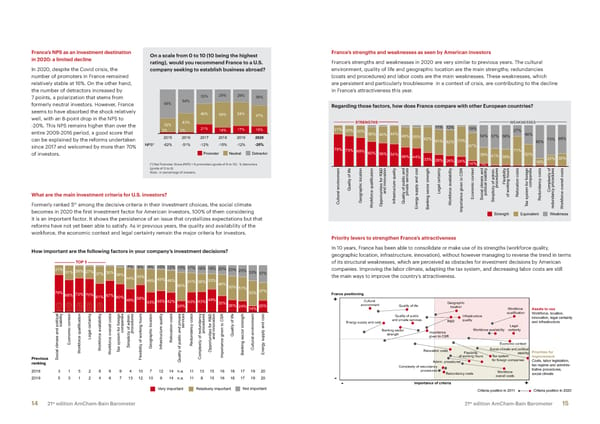

France’s NPS as an investment destination On a scale from 0 to 10 (10 being the highest France’s strengths and weaknesses as seen by American investors in 2020: a limited decline rating), would you recommend France to a U.S. France’s strengths and weaknesses in 2020 are very similar to previous years. The cultural In 2020, despite the Covid crisis, the company seeking to establish business abroad? environment, quality of life and geographic location are the main strengths; redundancies number of promoters in France remained (costs and procedures) and labor costs are the main weaknesses. These weaknesses, which relatively stable at 16%. On the other hand, are persistent and particularly troublesome in a context of crisis, are contributing to the decline the number of detractors increased by in France’s attractiveness this year. 7 points, a polarization that stems from 33% 29% 29% 36% formerly neutral investors. However, France 65% 54% Regarding those factors, how does France compare with other European countries? seems to have absorbed the shock relatively 46% 58% 54% well, with an 8-point drop in the NPS to 47% -20%. This NPS remains higher than over the 32% 43% STRENGTHS WEAKNESSES 3% 3% 21% 14% 17% 16% 21% 25% 30% 11% 12% 19% 27% entire 2009-2016 period, a good score that 36% 40% 44% 49% 54% 57% 58% 46% can be explained by the reforms undertaken 2015 2016 2017 2018 2019 2020 50% 62% 73% 73% 69% NPS* -62% -51% -12% -15% -12% -20% 61% 62% 80% since 2017 and welcomed by more than 70% 78% 67% of investors. Promoter Neutral Detractor 73% 69% 60% 56% 54% 71% 52% 46% 44% 39% 41% 39% 25% 30% 33% 28% 26% 24% 18% (*) Net Promoter Score (NPS) = % promoters (grade of 9 to 10) - % detractors 14% 7% (grade of 0 to 6) e D y s h y y R t y y s s s s Note : in percentage of answers. Quality of lif proceduresFlexibilit companies Complexity of What are the main investment criteria for U.S. investors? and innovation private service Legal certaintrkforce availabilitEconomic contexSocial climate andpolitical stabilitof working hourRelocation costRedundancy cost th Cultural environmentGeographic locationrkforce qualificationInfrastructure qualitQuality of public andWo Simplicity of admin. x system for foreign rkforce overall cost Formerly ranked 5 among the decisive criteria in their investment choices, the social climate Wo Opportunities for R& Energy supply and costBanking sector strengtImportance given to CS Ta redundancy proceduresWo becomes in 2020 the first investment factor for American investors, 100% of them considering Strength Equivalent Weakness it is an important factor. It shows the persistence of an issue that crystallizes expectations but that reforms have not yet been able to satisfy. As in previous years, the quality and availability of the workforce, the economic context and legal certainty remain the major criteria for investors. Priority levers to strengthen France’s attractiveness How important are the following factors in your company’s investment decisions? In 10 years, France has been able to consolidate or make use of its strengths (workforce quality, geographic location, infrastructure, innovation), without however managing to reverse the trend in terms TOP 5 of its structural weaknesses, which are perceived as obstacles for investment decisions by American 21% 7% 8% 9% 10% 12% 15% 17% 18% 18% 20% 23% 25% companies. Improving the labor climate, adapting the tax system, and decreasing labor costs are still 31% 26% 27% 37% 30% 36% 33% 37% the main ways to improve the country’s attractiveness. 44% 34% 45% 46% 33% 49% 41% 38% 46% 60% 50% 51% 79% 72% 70% 53% 37% France positioning 68% 61% 67% 60% 58% 49% 43% 45% 42% 43% 43% 49% 35% + Cultural Geographic 1 2 3 4 5 24% 26% 24% 25% environment Quality of life location 14% Workforce Assets to use y t y y s s y s e s s y D R e h Quality of public Infrastructure qualification Workforce, location, and private services quality innovation, legal certainty stabilit Energy supply and cost R&D and infrastructure service Legal companiesprocedures procedures Banking sector Importance Workforce availability certainty Legal certaint Relocation cost and innovationQuality of lif strength given to CSR Economic contexrkforce qualificationrkforce availabilitrkforce overall costx system for foreignSimplicity of admin.Geographic locationInfrastructure qualitRedundancy costCultural environment Economic context Wo Wo Ta Opportunities for R& Relocation costs Social climate and political Priorities for Wo Banking sector strengtEnergy supply and cost Flexibility Tax system stability Previous Social climate and political Flexibility of working hour Complexity of redundancImportance given to CS of working hours improvement ranking Quality of public and privat Admin. procedures for foreign companies Costs, labor legislation, Complexity of redundancy tax regime and adminis- 2018 371 52869410 12 14 n.a. 11 13 15 16 18 17 19 20 procedures Workforce trative procedures, Redundancy costs overall costs social climate 2019 513 124671312 0914 n.a. 11 815161817 19 20 - - Importance of criteria + Very important Relatively important Not important Criteria position in 2011 Criteria position in 2020 st st 14 21 edition AmCham-Bain Barometer 21 edition AmCham-Bain Barometer 15

AmCham-Bain Barometer Page 7 Page 9

AmCham-Bain Barometer Page 7 Page 9