUP/TRAIN LICENSE MEASURE ROI compete for. Managing Director Oren Klaff, Director BASIC MATH THE KEY CHALLENGE KEY FEATURES INTERSECTION CAPITAL Mr. Klaff has worked with Intersection since 1999, and joined full time TARGET $15 AVG. COST TEAM AFTER 90 DAYS We deal with the difficulty of 1. Fast implementation 2. Low cost in 2006. He is responsible for wholesaling the company’s real estate INTERSECTION CAPITAL RESI $5,660,000 REDUCTION getting page 1 placement. 4 3. Measureable results 4. Reporting +1 800-555-1212 +1.310.359-0779 acquisitions and management of the selling group. He also serves IN UPFRONT COSTS 3 oren@pitchanything.com Carlsbad CA 92008 as the company’s Chief Acquisition Officer and is responsible for the oren@intersectioncapital.com company’s extensive collateral portfolio and the document preparation $75M and financial review. Mr. Klaff has syndicated $100MM of real estate iand oversees the marketing of a $300M real estate portfolio. DEVELOPMENT SCHEDULE The jump from player to team is much harder than you would 4 KEY REASONS: WHY TECHNOLOGY IS HARD TO DELIVER think ... because being on a team is a little like being in a band: 2019 2020 2021 ASSET CLASS LOCATION ASSET BUDGET Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 STEAM GROUPS don’t give you enough information lots of strong personalities need to work together smoothly. It RESIDENTIAL LOS ANGELES $8.2M looks fun but the work of “winning” is intense and requires hard 1 on the team you’re signing up to play with. RESIDENTIAL ORANGE CO. $8.0M RESIDENTIAL TBD $3.2M work and strong sense of team; not something gamers are RESIDENTIAL LOS ANGELES $5.4M known for. FORUM THREADS don’t give you enough detail on RESIDENTIAL ORANGE CO. $2.1M a prospective teamate. RESIDENTIAL TBD $2.1M 2 RESIDENTIAL LOS ANGELES $5.4M Mike Smith is the account executive for REDDIT POSTS take too much time and are difficult for DreamTeam and leads business development. 3 Reddit novice to navigate mike@dreamteam.zero 800-555-1212 FIND A PLAYER sites are too thinly populated and are 4 largely amatuer efforts by non-gamers. Pitch Anything Blueprint 4

THE SOLUTION WHAT YOU SEND A BUYER SHOWS 3 THINGS ABOUT YOU: 1. Your ability to organize your thoughts 2. Your understanding of the sales process (don’t overwhelm me and respect my time) 3. Your professionalism So when the request comes in: SEND ME SOMETHING, whether you send a little or a lot, you absolutely need a one page proposal. Provide a summary that captures all the key ideas and important value of your product BUT STILL LEAVES ROOM for conversation e.g. another meeting. A T D O LI R A S WHAT’S CHANGING? V These are conscious IPO In Healthcare, there are dozens of companies interested in the and subconscious M&A value proposition of ANTI-INFECTION TREATMENT. We have reasons to pay identified— and explore give segments where there is a clear M&A rationale EXIT ANALYSIS 1 attention. to acquisition. Over 50 companies are represented. THE PROBLEM WE ARE WORKING TO SOLVE KEY FEATURES HOSPITALS AND URGENT CARE FACILITIES RELY on two methods to handle infection. If either of these treatments don’t work, your chances of getting very High-margin, high EBITDA products IPO RATIONALE sick go up substantially. Zinc enables intercellular adhesion of the bacteria. Large new-customer pipeline >$1B Remove the zinc, and the bacteria cannot build its protective biofilm because Products are two generations ahead of the cellular building blocks won’t bind together. Without a protective competitive offerings ACME mechanism, bacteria is much more susceptible to antibiotics. Limited options to investors in the HPA segment 1. Remove It. 2. Kill It. 3. Cover it. In technical medical terms Dressings are used in an attempt IPO this is called It is and includes antibiotics applied to seal out bacteria and control debridement. the removal—that is surgically topically (creams or foams) or moisture content. Many come cutting out—of a patient’s dead, given intravenously. with additives to absorb excess damaged, or infected tissue. moisture or assist in healing. usa management team H IT’S A DIFFICULT INTERSECTION CAPITAL DEAL Mike Smith is the account Y O HEALTHCARE MARKET SIZE AND GROWTH executive for ACME and leads R O EXIT ANALYSIS SUMMARY $120B business development. T K PROBLEM TO SOLVE HIPA RELATED PRODUCTS mike@dreamteam.zero N S KEY INVESTMENT MERITS DETAIL 800-555-1212 E Immediately overcome LARGE PAYORS Dr. Smith is currently the UCLA Eminent SECTOR HEALTHCARE CONSUMER PRODUCTS Scholar of Medicine where he is a Professor in FOCUS EXIT ANLYSIS the Department of Molecular Biochemistry and rejection triggers by GEOGRAPHIC FOCUS LOS ANGELES Microbiology. Dr. Smith focuses his research in HEALTHCARE IT mechanistic studies of cellular adhesion and INVESTMENT FOCUS SHORT HOLD HIGH YIELD receptor-mediated signaling to include the confirming why this EXIT DATE 2020 LAB/DIAGNOSTICS study of bio receptor disease. He has over 40 TARGET SIZE $30M Peer Reviewed publications and 2 patents to his name.and a PhD in Molecular Biophysics 2 deal is worth spending MARKET SHARE TARGET $80M from Yale University and was a Postdoctoral time on. TARGET PROJECT COMMITMENT $5M Fellow at the California Institute of Technology. TIME TO CAPITAL MARKETS EVENT A R T R IV A E N KEY FEATURES Explains uniqueness and advantage in 3 plain English. A R T R IV A E TEAM N Snapshot of who is in charge and why 4 they are the right person to lead. Pitch Anything Blueprint 5

WHAT YOU CAN EXPECT FROM THE BLUEPRINT THE SIX MINUTE PITCH BLUEPRINT CAN HELP YOU IMMEDIATELY CONVEY TRUST and credibility to your new buyers. They will give you high-priority status and attention to your ideas, and all this happens within minutes. * Your pitch will pass through their initial screens * You will close sales faster and more efficiently successfully and be marked as important than ever before. materials that require evaluation. * You will find yourself in the desirable position of * Your cost to acquire new being able to select the best buyers buyers will dramatically instead of taking what you can get. fall, as the call-back rate from your one page pitch is much higher than with conventional methods. * Your close rate will be much higher, as buyers will come into your meetings with desire rather than skepticism. At this stage, it’s yours to lose. CONSULTING AGREEMENT: SUMMARY OF CONTRACT NET PROGRAM MARKETING & AD PLACEMENT COST TO DEVELOP $2M MEDIA AND LAUNCH Actual COST in ROI MARKETING TARGET REDUCTION OF COSTS summarized OUR VALUE & METHOD CURRENT PERFORMANCE TARGET SPEND & ROI We are a digital marketing agency offering customer acquisition services for companies DOCUMENT PREPARATION WEEK 1 $470K looking to generate leads and sell products DIGITAL MARKETING $250K online. Everything we do is in support of the WEEK 1 final conversion delivering the right ANNUAL MINIMUM WEEK 2 28% message at the right time. $2,100,000 $6,440,000 CONTRACT PERIOD WEEK 3 2018 FULL YR. TARGET CPI WEEK 3 $1.25 COST REDUCTION TARGET ROI WEEK 4 3.15X Organic Search is like a snowball, or flywheel, the more you push and turn, the TOTAL SPEND Q1 WEEK 4 $1,700,000 greater the results. While search engines VOLUME REDUCTION WEEK 5 -18% evolve, the principles are still the same $199,600,000 $139,150,000 today - answer questions & deliver the best Bryan Smith is an Internet Sarah Jones is CEO of possible user experience. entrepreneur with almost 400Q a top advertising CURRENT CLIENTS INCLUDE $12,100,000 $10,900,000 20 years of experience agency in the U.S. that has pioneering digital compa- helped its clients capitalize nies, and a track record for on industry changes. growing businesses in During her 12-year tenure disruptive markets, Sarah has lead the agen- b Once your website is properly aligned with technical and optimization standards, the ongoing including the meteoric rise cy’s adaptability, building efforts focus on growing the voice and authority of your business. of 400Q as a top digital best in class practices WE SOLVE THIS PROBLEM CORE SOLUTION ELEMENTS agency. across creative and media. Organic search is excellent for Our technology creates fast access 1 driving traffic, but very difficult to 2 to page 1 organic search results. CREATIVE MEDIA BUY SETUP/TRAIN LICENSE MEASURE ROI compete for. THE KEY CHALLENGE KEY FEATURES We deal with the difficulty of 1. Fast implementation 2. Low cost +1 800-555-1212 $5,660,000 REDUCTION 3 getting page 1 placement. 4 3. Measureable results 4. Reporting IN UPFRONT COSTS oren@pitchanything.com Pitch Anything Blueprint 6

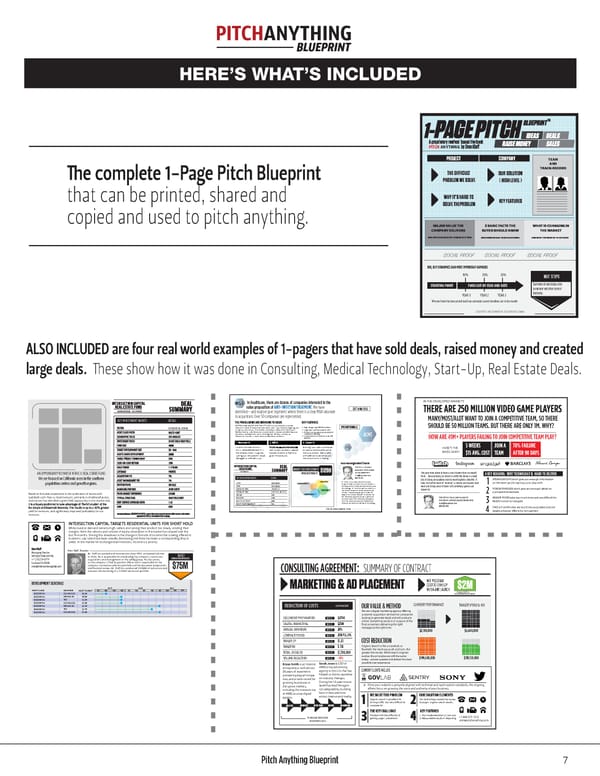

PITCHANYTHING HERE’S WHAT’S INCLUDED 1-PAGE PITCHBLUEPRINT IDEAS DEALS PITCH ANYTHING RAISE MONEY SALES PROJECT COMPANY TEAM AND TRACK RECORD The complete 1-Page Pitch Blueprint THE DIFFICULT OUR SOLUTION PROBLEM WE SOLVE ( HIGH LEVEL ) that can be printed, shared and WHY IT’S HARD TO KEY FEATURES copied and used to pitch anything. SOLVE THEPROBLEM MAJOR VALUE THE 5 BASIC FACTS THE WHAT IS CHANGING IN COMPANY DELIVERS BUYER SHOULD KNOW THE MARKET AND ONE GOOD REASON TO BELIEVE IT NOW DELIVERED IN LESS THAN 60 SECONDS AND HOW YOU NEED US TO SUCCEED SOCIAL PROOF SOCIAL PROOF SOCIAL PROOF detailed income projections are provided on page 4 ROI, KEY ECONOMICS AND MOST IMPORTANT NUMBERS 10% 20% 30% NEXT STEPS STARTING POINT FORECAST BY YEAR AND RATE Summary of next steps, time constraint and other control YEAR 1 YEAR 2 YEAR 3 elements. Why we think this forecast will hold true and what current trendlines are in the market CONTACT INFORMATION TELEPHONE EMAIL ALSO INCLUDED are four real world examples of 1-pagers that have sold deals, raised money and created large deals. These show how it was done in Consulting, Medical Technology, Start-Up, Real Estate Deals. INTERSECTION CAPITAL IPO In Healthcare, there are dozens of companies interested in the IN THE DEVELOPED MARKETS REAL ESTATE FUND DEAL M&A value proposition of ANTI-INFECTION TREATMENT. We have SUMMARY EXIT ANALYSIS MAJOR METROS - CALIFORNIA identified— and explore give segments where there is a clear M&A rationale THERE ARE 250 MILLION VIDEO GAME PLAYERS to acquisition. Over 50 companies are represented. MANY/MOST/ALOT WANT TO JOIN A COMPETITIVE TEAM, SO THERE KEY INVESTMENT MERITS DETAIL THE PROBLEM WE ARE WORKING TO SOLVE KEY FEATURES HOSPITALS AND URGENT CARE FACILITIES RELY on two methods to handle RESIDENTIAL REHAB infection. If either of these treatments don’t work, your chances of getting very High-margin, high EBITDA products IPO RATIONALE SHOULD BE 50 MILLION TEAMS. BUT THERE ARE ONLY 1M. WHY? sick go up substantially. Zinc enables intercellular adhesion of the bacteria. Large new-customer pipeline >$1B Remove the zinc, and the bacteria cannot build its protective biofilm because Products are two generations ahead of the cellular building blocks won’t bind together. Without a protective competitive offerings ACME mechanism, bacteria is much more susceptible to antibiotics. Limited options to investors in the HPA segment HOW ARE 49M+ PLAYERS FAILING TO JOIN COMPETITIVE TEAM PLAY? 1. Remove It. 2. Kill It. 3. Cover it. 5 WEEKS JOIN A 70% FAILURE In technical medical terms Dressings are used in an attempt IPO HERE’S THE this is called debridement. It is and includes antibiotics applied to seal out bacteria and control BASIC MATH the removal—that is surgically topically (creams or foams) or moisture content. Many come $15 AVG. COST TEAM AFTER 90 DAYS cutting out—of a patient’s dead, given intravenously. with additives to absorb excess damaged, or infected tissue. moisture or assist in healing. usa management team INTERSECTION CAPITAL DEAL Mike Smith is the account HEALTHCARE SUMMARY MARKET SIZE AND GROWTH executive for ACME and leads AN OPPORTUNITY TO INVEST IN THE IC REAL ESTATE FUND EXIT ANALYSIS HIPA RELATED PRODUCTS $120B business development. The jump from player to team is much harder than you would 4 KEY REASONS: WHY TECHNOLOGY IS HARD TO DELIVER mike@dreamteam.zero think ... because being on a team is a little like being in a band: We are focused on California areas in the southern KEY INVESTMENT MERITS DETAIL 800-555-1212 lots of strong personalities need to work together smoothly. It STEAM GROUPS don’t give you enough information SECTOR HEALTHCARE LARGE PAYORS Dr. Smith is currently the UCLA Eminent looks fun but the work of “winning” is intense and requires hard on the team you’re signing up to play with. population centers and growth regions. CONSUMER PRODUCTS Scholar of Medicine where he is a Professor in 1 FOCUS EXIT ANLYSIS the Department of Molecular Biochemistry and work and strong sense of team; not something gamers are GEOGRAPHIC FOCUS LOS ANGELES Microbiology. Dr. Smith focuses his research in known for. FORUM THREADS don’t give you enough detail on HEALTHCARE IT mechanistic studies of cellular adhesion and Based on five years experience in the syndication of assets with INVESTMENT FOCUS SHORT HOLD HIGH YIELD receptor-mediated signaling to include the 2 a prospective teamate. EXIT DATE 2020 LAB/DIAGNOSTICS study of bio receptor disease. He has over 40 stabilized cash-flow to retail investors, primarily in residentiall assets, TARGET SIZE $30M Peer Reviewed publications and 2 patents to Mike Smith is the account executive for REDDIT POSTS take too much time and are difficult for his name.and a PhD in Molecular Biophysics DreamTeam and leads business development. Intersection has identified a green field opportunity in this market that MARKET SHARE TARGET $80M from Yale University and was a Postdoctoral 3 Reddit novice to navigate TARGET PROJECT COMMITMENT $5M Fellow at the California Institute of Technology. mike@dreamteam.zero 800-555-1212 FIND A PLAYER sites are too thinly populated and are yield for investors, and significantly improved profitability for our TIME TO CAPITAL MARKETS EVENT 4 largely amatuer efforts by non-gamers. investors. INTERSECTION CAPITAL TARGETS RESIDENTIAL UNITS FOR SHORT HOLD U S M : I M N A While investor demand remains high, sellers are turning their product too slowly, eroding their O R I Y T C E margins. Both the velocity and volume of equity absorption in the market has slowed over the S last 14 months. Driving this slowdown is the change in the rate of income that is being offered to investors: cap rates have been steadily decreasing and there has been a corresponding drop in yields. In the market for Exchange retail investors, income is a priority. S Managing Director Oren Klaff, Director INTERSECTION CAPITAL Mr. Klaff has worked with Intersection since 1999, and joined full time TARGET in 2006. He is responsible for wholesaling the company’s real estate INTERSECTION CAPITAL RESI +1.310.359-0779 acquisitions and management of the selling group. He also serves Carlsbad CA 92008 as the company’s Chief Acquisition Officer and is responsible for the oren@intersectioncapital.com company’s extensive collateral portfolio and the document preparation $75M and financial review. Mr. Klaff has syndicated $100MM of real estate iand oversees the marketing of a $300M real estate portfolio. CONSULTING AGREEMENT: SUMMARY OF CONTRACT DEVELOPMENT SCHEDULE NET PROGRAM COST TO DEVELOP $2M 2019 2020 2021 MARKETING & AD PLACEMENT MEDIA AND LAUNCH ASSET CLASS LOCATION ASSET BUDGET Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Actual COST in RESIDENTIAL LOS ANGELES $8.2M ROI MARKETING TARGET RESIDENTIAL ORANGE CO. $8.0M RESIDENTIAL TBD $3.2M RESIDENTIAL LOS ANGELES $5.4M summarized CURRENT PERFORMANCE TARGET SPEND & ROI RESIDENTIAL ORANGE CO. $2.1M REDUCTION OF COSTS OUR VALUE & METHOD RESIDENTIAL TBD $2.1M We are a digital marketing agency offering RESIDENTIAL LOS ANGELES $5.4M customer acquisition services for companies DOCUMENT PREPARATION WEEK 1 $470K looking to generate leads and sell products DIGITAL MARKETING $250K online. Everything we do is in support of the WEEK 1 final conversion delivering the right ANNUAL MINIMUM WEEK 2 28% message at the right time. $2,100,000 $6,440,000 CONTRACT PERIOD WEEK 3 2018 FULL YR. TARGET CPI WEEK 3 $1.25 COST REDUCTION TARGET ROI WEEK 4 3.15X Organic Search is like a snowball, or flywheel, the more you push and turn, the TOTAL SPEND Q1 WEEK 4 $1,700,000 greater the results. While search engines VOLUME REDUCTION WEEK 5 -18% evolve, the principles are still the same $199,600,000 $139,150,000 today - answer questions & deliver the best Bryan Smith is an Internet Sarah Jones is CEO of possible user experience. entrepreneur with almost 400Q a top advertising CURRENT CLIENTS INCLUDE $12,100,000 $10,900,000 20 years of experience agency in the U.S. that has pioneering digital compa- helped its clients capitalize nies, and a track record for on industry changes. growing businesses in During her 12-year tenure disruptive markets, Sarah has lead the agen- b Once your website is properly aligned with technical and optimization standards, the ongoing including the meteoric rise cy’s adaptability, building efforts focus on growing the voice and authority of your business. of 400Q as a top digital best in class practices WE SOLVE THIS PROBLEM CORE SOLUTION ELEMENTS agency. across creative and media. Organic search is excellent for Our technology creates fast access 1 driving traffic, but very difficult to 2 to page 1 organic search results. CREATIVE MEDIA BUY SETUP/TRAIN LICENSE MEASURE ROI compete for. THE KEY CHALLENGE KEY FEATURES We deal with the difficulty of 1. Fast implementation 2. Low cost +1 800-555-1212 $5,660,000 REDUCTION 3 getting page 1 placement. 4 3. Measureable results 4. Reporting IN UPFRONT COSTS oren@pitchanything.com Pitch Anything Blueprint 7

INTRODUCING A REAL ESTATE DEAL (insert your own picture over the logo!) INTERSECTION CAPITAL DEAL REAL ESTATE FUND SUMMARY MAJOR METROS - CALIFORNIA KEY INVESTMENT MERITS DETAIL RESIDENTIAL REHAB AN OPPORTUNITY TO INVEST IN THE IC REAL ESTATE FUND We are focused on California areas in the southern population centers and growth regions. Based on five years experience in the syndication of assets with stabilized cash-flow to retail investors, primarily in residentiall assets, Intersection has identified a green field opportunity in this market that yield for investors, and significantly improved profitability for our investors. INTERSECTION CAPITAL TARGETS RESIDENTIAL UNITS FOR SHORT HOLD U S M : I M N A While investor demand remains high, sellers are turning their product too slowly, eroding their O R I Y T C E margins. Both the velocity and volume of equity absorption in the market has slowed over the S last 14 months. Driving this slowdown is the change in the rate of income that is being offered to investors: cap rates have been steadily decreasing and there has been a corresponding drop in yields. In the market for Exchange retail investors, income is a priority. S Managing Director Oren Klaff, Director INTERSECTION CAPITAL Mr. Klaff has worked with Intersection since 1999, and joined full time TARGET in 2006. He is responsible for wholesaling the company’s real estate INTERSECTION CAPITAL RESI +1.310.359-0779 acquisitions and management of the selling group. He also serves Carlsbad CA 92008 as the company’s Chief Acquisition Officer and is responsible for the oren@intersectioncapital.com company’s extensive collateral portfolio and the document preparation $75M and financial review. Mr. Klaff has syndicated $100MM of real estate iand oversees the marketing of a $300M real estate portfolio. DEVELOPMENT SCHEDULE 2019 2020 2021 ASSET CLASS LOCATION ASSET BUDGET Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 RESIDENTIAL LOS ANGELES $8.2M RESIDENTIAL ORANGE CO. $8.0M RESIDENTIAL TBD $3.2M RESIDENTIAL LOS ANGELES $5.4M RESIDENTIAL ORANGE CO. $2.1M RESIDENTIAL TBD $2.1M RESIDENTIAL LOS ANGELES $5.4M Pitch Anything Blueprint 8