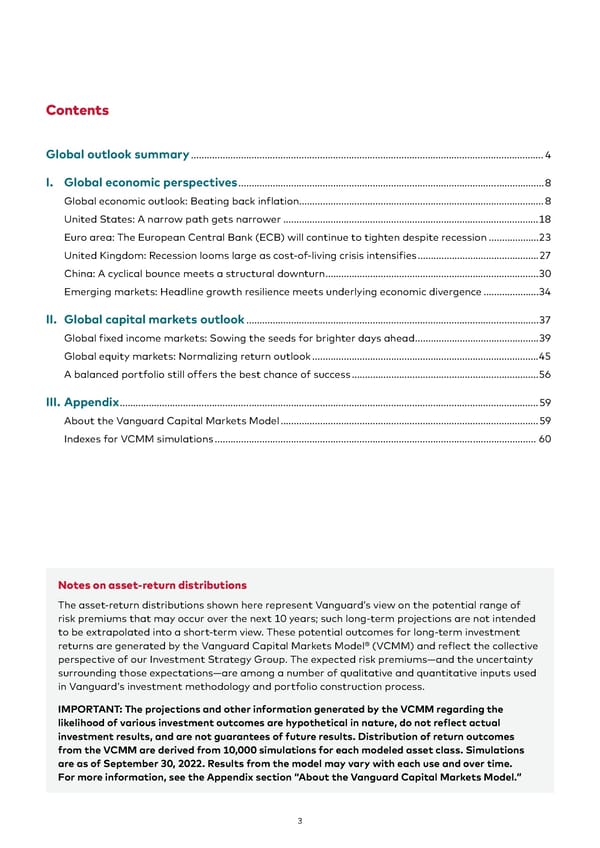

Contents Global outlook summary ......................................................................................................................................4 I. Global economic perspectives ....................................................................................................................8 Global economic outlook: Beating back inflation.............................................................................................8 United States: A narrow path gets narrower .................................................................................................18 Euro area: The European Central Bank (ECB) will continue to tighten despite recession ...................23 United Kingdom: Recession looms large as cost-of-living crisis intensifies ..............................................27 China: A cyclical bounce meets a structural downturn .................................................................................30 Emerging markets: Headline growth resilience meets underlying economic divergence .....................34 II. Global capital markets outlook ...............................................................................................................37 Global fixed income markets: Sowing the seeds for brighter days ahead ...............................................39 Global equity markets: Normalizing return outlook ......................................................................................45 A balanced portfolio still offers the best chance of success .......................................................................56 III. Appendix ...............................................................................................................................................................59 About the Vanguard Capital Markets Model ..................................................................................................59 Indexes for VCMM simulations .......................................................................................................................... 60 Notes on asset-return distributions The asset-return distributions shown here represent Vanguard’s view on the potential range of risk premiums that may occur over the next 10 years; such long-term projections are not intended to be extrapolated into a short-term view. These potential outcomes for long-term investment returns are generated by the Vanguard Capital Markets Model® (VCMM) and reflect the collective perspective of our Investment Strategy Group. The expected risk premiums—and the uncertainty surrounding those expectations—are among a number of qualitative and quantitative inputs used in Vanguard’s investment methodology and portfolio construction process. IMPORTANT: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of September 30, 2022. Results from the model may vary with each use and over time. For more information, see the Appendix section “About the Vanguard Capital Markets Model.” 33

Vanguard economic and market outlook for 2023 Page 2 Page 4

Vanguard economic and market outlook for 2023 Page 2 Page 4