Wells Fargo ESG Report

Environmental, Social, and Governance Report Published July 2021

2 A letter from the CEO . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 About Wells Fargo . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 Providing enhanced ESG disclosure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Identifying our ESG priorities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 ESG goals and progress . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 Contributing to the United Nations Sustainable Development Goals . . . . . . . . . . . . 11 Working together to drive positive impact . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 Continued response to the COVID-19 pandemic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 Corporate governance and ethics . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 Board of Directors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 Select governance practices and shareholder rights . . . . . . . . . . . . . . . . . . . . . . . . . . 17 Executive compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 ESG governance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 Code of Ethics and Business Conduct . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 Risk management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24 Public policy and political contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28 Tax overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30 Delivering value to our customers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 Financial health programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 Responsible treatment of customers with debt repayment problems . . . . . . . . 31 Customer satisfaction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 33 Integration of ESG criteria in Wealth & Investment Management . . . . . . . . . . . . 35 Expanding financial inclusion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38 Table of Contents

3 Responsible marketing supports informed decisions . . . . . . . . . . . . . . . . . . . . . . . . . 45 Information and cybersecurity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45 Protecting customer and employee privacy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47 Investing in our employees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49 Culture . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49 Diversity, equity, and inclusion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50 Addressing harassment in the workplace . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57 Performance management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57 Employee training and development . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58 Competitive compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59 Employee benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61 Employment security and responsible workforce restructuring . . . . . . . . . . . . . . . 64 Safety and health . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65 Dealing fairly and ethically with our suppliers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68 Supplier Code of Conduct . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68 Third-Party Center of Excellence . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68 Supplier diversity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68 Integrating ESG into supplier selection and engagement . . . . . . . . . . . . . . . . . . . . . 70 Community engagement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71 Philanthropy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71 Global philanthropy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74 Employee service and impact . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 74

4 Understanding environmental and social impacts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75 Global financial crimes risk management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75 Bank Secrecy Act/anti-money laundering . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75 Global sanctions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76 Anti-bribery and corruption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76 Environmental and social risk management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76 Respecting human rights . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79 Advancing environmental sustainability . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84 Climate commitment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85 Climate-related disclosure . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86 Sustainable finance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86 Operational efficiency . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88 Environmental risk and compliance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90 Forward-looking statements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91 Securities and Exchange Commission filings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91 References and resources . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92

5 As communities around the world begin to emerge from the COVID-19 pandemic, it’s incumbent on us to reflect on the lessons of this difficult period . The past year and a half has clearly demonstrated that significant economic, social, and environmental challenges disproportionately impact our most vulnerable communities . Wells Fargo has a significant role to play in delivering practical solutions to urgent challenges . We have the resources, business expertise, ingenuity, and relationships with public and private sector organizations to do so . Our work to support an inclusive recovery from the COVID-19 pandemic, and to address the systemic issues it has exposed, spans numerous areas . In early 2021, Wells Fargo announced a goal of aligning our business activities with the goals of the Paris Climate Agreement and achieving net- zero greenhouse gas emissions by 2050, including our financed emissions . We also launched an initiative that aims to manage the deployment of $500 billion in financing to sustainable business activities by 2030 . Climate change is one of the most urgent environmental and social issues of our time . It impacts all communities, particularly our most vulnerable ones, and inaction is not an option . Earlier this year we also issued Wells Fargo’s Inclusive Communities and Climate Bond — our first sustainability bond — which will fund projects and programs that support housing affordability, socioeconomic opportunity, and renewable energy . We also announced our Banking Inclusion Initiative, a 10-year commitment to help unbanked individuals gain access to affordable, mainstream, digitally enabled transactional accounts . The initiative will focus on reaching unbanked communities, with particular emphasis on helping remove barriers to financial inclusion for Black and African American, Hispanic, and Native American/Alaska Native families, which account for more than half of America’s 7 million unbanked households . 1 This report provides a comprehensive picture of the environmental, social, and governance (ESG) work underway at Wells Fargo . I hope it will help inform you and all our stakeholders on our progress, as it increases our accountability for meeting our ESG-related goals . We know this work has no finish line; we still have much more to do . But we’ve made a long-term commitment to these efforts, and I’m confident they will continue to deliver positive impacts . ‒ Charlie Scharf CEO, Wells Fargo & Company A letter from the CEO 1. 2019 FDIC Survey of Household Use of Banking and Financial Services, released in October 2020.

6 Wells Fargo & Company is a leading financial services company that has approximately $1 .9 trillion in assets and proudly serves one in three U .S . households and more than 10% of all middle market companies and small businesses in the U .S . Wells Fargo ranked No . 30 on Fortune’s 2020 rankings of America’s largest corporations . In the communities we serve, the company focuses its social impact on building a sustainable, inclusive future for all by supporting housing affordability, small business growth, financial health, and a low-carbon economy . We provide a diversified set of banking, investment, and mortgage products and services, as well as consumer and commercial finance, through our four reportable operating segments: Consumer Banking and Lending Commercial Banking Corporate & Investment Banking Wealth & Investment Management This report contains forward-looking statements, which may include our current expectations and assumptions regarding our future activities, plans, and objectives and other future conditions . Please see the “ Forward-looking statements ” section for more information about factors that could cause our actual results to differ materially from our forward-looking statements . About Wells Fargo

7 Our ESG Report and ESG Goals and Performance Data (PDF) are our foundational ESG disclosures . They provide an extensive overview of our most material ESG topics and how we manage key ESG issues . The ESG Report and ESG Goals and Performance Data are part of a suite of complementary ESG disclosures, which include the following: • 2020 Social Impact and Sustainability Highlights Report (PDF) • 2020 Task Force on Climate-related Financial Disclosures (TCFD) Report (PDF) • Global Reporting Initiative (GRI) Index (PDF) • Sustainability Accounting Standards Board (SASB) Index (PDF) Additional ESG-related resources such as policies, statements, environmental data verification, sustainable investing, Modern Slavery Act statements, memberships and commitments, and ESG viewpoints, can be found on our Goals and Reporting webpage . We intend to update our foundational ESG disclosures regularly to provide information that is current and relevant . Please refer to the publication date on the cover page as an indication of when updates were last made . We aim to provide the most up-to-date and accurate information in our disclosures . Commitments and time frames may vary . Providing enhanced ESG disclosure Performance trends can be found in the Wells Fargo ESG Goals and Performance Data (PDF) . Throughout this document you will see the following callout to indicate where information about performance trends is included in our ESG Goals and Performance Data (PDF) .

This is a modal window.

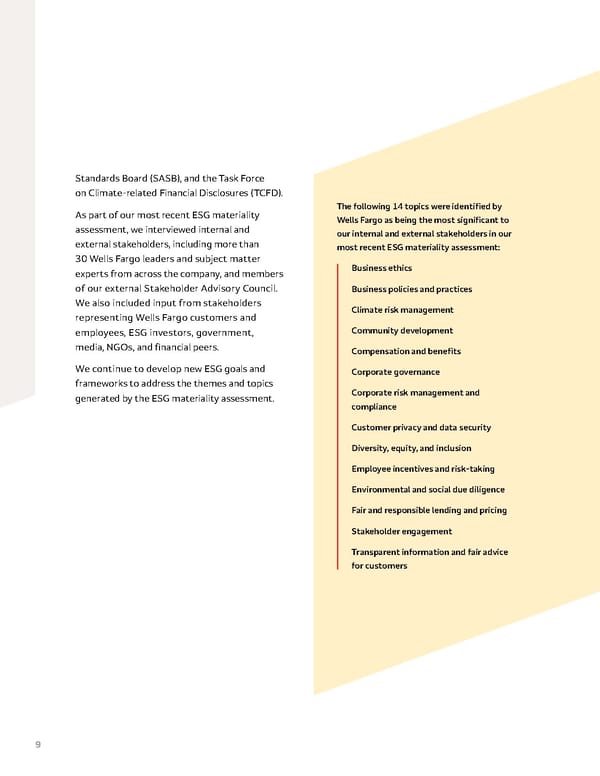

8 Identifying our ESG priorities Wells Fargo has an ongoing process to assess and prioritize ESG topics that are most relevant to our company and our stakeholders . The topics covered in this report reflect discussions with subject matter experts from across our company, findings from primary and secondary research, and feedback we receive and insights we gain through our ongoing engagement with stakeholders . At Wells Fargo, we regularly monitor ESG trends to inform our ESG strategy, goals, and reporting priorities . We have been conducting formal ESG materiality assessments periodically since 2009 to identify topics most important for ESG purposes . Our most recent ESG materiality assessment included substantial research in light of the significant, recent changes in our business and heightened stakeholder feedback about current and emerging socioeconomic and environmental trends . This research included an evaluation of global standard expectations, including the Global Reporting Initiative (GRI), the United Nations Sustainable Development Goals (SDGs), the Sustainable Accounting ENGAGING STAKEHOLDERS TO INFORM ESG PRIORITIES Understanding the perspectives of a wide range of stakeholders is critical to identifying and managing our ESG priorities. We engage with relevant stakeholders, including customers, employees, community members, suppliers, shareholders, regulators, media, analysts, and others. Engagement occurs through various channels, including face-to-face, telephone, email, social media, and surveys. Feedback is monitored and shared with relevant groups across the organization.

9 Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD) . As part of our most recent ESG materiality assessment, we interviewed internal and external stakeholders, including more than 30 Wells Fargo leaders and subject matter experts from across the company, and members of our external Stakeholder Advisory Council . We also included input from stakeholders representing Wells Fargo customers and employees, ESG investors, government, media, NGOs, and financial peers . We continue to develop new ESG goals and frameworks to address the themes and topics generated by the ESG materiality assessment . The following 14 topics were identified by Wells Fargo as being the most significant to our internal and external stakeholders in our most recent ESG materiality assessment: Business ethics Business policies and practices Climate risk management Community development Compensation and benefits Corporate governance Corporate risk management and compliance Customer privacy and data security Diversity, equity, and inclusion Employee incentives and risk-taking Environmental and social due diligence Fair and responsible lending and pricing Stakeholder engagement Transparent information and fair advice for customers

This is a modal window.

10 ESG goals and progress Performance trends can be found in the Wells Fargo ESG Goals and Performance Data (PDF) . As a leading global financial services company, we have a significant role to play in helping to address social, economic, and environmental challenges . In 2016, we established an integrated, companywide corporate responsibility strategy that included an ambitious set of goals to leverage our products and services, culture and business practices, and philanthropy to help address these global challenges over a five-year period . We are excited to announce that we’ve achieved nearly all of our 2020 goals, and that we are in the process of reevaluating our long-term commitments so we can take an active role in addressing pressing societal challenges . Our ESG Goals and Performance Data (PDF) reflects final progress toward our 2016-2020 goals . As we move forward, we continue to explore opportunities to deliver solutions that make an impact . In 2021, we committed to deploying $500 billion in sustainable financing by 2030 and set a goal to achieve net-zer o greenhouse gas emissions — including financed emissions — by 2050 . To help meet this ambitious goal, Wells F argo plans to measure and disclose financed emissions for select carbon-intensive por tfolios; set interim emission reduction targets; deploy more capital to finance climate innovation; and continue to work wi th our clients on their own emissions reduction efforts . We have launched an Institute for Sustainable Finance to manage our $500 billion commitment, as well as to suppor t science-based research on low- carbon solutions and adv ocate for policies that enable client transitions .

11 At Wells Fargo, we’re guided by a common effort to help our customers succeed financially . We also recognize that we have a responsibility to do our part to help address the many global challenges facing the communities we serve . As we strive to strengthen our business for the future, the United Nations (UN) Sustainable Development Goals * (SDGs) — a universal framework for Contributing to the United Nations Sustainable Development Goals accomplishing 17 desired global outcomes by 2030 — provide a guide for integrating sustainability more deeply into our business . Throughout this report, we share examples of how Wells Fargo is contributing to the advancement of certain global priorities outlined in the UN SDGs that are most relevant to our business . Those global priorities include: SDG 1: No Poverty End poverty in all its forms, everywhere Read more in Delivering value to our customers and Community engagement SDG 5: Gender Equality Achieve gender equality and empower all women and girls Read more in Investing in our employees SDG 7: Affordable and Clean Energy Ensure access to affordable, reliable, sustainable, and modern energy for all Read more in Understanding environmental and social impacts and Advancing environmental sustainability SDG 8: Decent Work and Economic Growth Promote sustained, inclusive, and sustainable economic growth; full and productive employment; and decent work for all Read more in Investing in our employees SDG 10: Reduced Inequalities Reduce inequality in and among countries Read more in Investing in our employees , Delivering value to our customers , and Community engagement SDG 11: Sustainable Cities and Communities Make cities and human settlements inclusive, safe, resilient, and sustainable Read more in Delivering value to our customers and Community engagement SDG 13: Climate Action Take urgent action to combat climate change and its impacts Read more in Understanding environmental and social impacts and Advancing environmental sustainability *We do not control this website . Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website .

12 We’re working hard to make meaningful and enduring contributions to society . This is at the heart of Wells Fargo’s approach to effectively managing ESG matters, and this report demonstrates the many ways ESG considerations are integrated into our policies and programs . We believe in clearly and transparently demonstrating how we’re delivering on our ESG commitments . And we further believe that corporate leaders — guided by the highest ethical standards — should use their influence and resources to make a positive impact on social and cultural issues . That’s why we’ve worked so hard to help ensure that our management policies contribute to positive value for our employees, customers, communities, and investors . One of the first things that CEO Charlie Scharf did when he joined Wells Fargo was to sign the Business Roundtable’s Statement of the Purpose of a Corporation . * In his words, “It’s simple and straightforward, and it’s a clear statement that businesses are responsible to a broad set of constituents and have responsibilities beyond what some companies have believed historically . Given the businesses we’re in and the reach we have, I believe our responsibilities and potential for impact are particularly great .” In line with that vision, Wells Fargo closely collaborates with the public sector to drive responsible business practices . A number of governments and regulators are pursuing initiatives that call for greater action and disclosure, including the UK Modern Slavery Act and the Task Force on Climate-related Financial Disclosures (TCFD) . Meanwhile, at an intergovernmental level, the UN SDGs * have become an important benchmark for multinational companies’ ESG efforts . Increasingly, investors use ESG factors to guide their investment decisions, and a growing number of shareholders identify as socially responsible . We’re also hearing more questions from customers on such topics as diversity, equity, and inclusion; climate change; and operational efficiency . On all these fronts and beyond, we strive to contribute meaningful solutions to pressing societal challenges, including inequality, COVID-19, and climate change, which — as many ESG experts have pointed out — are all interconnected . Going forward, these challenges will likely be magnified as demographics shift, racial and social inequities continue to grow, population densities increase, and extreme weather events become more frequent . Finding solutions will require global engagement and collaboration, and demands that we help navigate significant change to drive positive impact . At Wells Fargo, we’re answering that call . We’re taking actions to help address these interconnected crises in order to support an inclusive and enduring recovery . Working together to drive positive impact *We do not control this website . Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website .

13 COVID-19 has impacted all of our lives and we continue to navigate the challenges presented by the pandemic . From the beginning, we’ve prioritized the urgent needs of our employees, customers, and communities, working tirelessly to address the many challenges we’ve faced during the pandemic . We remain dedicated to working toward an inclusive and enduring recovery . Helping customers Customers’ needs shifted greatly during the pandemic . In response, we increased system capacity, enhanced automation, and created new features to allow customers to easily access banking and payment options . Throughout the pandemic, we’ve seen increased digital engagement with current and new customers, including adoption of our mobile and online offerings . The pandemic also highlighted the importance of Wells Fargo’s support for small businesses . In July 2020, we established the Open for Business Fund . We deferred approximately $420 million of Small Business Administration Continued response to the COVID-19 pandemic We’ve implemented a broad range of initiatives to help our employees, customers, and communities during the COVID-19 crisis. You’ll find personal accounts and stories on Wells Fargo Stories. processing fees in 2020 that will be recognized as interest income over the terms of the loans . We voluntarily committed to donate all of the gross processing fees received from Paycheck Protection Program loans funded in 2020 . Through June 30, 2021, we donated approximately $234 million of these processing fees to nonprofit organizations that support small businesses . Through the Open for Business Fund, we strive to engage nonprofit organizations to provide capital, technical support, and long-term resiliency programs to small businesses, with an emphasis on those owned by diverse entrepreneurs . Customers can access additional information available through Wells Fargo’s COVID-19 resources website .

14 Supporting employees Keeping employees safe remains one of our top priorities . We have taken measures to enhance the safety in our offices and branch locations based on the Centers for Disease Control and Prevention guidance . Safety kits were offered to all Wells Fargo employees and free, voluntary, on-site or self-administered COVID-19 testing is available for employees currently working at Wells Fargo locations in the U .S . Globally, employees who choose to get vaccinated can receive up to eight hours of additional paid time off for COVID-19 vaccine appointments . Early in the pandemic, we adjusted our child care benefits in the U .S . and Canada to provide additional resources and flexibility for employees impacted by school closures . We also enhanced our health care and time-off benefits in the U .S . to help cover medical costs associated with COVID-19 and allow high-risk, exposed, or infected employees to stay home without having to take paid time off . Employees have access to a range of other resources through our internal COVID-19 resource center . Engaging our suppliers We continue to work closely with many of our small and diverse-owned suppliers to provide support for a variety of needs during COVID-19 . We’ve utilized virtual communications to provide them with: • Information on the U .S . Small Business Administration’s Paycheck Protection Program (PPP) • Context on the economic impacts of COVID-19 • Grants to help support businesses across the U .S . through the pandemic • U .S . capacity-building programs to help businesses retool, recover, and restore Standing with communities We continue to evolve our social impact efforts to aid communities in response to COVID-19 . In 2020, we reallocated $175 million from the Wells Fargo Foundation to help address food shortages, public health needs, financial health, small business stability, and housing security for the most vulnerable populations . We expedited grant-making at the local level, as well as through relief efforts with national and international organizations, to help serve the immediate needs of our communities . As part of our response to the ongoing COVID-19-related humanitarian crisis in India, Wells Fargo committed more than $3 million through nongovernmental organizations to help increase hospital capacity, supply oxygen concentrators and critical medical equipment, provide emergency transportation, and support health care workers . Wells Fargo is a founding partner of the Ad Council and COVID Collaborative’s COVID-19 Vaccine Education Initiative, “It’s Up to You .” This is one of the largest public education efforts in U .S . history and is focused particularly on communities of color that have been disproportionately impacted by the pandemic . The campaign urges audiences to visit GetVaccineAnswers .org * ( DeTiDepende .org * in Spanish) for the latest information about COVID-19 vaccines . *We do not control this website . Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website .

15 Our Board is committed to sound and effective corporate governance practices and our efforts to transform its culture . We expect our management team and employees to share a common understanding of expectations in order to create a more consistent culture — doing what’s right, acting with integrity, and holding ourselves accountable . Board of Directors The Board remains focused on continual enhancement of its composition, oversight, and governance practices, and on Board succession planning to enable it to continue to oversee the company and its business effectively . Over the past few years, the Board has undergone significant refreshment to enhance the financial services, regulatory, financial reporting, business operations, and corporate governance skills and experiences represented on the Board . Our Board has adopted Corporate Governance Guidelines (PDF) to provide the framework for the governance of our Board and our company . These guidelines address many matters, including the role of our Board, membership criteria, director retirement and resignation policies, Director Independence Standards, information about Board committees, and other policies and procedures of our Board, including the majority vote standard for directors, management succession planning, our Board’s leadership structure, and director compensation . Corporate governance and ethics Performance trends can be found in the Wells Fargo ESG Goals and Performance Data (PDF) .

16 Board composition The Board’s current composition is a result of a thoughtful process informed by the Board’s own evaluation of its composition and effectiveness, and feedback received from our engagement with shareholders and other stakeholders . The Board and its Governance and Nominating Committee (GNC) expect that the Board as a whole has an appropriate balance of skills, knowledge, experience, and perspectives relevant to our business and strategy . In addition to minimum qualifications required for Board service under the Board’s Corporate Governance Guidelines, the Board identifies additional qualifications and experience through its annual self-evaluation process as desirable in light of Wells Fargo’s business, strategy, risk profile, and risk appetite . Each year, the Board conducts a comprehensive self-evaluation to assess its effectiveness, review our governance practices, and identify areas for enhancement . This annual assessment is also a key part of the Board’s director nomination process and succession planning . The GNC reviews and determines the overall approach, scope, and content of the Board’s annual self- evaluation process, including whether to engage a third party to help the Board conduct its self-evaluation . Each of the Board’s standing committees also conducts a self-evaluation process annually . The Board’s, and each committee’s, self-evaluation includes a review of the Corporate Governance Guidelines and its committee charter, respectively, to consider any proposed changes . Director independence The Board’s Corporate Governance Guidelines provide that a significant majority of the directors on our Board, and all members of the Audit Committee, Governance and Nominating Committee, Human Resources Committee, and Risk Committee, must be independent under applicable independence standards . Each year our Board evaluates and determines the independence of each director and each nominee for election as a director . Independent Board Chair Wells Fargo has had an independent Board Chair separate from the CEO role since 2016 . In 2016, taking into account feedback from our investors, the Board also amended Wells Fargo’s By-Laws (PDF) to require that the Board Chair be independent . The Board has adopted, and annually reviews and approves, well-defined authority and responsibilities of the independent Chair . ONLINE RESOURCES Annual Reports and Proxy Statements Board committee members and charters By-laws of Wells Fargo & Company (PDF) Code of Ethics and Business Conduct (PDF) Corporate Governance Guidelines (PDF) Leadership and governance

17 Board diversity While our Board doesn’t have a specific policy on diversity, the Board’s Corporate Governance Guidelines (PDF) and the GNC’s charter (PDF) specify that the Board and the GNC incorporate a broad view of diversity into its director nomination process . The GNC considers the current composition of the Board in light of the diverse communities and geographies we serve and the interplay of a first-time director candidate’s or director nominee’s experience, education, skills, background, gender, race, ethnicity, and other qualities and attributes with those of other Board members . The GNC incorporates this broad view of diversity, in addition to having a diverse candidate pool for each director search the Board undertakes, when evaluating and recommending director nominees to serve on our Board so that our Board’s composition as a whole appropriately reflects the current and anticipated needs of our Board and our company . Board committees The Board carries out its risk oversight responsibilities directly and through the work of each of its standing committees . All of these committees report to the full Board about committee activities, including risk oversight matters, and are composed solely of independent directors . Each Board committee has defined authority and responsibilities under its charter for primary oversight of specific risks and works closely with management to understand and oversee our company’s key risk exposures . The Board has six standing committees: Audit; Corporate Responsibility; Finance; Governance and Nominating; Human Resources; and Risk . Each standing Board committee’s charter is available on our website . The Board appoints the members and chair of each committee based on the GNC’s recommendation . Select governance practices and shareholder rights Wells Fargo has a demonstrated track record of responsiveness to shareholders and other stakeholders . As reflected below, our by-laws and other corporate governance documents contain provisions that we believe reflect sound and effective corporate governance principles and practices, including provisions that are reflective of and have enhanced shareholder rights . Governance practices include: • Independent Board Chair with clearly defined authority and responsibilities • Robust shareholder engagement program with independent director participation • Each share of our common stock is entitled to one vote • No “poison pill” • “Overboarding” policy that limits the number of public company boards on which our directors may serve (a director who is the CEO of a public company may not serve on more than three total public company boards, and other directors may not serve on more than four total public company boards, including Wells Fargo) • All standing Board committees consist solely of independent directors • Strong executive compensation clawback and forfeiture policies, including reduction or forfeiture of equity awards if the company or the executive’s business group suffers a material failure of risk management • Robust stock ownership and retention policies for our executive officers and nonemployee directors

18 • Anti-hedging policies that prohibit all employees, including executive officers and directors, from engaging in derivative or hedging transactions that involve any company securities, including our common stock • Pledging policy that prohibits our directors and executive officers from pledging company equity securities as collateral for margin or other loan transactions Shareholder rights include: • All of the company’s directors are elected annually by a majority vote in uncontested director elections, and by a plurality vote in contested elections • The right to call a special meeting of shareholders • A requirement that the Chair of the Board be an independent director • A proxy access right to nominate directors • Our Certificate of Incorporation and By-Laws permit shareholders to act by written consent by the minimum number of votes that would be necessary to take such action at a meeting at which all shareholders entitled to vote were present and voting Executive compensation Strong governance and oversight of executive compensation programs is essential to our long- term success . The Board’s Human Resources Committee (HRC), which oversees the company’s performance management and incentive compensation programs and approves all compensation decisions relating to the company’s executive officers, is composed of independent directors with qualifications and experience related to human capital management and risk management . The members of the HRC make market-informed decisions based on discussions throughout the year . The full Board approves the CEO’s compensation . Over the past few years, the HRC has continued to approve changes intended to strengthen the alignment between performance and compensation, and hold executives accountable for risk management failures . The HRC and our CEO use a total variable compensation model . Under this model, each named executive is provided a single total variable compensation target level, with payout based on performance assessed using our holistic performance assessment framework that considers company performance, individual performance, and risk management . The total variable earned amount is awarded partly in cash and the majority in long-term incentives that vest over, or at the end of, a three-year period and that are subject to performance-based vesting conditions . This approach helps reinforce pay for performance and makes our compensation decisions more transparent to shareholders .

19 Our executive compensation programs are designed and administered in accordance with the following compensation principles, each of which is an essential component in driving strong, risk-managed performance . • Pay for performance – Compensation is linked to company, business line, and individual performance, including meeting regulatory expectations and creating long- term value consistent with the interests of shareholders . • Promote effective risk management – Compensation promotes effective risk management and discourages imprudent or excessive risk-taking . • Attract and retain talent – People are one of our competitive advantages; therefore, compensation must help attract, motivate, and retain people with the skills, talent, and experience to drive superior long-term performance . Consistent with these principles, the combination of annual and long-term incentives is designed to motivate executives to achieve short-, medium-, and long-term performance that generates sustained shareholder value . Both annual and long- term incentives are based on performance . Additionally, we have a Clawback and Forfeiture Policy that, under specified conditions, strengthens our ability to forfeit or recover compensation in the event that named executive officers’ and certain other employees’ actions, or inactions, result in specified types of negative outcomes for our company . Our named executive officers are those executive officers for whom disclosure is included in the Compensation Discussion and Analysis and related compensation disclosures contained in our Proxy Statement (PDF) . ESG governance We challenge ourselves to integrate ESG strategies into our business every day . The day- to- day execution of our sustainability initiatives lies with our Public Affairs team, which is responsible for driving positive societal impact, proactively engaging with our stakeholders, and effectively communicating our priorities . The team brings together Communications & Brand Management, Social Impact & Sustainability, Government Relations & Public Policy, and Strategy & Transformation . A number of councils and committees provide governance, oversight, and recommendations to help us do this effectively . Corporate Responsibility Committee The Corporate Responsibility Committee has primary oversight responsibility for our significant strategies, policies, and programs on social and public responsibility matters and our relationships and enterprise reputation with external stakeholders on those matters . The committee’s oversight responsibilities include our community development and reinvestment activities and performance and strategies, policies, and programs relating to environmental sustainability and climate change, human rights, supplier diversity, government relations, and the support of nonprofit organizations .

20 External Stakeholder Advisory Council We created the Stakeholder Advisory Council in 2017 to provide external insight and feedback to the Board and senior management on current and emerging issues . The council is composed of external experts and thought leaders who represent groups focused on human rights, consumer rights, fair lending, the environment, civil rights, and governance . The council represents a diverse range of perspectives and experiences, and is focused on deepening our understanding of current and emerging ESG issues that are relevant to our stakeholders . Key issues include serving the financial needs of underserved communities, diversity and social inclusion, and environmental sustainability . This group helps us understand and consider a broad range of perspectives — not only in our ESG plans and activities, but also in our day-to-day business operations and decisions . ESG Disclosure Council In 2018, we formed an internal ESG Disclosure Council comprising senior leaders from the Controller’s Division, the Legal Department, Finance, Corporate Risk, and Public Affairs . The council helps us deliver on our commitment to transparency by providing senior-level accountability for ESG reporting and disclosures, as well as by considering ways to address gaps and deficiencies .

21 Code of Ethics and Business Conduct The Wells Fargo Code of Ethics and Business Conduct (PDF) (Code) provides clarity and focus on the ethical behavior we expect of all employees and Board members . The Code reinforces our commitment to always do what’s right by our customers, employees, communities, and stakeholders . And it contains basic principles and guidance that help our employees make decisions that align with these standards and comply with the laws, rules, and regulations that govern our business . To help make sure that the Code is accessible to our diverse workforce, we have made it available in English, French Canadian, and Simplified Chinese . No code of conduct can cover every possible situation, which is why we rely on employees to use good judgment and speak up promptly when they have questions or concerns . Every employee completes Code of Ethics training annually . This training provides interactive activities that guide employees through situations they may encounter . Beyond this training, we extend the learning through our online Wells Fargo Ethics site, Manager Center Ethics site, and Ethics Moments platform, all located on our employee intranet portal, Teamworks . These resources provide employees with information to help them navigate ethical dilemmas and make decisions guided by integrity and ethics . In addition to the Board’s oversight of conduct risk, members of the Board also attest annually that they have read and understand their obligations under the Code . While we consider our Code to be the starting point and not the finish line, it lays out the basic rules for how we conduct business . We encourage employees to read the Code throughout the year so they stay familiar with the following principles: • Anti-bribery and corruption – We do not tolerate bribery and corruption . We don’t offer or accept bribes or any other kind of improper payment — including facilitation payments or anything of value — and we do not do anything through a third party that we aren’t allowed to do ourselves . • Antitrust – We believe in free and open competition . We gain our competitive advantage through superior performance, not through anticompetitive business practices . • Insider trading – Employees must never buy or sell securities when they have material, nonpublic information, nor should they ever “tip” others by providing them with material, nonpublic information . Insider trading restrictions cover Wells Fargo securities, as well as the securities of other companies, including customers and third- party service providers, and they apply to all employees and their immediate families . • Gifts – We generally permit the giving and receiving of reasonable business gifts and entertainment that are neither lavish nor excessive in frequency; that are consistent with accepted, lawful business practices . • Conflict of interest – We work to avoid conflicts of interest in our employees’ personal and business activities in a number of circumstances, including through outside employment or business

22 activities and personal transactions, finances, or relationships . Where conflicts can’t be avoided, we aim to be transparent about their existence and we strive to take proactive steps to manage them . • Money laundering – As a global financial institution, we have special responsibilities to help combat money laundering . Our anti-money laundering policy and related procedures are designed to comply with applicable laws and regulations related to money laundering and terrorist financing . We require all employees to comply with these policies, procedures, and controls . • Serving communities – We want to be known as a trusted neighbor in the communities where we live and operate, and we encourage volunteerism . • Human rights – We recognize our responsibility to respect human rights throughout our operations, products, and services . That responsibility includes consistent treatment among people, employee well-being and security, economic and social freedom, and environmental stewardship . • Environment – We are integrating environmental mindfulness into all we do, and we work across our company to accelerate environmental sustainability . We take violations of our Code seriously . Anyone who knowingly violates any of the provisions of the Code, or the referenced policies and guidelines, may face corrective action, which may include termination of employment . Certain actions may also result in legal proceedings, including prosecution for criminal violations . To make Wells Fargo the best possible place to work, we encourage our employees to ask questions if uncertain about the right path and to speak up to their manager, Employee Relations, or the EthicsLine if they see or suspect misconduct or wrongdoing . Our Conduct Risk function, which is part of our Compliance organization, establishes conduct- related policies and requirements, including the Code, and provides independent oversight of the company’s adherence to those requirements . The frontline Conduct Management function is responsible for the allegation management life cycle, including the intake, research, and investigation of allegations of misconduct, overseeing and managing our EthicsLine, and performing root cause analysis and customer impact assessments . The Ethics Office, which also sits in the frontline Conduct Management organization, serves as an employee resource for questions on topics covered in the Code of Ethics and supports employees as they make decisions guided by integrity and ethics . Measuring our progress, employee sentiment scores directly related to “comfort in reporting dishonest or unethical practices without fear of retaliation” have trended upward from early 2020 .

23 Upgraded digital resources support doing what’s right In 2020, Wells Fargo upgraded its digital tools and resources to further empower employees and managers worldwide to do what’s right by speaking up about ethics-related concerns without fear of retaliation or other negative actions . These include: • The enhanced Ethics site for employees leverages key insights from our Pulse survey results and provides employees the critical tools and resources they need to speak up confidently and without fear of retaliation when they have ethics- related concerns . • The upgraded Manager Center Ethics site empowers managers to be ethical champions, better prepares them to listen to their employees and provide informed guidance when employees come to them to report misconduct, and reiterates that Wells Fargo does not tolerate retaliation when concerns are reported in good faith . Additionally, a new Manager Toolkit helps managers understand their reporting options, know what action to take and when, and find a range of useful resources organized by category . • To simplify the online reporting process and enhance the overall user experience, the upgraded EthicsLine web-reporting site, which is hosted by a third-party vendor, is more accessible and makes it easier to submit a report from anywhere and from any device 24 hours a day, 7 days a week, 365 days a year . • New Shared Success eCard designs increase engagement around ethics with cards used to thank employees for showing courage by speaking up about ethics-related concerns and to thank managers for listening to concerns with care and empathy . ENHANCING OUR FOCUS ON ETHICS Enhancements to maintain our focus on ethical behaviors include: • Centralized allegation management activities under Conduct Management to create efficiencies, enhance learnings, and assess trends. • Enhanced root cause analysis and data reporting capabilities to support analysis designed to uncover trends and distill insights. • Continued enhancing of processes designed to optimize investigations. • Developed resources to enhance transparency and reiterate our commitment to nonretaliation. • Continued efforts to understand employee sentiment about ethics.

24 Updated Speak Up and Nonretaliation Policy Speaking up about ethical concerns — including suspected allegations, policy violations, workplace concerns, process improvements, or other concerns — is an expectation of all Wells Fargo employees worldwide as part of doing what’s right and is outlined in the Speak Up and Nonretaliation Policy . The policy was revised in December 2020 to: • Provide employees updated and expanded guidance on how to report a variety of types of concerns . • Provide improved clarity on roles and responsibilities, including those of managers, as they relate to speaking up and nonretaliation . • Provide new and enhanced definitions for terms such as retaliation and misconduct . • Provide additional requirements for international employees including links to country-specific policies for Australia; India; the Philippines; and Europe, Middle East, and Africa . Wells Fargo does not tolerate retaliation or other negative actions such as harassment or unprofessionalism as a result of an employee speaking up in good faith . Risk management Every employee has a role in managing risk at Wells Fargo . The Risk Management Framework sets forth our core principles for managing and governing its risk . Senior management sets the tone at the top by supporting a strong culture defined by the company’s expectations ¹ that guides how employees conduct themselves and make decisions . The Board holds senior management accountable for establishing and maintaining the company’s culture, including its risk management component and effectively managing risk . Wells Fargo views climate change as a global challenge that presents significant impacts for businesses and communities around the world, and is committed to finding solutions to help mitigate the impacts of climate change related to its activities and to partner with key stakeholders, including communities and customers, to do the same . We expect climate change to increasingly impact the risk types we manage, and will continue to integrate climate considerations into the Risk Management Framework as understanding of climate change and risks driven by it evolve . Wells Fargo’s Environmental and Social Risk Management (ESRM) Framework provides information and transparency about our approach to managing environmental and social risks, including those related to climate change . Our ESRM Framework is generally aligned to our Risk Management Framework . Environmental and social issues, including climate change, can manifest across risk types . Risk operating model – roles and responsibilities Wells Fargo has three lines of defense to manage risk: the Frontline, Independent Risk Management, and Internal Audit . Our risk operating model creates necessary interaction, interdependencies, and ongoing engagement among the lines of defense: • Frontline – The Frontline, which is composed of our principal lines of business and certain enterprise function activities, is the first line of defense . In the course of its business activities, the Frontline identifies, measures, assesses, controls, monitors, and reports on risk generated by or associated with its business activities and balances risk and reward in decision-making while operating within our risk appetite . 1 . Please see the Investing in our employees section for more on the company’s expectations .

25 • Independent Risk Management (IRM) – IRM is the second line of defense . It establishes and maintains our risk management program and provides oversight, including challenge to and independent assessment of, the Frontline’s execution of its risk management responsibilities . • Internal Audit – Internal Audit is the third line of defense . It is responsible for acting as an independent assurance function and validates that the risk management program is adequately designed and functioning effectively . In addition to the three lines of defense, our control environment is strengthened by enterprise control activities that are performed by enterprise functions with specialized subject matter expertise such as accounting, reporting and tax, human capital, and legal services . Risk and culture Employees are encouraged and expected to speak up when they see something that could cause harm to our customers, communities, employees, shareholders, or reputation . Because risk management is everyone’s responsibility, all employees are empowered to and expected to challenge risk decisions when appropriate and to escalate their concerns when they haven’t been addressed . Effective risk management is a central component of employee performance evaluations . Our performance management and incentive compensation programs are designed to establish a balanced framework for risk and reward under our core principles that employees are expected to know and practice . The Board plays an important role in overseeing and providing credible challenge to our performance management and incentive compensation programs and reviews, and approves the compensation of the company’s executive officers and other officers or employees as it determines appropriate . Please see our most recent Proxy Statement (PDF) for additional details about how risk management is factored into executive compensation .

26 Training Wells Fargo has mandatory, recurring, risk and compliance-related training courses for all new and existing employees . These resources educate employees about our risk management program generally, and on how to recognize, understand, and address the risks they and the company face every day . Risk and strategy Our risk profile, risk capacity, risk appetite, and risk management effectiveness are considered in the strategic planning process, which is closely linked with our capital planning process . Wells Fargo’s Independent Risk Management (IRM) organization participates in strategic planning at several points in the process, providing challenge to, and independent assessment of, our self- assessment of the risks associated with strategic initiatives . IRM also independently assesses and challenges the impact of the strategic plan on risk capacity, risk appetite, and risk management effectiveness at the line of business, enterprise function, and aggregate company level . After review by management, the strategic plan is presented to the Board each year for review and approval . We continue to work hard to strengthen our company by building the right risk and control infrastructure. We continue to enhance our risk management programs, including our operational and compliance risk management as required by the Federal Reserve’s February 2, 2018, and the CFPB/ OCC’s April 20, 2018, consent orders.

27 Role of the Board and Board committee structur e The Board oversees the company’s business, including its risk management . The Board assesses senior management’s performance, provides credible challenge, and holds senior management accountable for maintaining and adhering to an effective risk management program . The Board carries out its risk oversight responsibilities directly and through its committees . The Risk Committee oversees Wells Fargo’s Risk Management Framework, including the risk management program, governance structures used by management to execute the risk management program, risk profile, risk appetite, and risk management effectiveness . The Chief Risk Officer (CRO) reports functionally to the Risk Committee and administratively to the CEO . The CRO and other leaders in Independent Risk Management have unrestricted access to the Risk Committee . Management committee structure We have established management committees, including those focused on risk, that support management in carrying out its governance and risk management responsibilities . One type of management committee is a governance committee, which is a decision-making body that operates for a particular purpose . Each governance committee, in accordance with its charter, is expected to discuss, document, and make decisions regarding high-priority and significant risks, emerging risks, risk acceptances, and risks and issues escalated to it . Each also reviews and monitors progress related to critical and high-risk issues and remediation efforts within its scope, including lessons learned . It also reports key challenges, decisions, escalations, other actions, and open issues as appropriate . The Enterprise Risk & Control Committee, a governance committee, is a decision-making and escalation body that governs the management of all risk types . The impacts of climate-related risks on the financial sector are increasingly an area of focus for governments and regulators globally . We’re actively monitoring for potential future governmental policy actions that seek to address climate change . We engage with policymakers to understand the policy landscape and potential developments that may impact our business or clients in the future . This informs our approach to managing climate-related risk and our efforts to further integrate climate-related risk considerations into our risk management programs . We aim to continue to improve our ability to identify and assess climate- related risks over time and expect to continue to refine our approach as we strengthen our understanding of how climate change impacts our business activities, processes, and risks .

28 Public policy and political contributions The Wells Fargo Government Relations and Public Policy team works closely with our lines of business to help make certain that our legislative and political activities adhere to good corporate governance practices and adhere to Wells Fargo policies and procedures . The Board’s Corporate Responsibility Committee oversees our government relations activities, as well as our public advocacy policies and programs . At least annually, the committee also receives reports from management on political and lobbying activities in the U .S ., including payments made by Wells Fargo to trade associations . Information on the Wells Fargo political action committee (PAC) and corporate political spending can be found on our Government Relations and Public Policy page . Advocacy and lobbying Wells Fargo participates in the U .S . public policy arena on a wide range of issues that may impact the company, such as policy issues addressing banking, finance, housing, small business, tax, and bankruptcy . We monitor and comment on proposed legislation and regulations that may affect the way we serve our customers . The Government Relations and Public Policy team must approve any use of company funds for lobbying . Further, we disclose federal lobbying activities under the Lobbying Disclosure Act (LDA), which requires quarterly reports to be filed with the United States Congress . These reports are publicly available on the U .S . House website .* U.S. campaign finance and PACs Wells Fargo’s PACs are funded through voluntary contributions from eligible exempt employees . Decisions about which candidates the PACs support are made by the Government Relations and Public Policy team . Wells Fargo’s PACs report to the Federal Elections Committee and/or to state agencies as required by law . Contributions are made without regard to the personal political preferences of the company’s senior management . In early 2021, Wells Fargo decided to pause PAC disbursements in order to conduct a comprehensive review of our PAC giving criteria and strategy to ensure it aligns with our business goals and expectations . Our comprehensive review included talking with Wells Fargo employees through focus groups, an in-depth survey of PAC members, individual conversations, and benchmarking against our peers and other Fortune 50 companies . The results of this review informed our future PAC giving strategy, and we’ll continue to operate our PACs with transparency . Policy on political contributions Pursuant to company policies, Wells Fargo does not use company money or resources to influence any U .S . domestic or foreign candidate elections . In accordance with these policies, we don’t assist candidate campaign committees, political parties, or caucuses, and don’t make independent expenditures on other political committees, or partake in any other type of election-related activity . Performance trends can be found in the Wells Fargo ESG Goals and Performance Data (PDF) . *We do not control this website . Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website .

29 We have policies and procedures in place designed to help make sure that we comply with applicable laws regarding political contributions . Wells Fargo also maintains compliance processes intended to make sure that its activities are conducted in accordance with those policies, our Code, and with applicable laws governing political contributions and lobbying activities . Employee activity Our Code of Ethics and Business Conduct (PDF) encourages employees to engage in civic and political activities on their own time and based on their individual desires and political preferences . We make it clear that employees must be sure that their personal political opinions and activities are not viewed as those of Wells Fargo . Employees are free to make personal contributions on their own behalf to candidates and related political entities of their choice so long as they comply with the Code and any applicable policies of their business line . Wells Fargo provides eligible employees up to three paid hours away from work to vote in any general, statewide, or special election .

30 Tax overview Wells Fargo files income tax returns in the U .S . and over 30 additional countries and territories in which we operate . Our income tax profile reflects the commercial and regulatory considerations that drive our business structure and strategy . As a taxpayer in many jurisdictions, we’re routinely under examination by various tax authorities . Wells Fargo emphasizes a culture of strong internal controls and risk management designed to achieve compliance with applicable local income tax laws and regulations . We offer transparency with global tax authorities, including sharing relevant information regarding our business operations and tax profile . In addition, we’ve implemented systems and processes to assist in our global compliance with applicable customer tax information reporting laws, the Foreign Account Tax Compliance Act, and the Common Reporting Standard . Our consolidated financial statements include information related to the reconciliation of our effective tax rate to the U .S . statutory income tax rate and our net income taxes paid . In addition, we file publicly available legal entity financial statements in certain non-U .S . jurisdictions . For more information on the impact of income taxation at Wells Fargo, see our Income Taxes footnote regarding our global effective tax rate and our Statement of Cash Flows supplemental information for net cash taxes paid in our Annual Report . Our most up-to-date financial reports can be found here .

31 Wells Fargo aims to exceed customer expectations and provide value to individual customers, investors, and small businesses across the economic spectrum . We’re working hard to enhance the customer experience through innovative product offerings delivered with the highest level of customer service . Our customer-centric strategy aims to put customers first in all that we do, meet customers’ needs in a personal and relevant manner, deliver seamless and frictionless experiences, and ultimately create meaningful relationships with our customers to help them reach their financial goals . Financial health programs We know that consumers are more likely to achieve financial success if they understand the steps they can take to establish healthy financial habits . That’s why we provide a variety of resources and products designed to enable individuals to learn how to manage money responsibly, build and improve credit, plan and save for the future, and reach their financial goals . • Hands on Banking ® by Wells Fargo is a free online learning program provided as a public service to all individuals, without any endorsements Delivering value to our customers or advertising . The program offers resources for anyone who wants to learn more about responsible money management . It’s designed to provide individuals and families with the knowledge they need to take control of their financial future, including educational articles on a variety of topics, classroom resources for educators, and self-directed courses for everyone from seniors and military members to entrepreneurs and kids . • The Smarter Credit TM Center includes resources to help customers understand, build, and improve credit, as well as manage debt and plan for large purchases . • Eligible Wells Fargo customers can access their FICO® credit scores for free through Wells Fargo Online ® . • Control Tower ® provides simple, secure, and centralized access to Wells Fargo cards and account information, enabling customers to easily view, manage, and monitor their digital financial footprint from a single location . Responsible treatment of customers with debt repayment problems We understand that keeping up with loan and credit card payments can be difficult, especially for people who’ve lost a job, been ill, or become overextended with credit . Performance trends can be found in the Wells Fargo ESG Goals and Performance Data (PDF) .

32 Wells Fargo Assist SM offers a variety of options and support to customers facing financial hardship related to: Home loans Wells Fargo home preservation specialists help homeowners with payment challenges, guiding them through options and approaches based on their individual situation and loan terms . Our Responsible Lending and Servicing Principles for U .S . Residential Real Estate Products govern our business practices in this area . These principles include providing customers with the information they need to make fully informed decisions about credit products and services, pricing those products and services appropriately, only approving applications when we believe the borrower has the ability to repay the credit according to its terms, and providing timely responses to customer questions and complaints, as well as prompt action to correct errors . Credit cards If customers are struggling to make monthly credit card or loan payments, or can’t catch up with past-due payments, we review the nature of the hardship and the customer’s financial information to determine whether they qualify for alternative payment options . Payment options are determined on a case-by-case basis, and may include a lower interest rate and, possibly, a lower minimum payment amount . Checking accounts Wells Fargo provides many services to help avoid overdrafts and manage customer accounts . Online, mobile, and text banking tools allow customers to monitor account activity, transfer funds, and help avoid unexpected overdrafts . These services include: • Overdraft Rewind ®, a service that helps customers with direct deposit avoid certain overdraft charges . It may help customers avoid returned payment and related merchant fees, so long as the customer’s incoming direct deposit is sufficient to cover payments from the prior business day that would have otherwise been returned unpaid . • Automatic zero-balance alerts that notify online banking customers by email if their account balances drop to zero or below . • No overdraft or return item fee is charged for any transaction of $5 or less and for any overdrawn balance of $5 or less . • In 2020, we introduced a new low-cost bank account with no overdraft fees: Clear Access Banking SM . This checkless bank account helps customers avoid spending more than the amount available in the account without incurring overdraft or nonsufficient funds fees . Clear Access Banking is structured to meet the Cities for Financial Empowerment Fund’s Bank On National Account Standards for safe and appropriate financial products that can help people enter or reenter the mainstream financial system . Loans For customers who have difficulties making payments, we offer a variety of options based on their specific needs . We ask that customers contact us so we can better understand their challenges and talk through options that might work for them . These may include a due date change, payment deferral, loan modification, or hardship refinance .

33 Customer satisfaction Keeping customers front and center is at the heart of Wells Fargo’s continued evolution . We’re focused on embedding customer perspectives directly into our decision-making processes, and we recently established new groups to complement our existing dedication to customer experience . Office of Consumer Practices Wells Fargo established the Office of Consumer Practices (OCP) in 2021 as a companywide, consumer-focused advisory group within the Chief Operating Office . The OCP is working to help ensure our products, services, and business practices are fair and transparent, and is reinforcing a customer-centric culture across Wells Fargo . The OCP’s work complements efforts already underway to improve Wells Fargo’s sales practices and its overall customer experience . The group’s activities include: • Assessing and advising on consumer-related products, services, and business practices designed to ensure the consumer’s perspective plays a significant role in decision-making . • Engaging in all elements of the customer- product life cycle, including advising on product development processes like terms, conditions, and pricing . • Reviewing complaint metrics and other data to help identify and advise on potential consumer-related trends and outcomes . • Providing advice on policies, procedures, and training that impact how Wells Fargo interacts with consumers, including older adults and people with disabilities . Consumer Data and Engagement Platforms Established in 2020, Consumer Data and Engagement Platforms (CDEP) is focused on building a shared enterprise strategy around providing better and more seamless experiences for our customers — and ultimately improving their financial health . Central to that work is a deep focus on providing opportunities for sustainable business growth anchored in delivering meaningful experiences at every customer engagement touch point . To achieve these goals, CDEP works across the Consumer and Small Business Banking, Consumer Lending, and Wealth & Investment Management lines of business to help develop coordinated strategies for growth in each of Wells Fargo’s customer segments . In 2021, the group evolved to include Enterprise Marketing channels, platforms, and execution . This addition enhanced our ability to build the next-generation digital, data and analytics, and functional capabilities required to meet the changing demands of the marketplace, and the needs of more sophisticated consumers whose expectations for simple, customizable, and personalized services are constantly evolving . Key areas of focus for CDEP in 2021 include: • Financial health: A new assessment tool deployed across our branches and digital spaces will help us understand customers’ needs so we can create personalized solutions to meet those needs and support their long- term financial health .

34 • Customer Experience Council: The council brings together the most senior leaders across the company to build capabilities that help us listen to customers, understand their feedback, and use their input to develop and launch programs that aim to directly improve the customer experience . • Customer journeys: We’re transitioning to a focus on the holistic needs of the customer, and aiming to deliver a seamless experience regardless of the type of product or service they need, or the channel they choose to use to interact with Wells Fargo . • Net Promoter System® (NPS): We continue to make significant progress in rolling out NPS to lines of business acr oss the enterprise, with employees regularly using the NPS to better understand the experience customers are having, and to guide actions we can take to make that experience even better . Since the program’s introduction in 2019, nearly 8 million survey responses have been collected, and those have been the catalyst for driving significant customer experience change across the organization . Enterprise complaints management The Enterprise Complaints Management Office (ECMO) is designed to provide standardized and coordinated application of the Wells Fargo Complaints Management Policy across all Wells Fargo businesses . ECMO is monitored by internal and external validation partners and oversight teams via updated metrics, reports, and scorecards with a goal of ensuring that our processes, procedures, and data can be counted on at all levels of the organization, and meet the commitments we’ve made to all of our stakeholder groups . ECMO’s complaints management employees utilize Wells Fargo’s integrated, companywide complaint technology — the Enterprise Complaints Management Platform (ECMP) — to facilitate proper routing, intake, research, and final resolution of complaints among Wells Fargo’s Frontline employees, line of business complaint teams, and three ECMO escalated Complaint Executive Offices . Together with all of these groups, ECMO tracks and addresses complaints that range from the seemingly simple “service complaints,” which are generally addressed by employees upon the initial call, to the more complicated “escalated complaints,” which require deeper research, operational risk reviews, and final communication of resolution . The ECMP puts up-to-date customer information and capabilities at the employees’ fingertips with data and supportive technology designed to enhance their effectiveness . On a planned path of continuous improvement, enhancements to the ECMP are made every few weeks to help employees work more efficiently and consistently to provide the kind of experience our customers deserve . In addition, ECMO’s Complaints Data, Analytics, and Reporting (CDAR) team is responsible for root cause analysis of complaints . CDAR has developed proprietary A dvanced Listening® technology and processes that leverage artificial intelligence, natural language, and speech recognition, to deliver deeper insight into our customers’ experiences . This helps CDAR identify complaint trends and emerging risks, along with performing