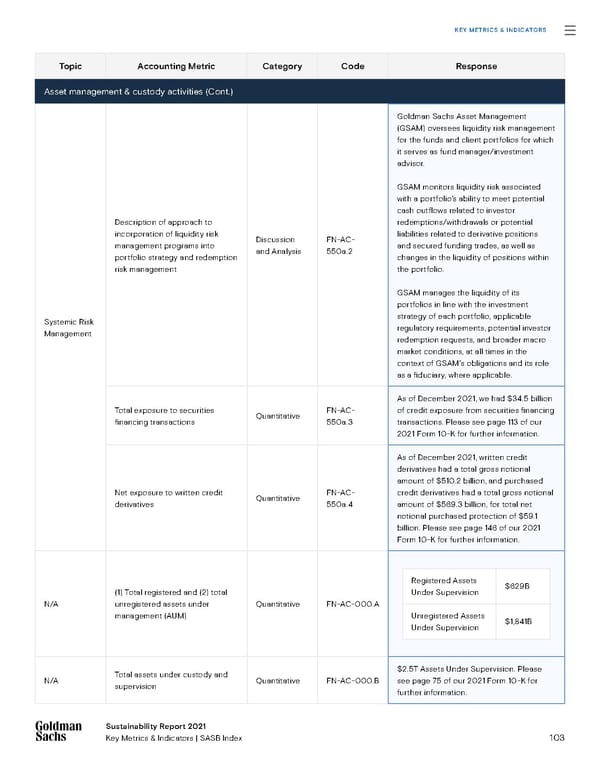

KEY METRICS & INDICATORS Topic Accounting Metric Category Code Response Asset management & custody activities (Cont.) Goldman Sachs Asset Management (GSAM) oversees liquidity risk management for the funds and client portfolios for which it serves as fund manager/investment advisor. GSAM monitors liquidity risk associated with a portfolio’s ability to meet potential cash outflows related to investor Description of approach to redemptions/withdrawals or potential incorporation of liquidity risk Discussion FN-AC- liabilities related to derivative positions management programs into and Analysis 550a.2 and secured funding trades, as well as portfolio strategy and redemption changes in the liquidity of positions within risk management the portfolio. GSAM manages the liquidity of its portfolios in line with the investment Systemic Risk strategy of each portfolio, applicable Management regulatory requirements, potential investor redemption requests, and broader macro market conditions, at all times in the context of GSAM’s obligations and its role as a fiduciary, where applicable. As of December 2021, we had $34.5 billion Total exposure to securities Quantitative FN-AC- of credit exposure from securities financing financing transactions 550a.3 transactions. Please see page 113 of our 2021 Form 10-K for further information. As of December 2021, written credit derivatives had a total gross notional amount of $510.2 billion, and purchased Net exposure to written credit Quantitative FN-AC- credit derivatives had a total gross notional derivatives 550a.4 amount of $569.3 billion, for total net notional purchased protection of $59.1 billion. Please see page 146 of our 2021 Form 10-K for further information. Registered Assets $629B (1) Total registered and (2) total Under Supervision N/A unregistered assets under Quantitative FN-AC-000.A management (AUM) Unregistered Assets $1,841B Under Supervision Total assets under custody and $2.5T Assets Under Supervision. Please N/A supervision Quantitative FN-AC-000.B see page 75 of our 2021 Form 10-K for further information. SSuussttaaiinnaabbiilliittyy Re Reppoorrtt 2 2002121 KKeey My Meettrriiccs & Is & Innddiiccatatoorrs | Ss ASB Index 103

Sustainability Report | Goldman Sachs Page 102 Page 104

Sustainability Report | Goldman Sachs Page 102 Page 104