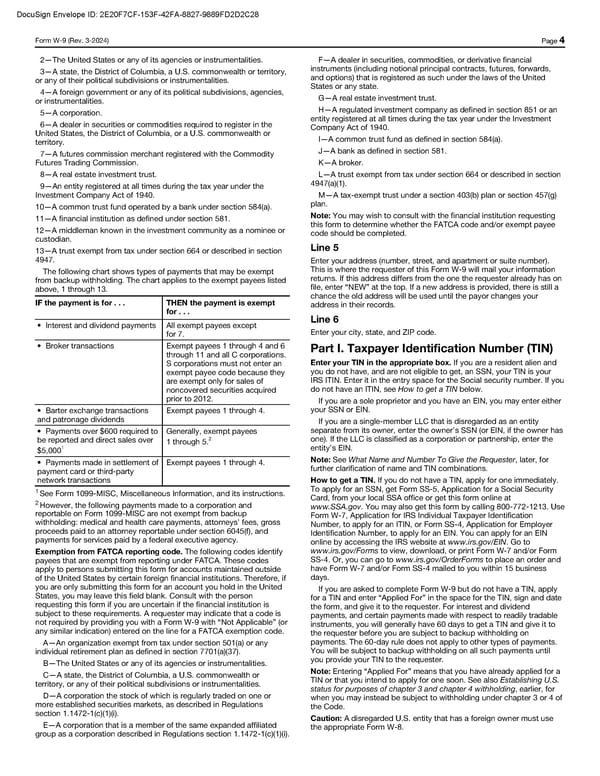

DocuSign Envelope ID: 2E20F7CF-153F-42FA-8827-9889FD2D2C28 Form W-9 (Rev. 3-2024) Page 4 2—The United States or any of its agencies or instrumentalities. F—A dealer in securities, commodities, or derivative financial 3—A state, the District of Columbia, a U.S. commonwealth or territory, instruments (including notional principal contracts, futures, forwards, or any of their political subdivisions or instrumentalities. and options) that is registered as such under the laws of the United 4—A foreign government or any of its political subdivisions, agencies, States or any state. or instrumentalities. G—A real estate investment trust. 5—A corporation. H—A regulated investment company as defined in section 851 or an 6—A dealer in securities or commodities required to register in the entity registered at all times during the tax year under the Investment United States, the District of Columbia, or a U.S. commonwealth or Company Act of 1940. territory. I—A common trust fund as defined in section 584(a). 7—A futures commission merchant registered with the Commodity J—A bank as defined in section 581. Futures Trading Commission. K—A broker. 8—A real estate investment trust. L—A trust exempt from tax under section 664 or described in section 9—An entity registered at all times during the tax year under the 4947(a)(1). Investment Company Act of 1940. M—A tax-exempt trust under a section 403(b) plan or section 457(g) 10—A common trust fund operated by a bank under section 584(a). plan. 11—A financial institution as defined under section 581. Note: You may wish to consult with the financial institution requesting 12—A middleman known in the investment community as a nominee or this form to determine whether the FATCA code and/or exempt payee custodian. code should be completed. 13—A trust exempt from tax under section 664 or described in section Line 5 4947. Enter your address (number, street, and apartment or suite number). The following chart shows types of payments that may be exempt This is where the requester of this Form W-9 will mail your information from backup withholding. The chart applies to the exempt payees listed returns. If this address differs from the one the requester already has on above, 1 through 13. file, enter “NEW” at the top. If a new address is provided, there is still a IF the payment is for . . . THEN the payment is exempt chance the old address will be used until the payor changes your for . . . address in their records. • Interest and dividend payments All exempt payees except Line 6 for 7. Enter your city, state, and ZIP code. • Broker transactions Exempt payees 1 through 4 and 6 Part I. Taxpayer Identification Number (TIN) through 11 and all C corporations. S corporations must not enter an Enter your TIN in the appropriate box. If you are a resident alien and exempt payee code because they you do not have, and are not eligible to get, an SSN, your TIN is your are exempt only for sales of IRS ITIN. Enter it in the entry space for the Social security number. If you noncovered securities acquired do not have an ITIN, see How to get a TIN below. prior to 2012. If you are a sole proprietor and you have an EIN, you may enter either • Barter exchange transactions Exempt payees 1 through 4. your SSN or EIN. and patronage dividends If you are a single-member LLC that is disregarded as an entity • Payments over $600 required to Generally, exempt payees separate from its owner, enter the owner’s SSN (or EIN, if the owner has be reported and direct sales over 2 one). If the LLC is classified as a corporation or partnership, enter the 1 through 5. $5,0001 entity’s EIN. • Payments made in settlement of Exempt payees 1 through 4. Note: See What Name and Number To Give the Requester, later, for payment card or third-party further clarification of name and TIN combinations. network transactions How to get a TIN. If you do not have a TIN, apply for one immediately. 1 To apply for an SSN, get Form SS-5, Application for a Social Security See Form 1099-MISC, Miscellaneous Information, and its instructions. Card, from your local SSA office or get this form online at 2 However, the following payments made to a corporation and www.SSA.gov. You may also get this form by calling 800-772-1213. Use reportable on Form 1099-MISC are not exempt from backup Form W-7, Application for IRS Individual Taxpayer Identification withholding: medical and health care payments, attorneys’ fees, gross Number, to apply for an ITIN, or Form SS-4, Application for Employer proceeds paid to an attorney reportable under section 6045(f), and Identification Number, to apply for an EIN. You can apply for an EIN payments for services paid by a federal executive agency. online by accessing the IRS website at www.irs.gov/EIN. Go to Exemption from FATCA reporting code. The following codes identify www.irs.gov/Forms to view, download, or print Form W-7 and/or Form payees that are exempt from reporting under FATCA. These codes SS-4. Or, you can go to www.irs.gov/OrderForms to place an order and apply to persons submitting this form for accounts maintained outside have Form W-7 and/or Form SS-4 mailed to you within 15 business of the United States by certain foreign financial institutions. Therefore, if days. you are only submitting this form for an account you hold in the United If you are asked to complete Form W-9 but do not have a TIN, apply States, you may leave this field blank. Consult with the person for a TIN and enter “Applied For” in the space for the TIN, sign and date requesting this form if you are uncertain if the financial institution is the form, and give it to the requester. For interest and dividend subject to these requirements. A requester may indicate that a code is payments, and certain payments made with respect to readily tradable not required by providing you with a Form W-9 with “Not Applicable” (or instruments, you will generally have 60 days to get a TIN and give it to any similar indication) entered on the line for a FATCA exemption code. the requester before you are subject to backup withholding on A—An organization exempt from tax under section 501(a) or any payments. The 60-day rule does not apply to other types of payments. individual retirement plan as defined in section 7701(a)(37). You will be subject to backup withholding on all such payments until B—The United States or any of its agencies or instrumentalities. you provide your TIN to the requester. C—A state, the District of Columbia, a U.S. commonwealth or Note: Entering “Applied For” means that you have already applied for a territory, or any of their political subdivisions or instrumentalities. TIN or that you intend to apply for one soon. See also Establishing U.S. status for purposes of chapter 3 and chapter 4 withholding, earlier, for D—A corporation the stock of which is regularly traded on one or when you may instead be subject to withholding under chapter 3 or 4 of more established securities markets, as described in Regulations the Code. section 1.1472-1(c)(1)(i). Caution: A disregarded U.S. entity that has a foreign owner must use E—A corporation that is a member of the same expanded affiliated the appropriate Form W-8. group as a corporation described in Regulations section 1.1472-1(c)(1)(i).

W-9 Page 3 Page 5

W-9 Page 3 Page 5