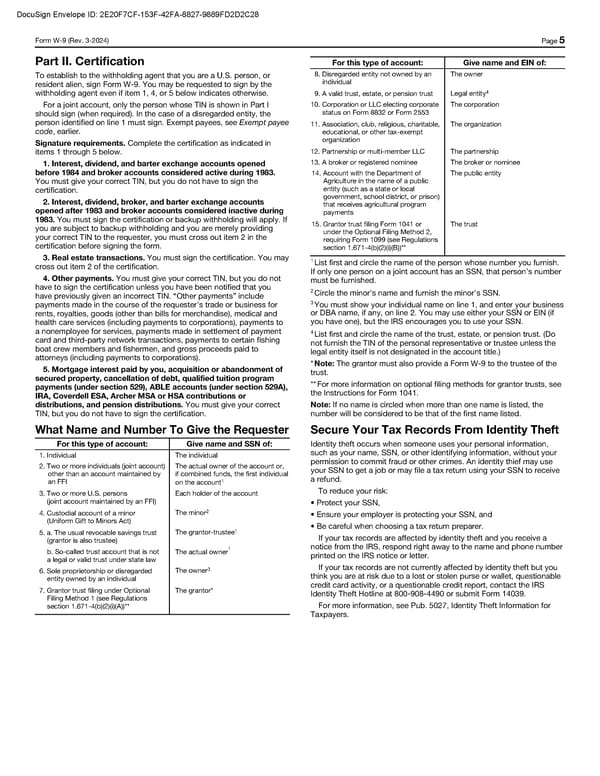

DocuSign Envelope ID: 2E20F7CF-153F-42FA-8827-9889FD2D2C28 Form W-9 (Rev. 3-2024) Page 5 Part II. Certification For this type of account: Give name and EIN of: To establish to the withholding agent that you are a U.S. person, or 8. Disregarded entity not owned by an The owner resident alien, sign Form W-9. You may be requested to sign by the individual 4 withholding agent even if item 1, 4, or 5 below indicates otherwise. 9. A valid trust, estate, or pension trust Legal entity For a joint account, only the person whose TIN is shown in Part I 10. Corporation or LLC electing corporate The corporation should sign (when required). In the case of a disregarded entity, the status on Form 8832 or Form 2553 person identified on line 1 must sign. Exempt payees, see Exempt payee 11. Association, club, religious, charitable, The organization code, earlier. educational, or other tax-exempt Signature requirements. Complete the certification as indicated in organization items 1 through 5 below. 12. Partnership or multi-member LLC The partnership 1. Interest, dividend, and barter exchange accounts opened 13. A broker or registered nominee The broker or nominee before 1984 and broker accounts considered active during 1983. 14. Account with the Department of The public entity You must give your correct TIN, but you do not have to sign the Agriculture in the name of a public certification. entity (such as a state or local 2. Interest, dividend, broker, and barter exchange accounts government, school district, or prison) opened after 1983 and broker accounts considered inactive during that receives agricultural program payments 1983. You must sign the certification or backup withholding will apply. If 15. Grantor trust filing Form 1041 or The trust you are subject to backup withholding and you are merely providing under the Optional Filing Method 2, your correct TIN to the requester, you must cross out item 2 in the requiring Form 1099 (see Regulations certification before signing the form. section 1.671-4(b)(2)(i)(B))** 3. Real estate transactions. You must sign the certification. You may 1 cross out item 2 of the certification. List first and circle the name of the person whose number you furnish. 4. Other payments. You must give your correct TIN, but you do not If only one person on a joint account has an SSN, that person’s number have to sign the certification unless you have been notified that you must be furnished. 2 have previously given an incorrect TIN. “Other payments” include Circle the minor’s name and furnish the minor’s SSN. 3 payments made in the course of the requester’s trade or business for You must show your individual name on line 1, and enter your business rents, royalties, goods (other than bills for merchandise), medical and or DBA name, if any, on line 2. You may use either your SSN or EIN (if health care services (including payments to corporations), payments to you have one), but the IRS encourages you to use your SSN. a nonemployee for services, payments made in settlement of payment 4 card and third-party network transactions, payments to certain fishing List first and circle the name of the trust, estate, or pension trust. (Do boat crew members and fishermen, and gross proceeds paid to not furnish the TIN of the personal representative or trustee unless the attorneys (including payments to corporations). legal entity itself is not designated in the account title.) 5. Mortgage interest paid by you, acquisition or abandonment of * Note: The grantor must also provide a Form W-9 to the trustee of the secured property, cancellation of debt, qualified tuition program trust. payments (under section 529), ABLE accounts (under section 529A), ** For more information on optional filing methods for grantor trusts, see IRA, Coverdell ESA, Archer MSA or HSA contributions or the Instructions for Form 1041. distributions, and pension distributions. You must give your correct Note: If no name is circled when more than one name is listed, the TIN, but you do not have to sign the certification. number will be considered to be that of the first name listed. What Name and Number To Give the Requester Secure Your Tax Records From Identity Theft For this type of account: Give name and SSN of: Identity theft occurs when someone uses your personal information, 1. Individual The individual such as your name, SSN, or other identifying information, without your 2. Two or more individuals (joint account) The actual owner of the account or, permission to commit fraud or other crimes. An identity thief may use other than an account maintained by if combined funds, the first individual your SSN to get a job or may file a tax return using your SSN to receive an FFI 1 a refund. on the account 3. Two or more U.S. persons Each holder of the account To reduce your risk: (joint account maintained by an FFI) • Protect your SSN, 2 4. Custodial account of a minor The minor • Ensure your employer is protecting your SSN, and (Uniform Gift to Minors Act) • Be careful when choosing a tax return preparer. 1 5. a. The usual revocable savings trust The grantor-trustee If your tax records are affected by identity theft and you receive a (grantor is also trustee) notice from the IRS, respond right away to the name and phone number b. So-called trust account that is not 1 The actual owner printed on the IRS notice or letter. a legal or valid trust under state law 6. Sole proprietorship or disregarded The owner3 If your tax records are not currently affected by identity theft but you entity owned by an individual think you are at risk due to a lost or stolen purse or wallet, questionable 7. Grantor trust filing under Optional The grantor* credit card activity, or a questionable credit report, contact the IRS Filing Method 1 (see Regulations Identity Theft Hotline at 800-908-4490 or submit Form 14039. section 1.671-4(b)(2)(i)(A))** For more information, see Pub. 5027, Identity Theft Information for Taxpayers.

W-9 Page 4 Page 6

W-9 Page 4 Page 6