2021 | Marketing Media Technology

Revealing what broadcast and media technology buyers want from their suppliers' marketing communications

Marketing Media Technology Revealing what broadcast and media technology buyers want from their suppliers' marketing communications

MARKETING MEDIA TECHNOLOGY Contents: 01. CHOOSING THE CHANNELS 02. FOCUSING THE MESSAGE 03. UNDERSTANDING THE AUDIENCE 04. OUTBOUND TO INBOUND, CUTTING THE COLD CALLING 05. REFLECTING THE PACE OF INDUSTRY CHANGE 06. A TWO-WAY PROCESS

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Executive Summary Modern broadcast and media technology buyers feel bombarded with marketing messages, digital content and cold calling from technology suppliers. Most of it is not relevant to them at that moment in time and gets ignored. But buyers do want to keep up with innovation and find out what industry vendors can do, specifically what business problems they can solve. Then, when the time is right, and a project is budgeted and underway, buyers know which vendors to approach. This report reveals the current state of the media technology sales and marketing landscape: ow buyers are finding out about the market, how they want to engage with technology h providers, the sort of marketing content they are consuming through which channels, and how their vendors can best respond. Independently researched and produced by Caretta Research in partnership with Bubble Agency, it is based on analysis of detailed focus group interviews and survey data, gathered from a broad range of global industry leaders, including technology buyers and sellers, in Q3 2021. Key Findings Despite cancellations in 2020-21, trade shows retain a Well before the pandemic, sales and marketing in media crucial role: still the most popular channel for buyers to technology was changing with the shift to SaaS and cloud keep up with industry trends and vendors, and the channel services, smaller projects, faster buying cycles, and informed that buyers trust most. buyers cherry picking the vendors they want to work with. Face-to-face events like trade shows should be increasing- Buyers want their suppliers to communicate clearly how ly seen as the mechanism to close deals by creating trusted products and services can address specific business issues relationships. Content-led lead generation to build pipeline and show where they’ve done it before. comes earlier in the process. Events and content supported by industry organisations In a market where trust is crucial, buyers hate vendors who like DPP, EBU, IABM, MESA, SMPTE and SVG, along with make over-inflated or vague claims. Buyers want honest buyers’ own personal networks, are the other most-trust- and transparent marketing communications. ed sources of industry information. Marketing needs to be two-way. Listening is as important Clear, concise bite-size content across a range of formats and channels, particularly LinkedIn and YouTube, is the as broadcasting the message. Buyers feel that many best route to reach buyers who want to keep up with the suppliers fail to understand their real business needs. market and research individual suppliers. Technology suppliers following these steps, and using marketing to clearly position their specific capabilities and Beyond the explosion of digital content, face-to-face experience of solving specific business challenges will be in interactions remain crucial for building a buyer’s trust in prime place when buyers are creating a shortlist. the supplier’s ability to deliver what they’re promising.

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Choosing the channels 01. Keeping up with industry trends Even after a series of cancelled trade shows, including NAB and IBC in 2020 and 2021, we expect them to bounce back: the lure of a convention remains strong—at the top of buyers’ and sellers’ favourite channels for keeping up with the industry. Elsewhere in the rankings, trade press publications are more popular than social media, though not quite as popular among buyers as they are with suppliers. And published white papers, reports and case studies, a marketing stalwart for many, come much lower down the list for buyers. Direct contact is ranked higher by buyers than sellers, but with different interpreta- tions. Buyers like to get in touch ‘inbound’ when they need specific information from a vendor, while sellers often still focus on sales emails and cold calling which buyers consistently say they hate. Favourite sources of industry info 83% Trade shows 1 Trade shows 72% 70% Industry 2 Trade press 71% organisations mags/websites 69% Personal networks 3 Industry 68% organisations 69% Trade press 4 Personal networks 64% mags/websites Buyers 55% Webinars 5 Webinars 59% Sellers 53% Direct contacts 6 White papers, 54% reports, case studies 50% Social media 7 Online search (SEO) 49% 48% Online search 8 Social Media 49% 48% White papers, reports, 9 Direct Contacts 45% case studies 32% Paid-for research 10 Paid-for research 25% Respondents ranked channels in order of which they most like to use. Aggregated popularity metric.

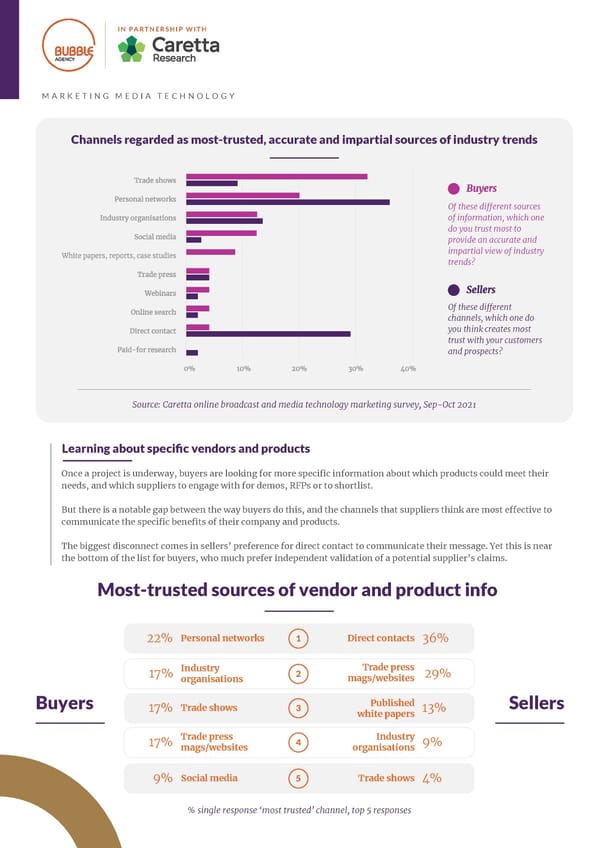

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Most-trusted sources There is rather more disconnect between buyers’ most-trusted sources of accurate Trade shows will have and impartial industry information, and the channels that suppliers think create most trust with their prospects. more of a role—most suppliers are not based Buyers have far more faith in social media, webinars and published content than sellers think, while sellers greatly overestimate the importance of direct contact. in our country. It’s easier to work with Sellers also underestimate the role of trade shows in creating a trusted relationship with buyers. It can be notoriously di昀케cult to quantify the value of investing in a them remotely if you’ve trade show presence in terms of leads and pipeline growth—but this research (our met face-to-face once focus group and survey) reveals a consistent message: buyers want to meet their or twice a year. potential suppliers face-to-face before they do business together, and trade shows Senior architect, European are an e昀昀ective and e昀케cient way to do this. commercial broadcaster Trade shows, and meetings arranged by industry organisations, o昀昀er a chance to build trust and rapport that can sustain virtual interactions via web conferencing the People go to trade rest of the year. shows to qualify you out, not in. Trade shows increasingly play a more important role in closing Marketing VP, production sales than in generating pipeline, with content-based marketing software technology provider raising awareness long before the convention begins. Most-trusted sources of industry info 32% Trade shows 1 Personal networks 36% 20% Personal networks 2 Direct contacts 29% Buyers 12% Industry 3 Industry 13% Sellers organisations organisations 12% Social media 4 Trade shows 9% 8% White papers, 5 Trade press 4% reports, case studies mags/websites % single response ‘most trusted’ channel, top 5 responses

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Channels regarded as most-trusted, accurate and impartial sources of industry trends Of these di昀昀erent sources of information, which one do you trust most to provide an accurate and impartial view of industry trends? Of these di昀昀erent channels, which one do you think creates most trust with your customers and prospects? Source: Caretta online broadcast and media technology marketing survey, Sep-Oct 2021 Learning about specific vendors and products Once a project is underway, buyers are looking for more specific information about which products could meet their needs, and which suppliers to engage with for demos, RFPs or to shortlist. But there is a notable gap between the way buyers do this, and the channels that suppliers think are most e昀昀ective to communicate the specific benefits of their company and products. The biggest disconnect comes in sellers’ preference for direct contact to communicate their message. Yet this is near the bottom of the list for buyers, who much prefer independent validation of a potential supplier’s claims. Most-trusted sources of vendor and product info 22% Personal networks 1 Direct contacts 36% 17% Industry 2 Trade press 29% organisations mags/websites Buyers Published Sellers 17% Trade shows 3 white papers 13% 17% Trade press 4 Industry 9% mags/websites organisations 9% Social media 5 Trade shows 4% % single response ‘most trusted’ channel, top 5 responses

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Top of the buyers’ list is using their own personal network—directly contacting someone already using the product. Suppliers can help facilitate this by being more transparent about their current deployments, highlighting success stories and encouraging their customers to be advocates. Content and events created by trusted industry organisations like the DPP, EBU, MESA, IABM, SMPTE and SVG are important for buyers wanting to sound out a particular supplier, followed by information from the trade press and social media. And while webinars and white papers are a popular way for sellers to set out their stall, and do resonate with buyers wanting to keep on top of general industry trends, they come at the bottom of the list for buyers seeking more specific information about individual products and suppliers. Channels most useful to learn about specific suppliers and products Of the di昀昀erent sources of information you ranked earlier, which one is most useful to learn about specific broadcast and media technology suppliers and their particular products, for example when you are considering which suppliers to approach about a project? Of the di昀昀erent sources of information you ranked earlier, which one is most useful to communicate the benefits of your particular company and products, for example when a prospect is considering which suppliers to approach about a project? Source: Caretta online broadcast and media technology marketing survey, Sep-Oct 2021 Social media mostly means LinkedIn and YouTube Social media may not be the most popular marketing channel for either buyers or sellers of media technology, but it plays an important role as part of the overall marketing mix, and is one of the sources more trusted by buyers. Social-media savvy marketing professionals also tend to overrate its importance compared with their customers. While buyers use social media less often, they do use a wider range of platforms.

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY LinkedIn is the principal social platform for both buyers and sellers— 98% of technology providers use it for industry research ‘often’ or ‘sometimes’, and 88% of buyers. After that, YouTube is the most popular social platform among buyers, with 72% using it ‘often’ or ‘sometimes’. In general, we think YouTube is an underused resource by many marketing teams. Bite-size videos are an e昀昀ective way to communicate product capabilities, customer case studies and industry know-how. Yet very few industry suppliers have an actively-updated YouTube channel, and almost none have equipped their spokespeople with even the most basic video and audio kit for recording and streaming. Focusing on those platforms that are used “often”, Twitter and Facebook are in the top four along with LinkedIn and YouTube. TikTok is the surprise entry, with just under a quarter of buyers saying they use it often. When more occasional use is taken into account, buyers say they use an even wider range of social platforms at least sometimes—including Instagram, Reddit, Pinterest and Weibo. There is little evidence that these longer-tail social platforms have much traction for professional use though, with fewer than one in five turning to them often. That said, technology suppliers are under-estimating the importance of TikTok compared with buyers and rather over-estimating the role of Instagram. Social media platforms used "often" for researching media technology industry and products Which of the social media platforms (if any) do you like to use to keep on top of broadcast and media technology industry trends and learn about suppliers and products? Which of the social media platforms (if any) do you like to use for marketing communica- tions? Source: Caretta online broadcast and media technology marketing survey, Sep-Oct 2021

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Focusing the message The request from broadcast and media technology buyers is clear: they want 02. marketing communications from potential suppliers to be honest and transparent. About the supplier’s company... Buying modern broadcast and media technology is often more about trust than product specs. Particularly in software and services, the product is never finished (and in many cases not yet started), so buyers are instead looking to build trust in their supplier’s ability to deliver. In this sense, marketing communications play a vital role in conveying the credibility, experience and capability of the company and its people. Avoid coining new marketing terms. Call the products what they Buyers want reassurance that a prospective provider: are so buyers can see Has enough resources and bandwidth to deliver their project, and that their particular needs will not get pushed to the end of the roadmap. where they compete. Head of infrastructure, stream- Can articulate a clear vision for how they respond to the changing industry. ing platform, MENA region Demonstrates a cultural fit in the way of working. Can run critical infrastructure reliably and securely for SaaS solutions. Is stable and secure, and investing in its product roadmap. Unfortunately I have to be less and less trusting ...And its products of suppliers’ ability to deliver on promises. Of course, buyers also want to understand the capabilities of individual products so they can assess how these could meet their needs. Ultimately this pushes up procurement costs as Buyers value accurate, honest descriptions of what a product does, so they can easily we have to do extra due see where it fits into a project. diligence. Buyer, survey respondent Making sweeping or inaccurate claims about a product leads to buyer frustration. Common complaints from our focus group include buyers that invent new terms for products instead of using industry conventions, or claiming that they can cover all requirements by o昀昀ering an ‘end-to-end’ solution. We dislike vendors that In a modular, microservices world, buyers are more interested in suppliers that are are misrepresenting focused on doing a few things very well. their abilities and jumping on industry Pilots, proofs of content (PoCs) and loan equipment are an increasingly important part of this process. In SaaS, customers increasingly expect to be able to try out a product with minimal initial cost and no commitment. Product marketers can learn bandwagons. Buyer, survey respondent from the strategies of consumer SaaS businesses, and the role of the ‘free tier’. And with many SaaS products and public cloud providers moving to transparent pricing, there is pressure for more specialist broadcast and media technology suppliers to follow suit and move away from the opaque ‘enterprise pricing’ models of old.

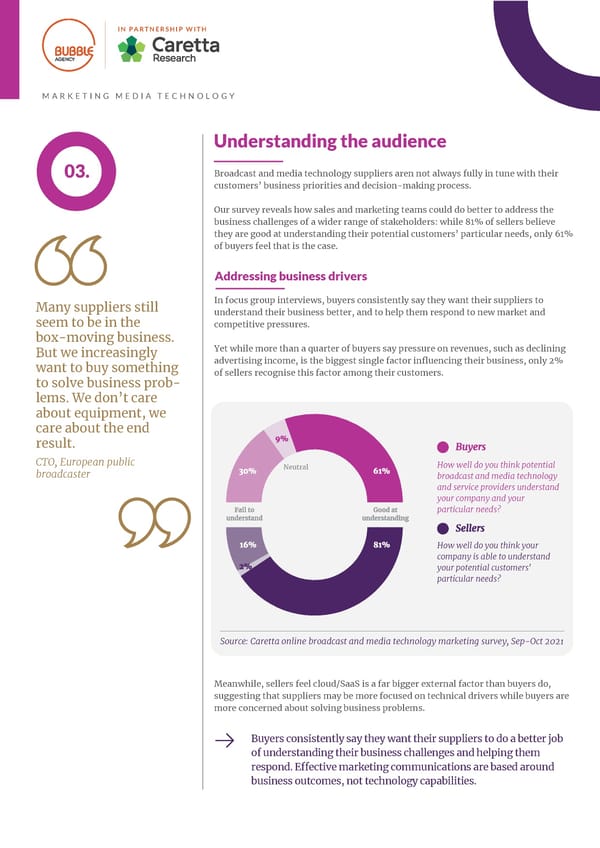

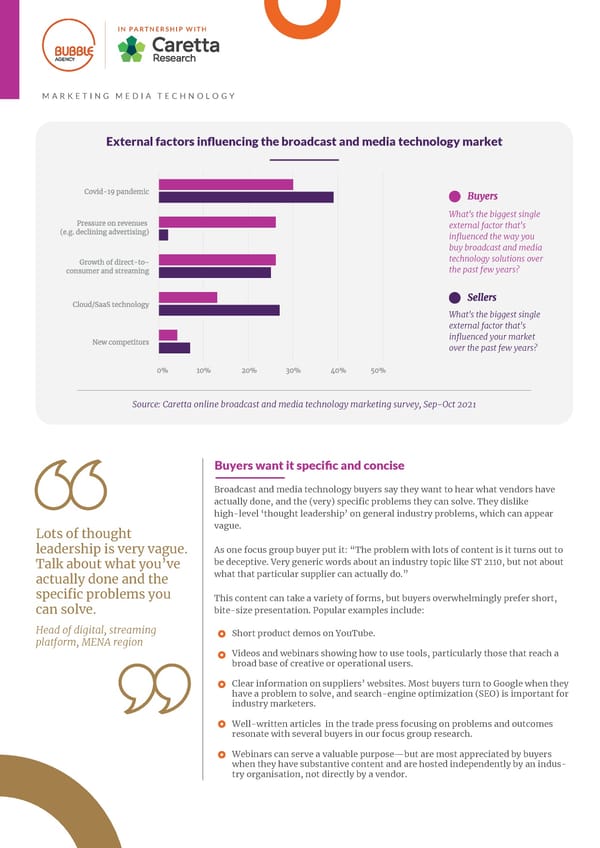

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Understanding the audience 03. Broadcast and media technology suppliers aren not always fully in tune with their customers’ business priorities and decision-making process. Our survey reveals how sales and marketing teams could do better to address the business challenges of a wider range of stakeholders: while 81% of sellers believe they are good at understanding their potential customers’ particular needs, only 61% of buyers feel that is the case. Addressing business drivers Many suppliers still In focus group interviews, buyers consistently say they want their suppliers to seem to be in the understand their business better, and to help them respond to new market and competitive pressures. box-moving business. Yet while more than a quarter of buyers say pressure on revenues, such as declining But we increasingly want to buy something advertising income, is the biggest single factor influencing their business, only 2% to solve business prob- of sellers recognise this factor among their customers. lems. We don’t care about equipment, we care about the end result. CTO, European public Neutral How well do you think potential broadcaster broadcast and media technology and service providers understand your company and your particular needs? How well do you think your company is able to understand your potential customers' particular needs? Source: Caretta online broadcast and media technology marketing survey, Sep-Oct 2021 Meanwhile, sellers feel cloud/SaaS is a far bigger external factor than buyers do, suggesting that suppliers may be more focused on technical drivers while buyers are more concerned about solving business problems. Buyers consistently say they want their suppliers to do a better job of understanding their business challenges and helping them respond. E昀昀ective marketing communications are based around business outcomes, not technology capabilities.

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY External factors influencing the broadcast and media technology market What's the biggest single external factor that's influenced the way you buy broadcast and media technology solutions over the past few years? What's the biggest single external factor that's influenced your market over the past few years? Source: Caretta online broadcast and media technology marketing survey, Sep-Oct 2021 Buyers want it specific and concise Broadcast and media technology buyers say they want to hear what vendors have actually done, and the (very) specific problems they can solve. They dislike high-level ‘thought leadership’ on general industry problems, which can appear vague. Lots of thought As one focus group buyer put it: “The problem with lots of content is it turns out to leadership is very vague. be deceptive. Very generic words about an industry topic like ST 2110, but not about Talk about what you’ve actually done and the what that particular supplier can actually do.” specific problems you This content can take a variety of forms, but buyers overwhelmingly prefer short, bite-size presentation. Popular examples include: can solve. Head of digital, streaming platform, MENA region Short product demos on YouTube. Videos and webinars showing how to use tools, particularly those that reach a broad base of creative or operational users. Clear information on suppliers’ websites. Most buyers turn to Google when they have a problem to solve, and search-engine optimization (SEO) is important for industry marketers. Well-written articles in the trade press focusing on problems and outcomes resonate with several buyers in our focus group research. Webinars can serve a valuable purpose—but are most appreciated by buyers when they have substantive content and are hosted independently by an indus- try organisation, not directly by a vendor.

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Targeting the right people Broadcast and media technology suppliers aren’t always targeting the right audience with their sales and marketing campaigns. They rightly recognise the importance of technology end users and broadcast engineers in the decision-making process, and of senior management in granting final approval to new contracts. But nearly half of suppliers regard procurement and IT teams as low priorities when planning their marketing communications strategy. Analysis of the data indicates this is a mistake—in an IT-driven media industry, it is not surprising that IT teams play a key role in project and vendor selection, as does the finance function. And procurement departments are also influential. Suppliers can consider targeting each decision-making role with tailored, relevant messaging about their capabilities. Decision-making roles in broadcast and media technology buying organisations Final approval Involved in decision-making Recommend / influence Source: Caretta online broadcast and media technology marketing survey, Sep-Oct 2021

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Outbound to inbound, 04. cutting the cold calling In our focus group, multiple buyers report being frustrated by an onslaught of cold calls, ‘spam’ emails and unsolicited LinkedIn connection requests, a vast majority of which are irrelevant. At the same time, buyers do value the chance to hear about a relevant new product. Despite the deluge of email and social media posts, buyers in our focus group interviews say they do pick out highlights, or recall something to return to—often months later. Email outreach! So rarely has anyone The secret to resonating with buyers appears to be a very clear, succinct, focused researched my company email that avoids making grand claims (“saving the BBC millions!”) but provides or developed a real specific evidence of a suppliers’ relevance to the buyer, with a link for more information. Communicating one clear concept in the first paragraph is crucial. pitch. Buyer, survey respondent Outbound to inbound, cutting the cold calling Email newsletters from industry groups and trade press titles are valued by many buyers for providing a succinct summary of industry news, vendor activity, product There’s lots of spam in launches and new case studies, conveniently collated in one place. email and LinkedIn. But some things catch your Marketing plans an essential role eye. It’s important to Cutting through the noise requires highly-focused messaging—very clear position- raise awareness. ing of a product’s benefits and where it fits, along with accurate targeting of relevant CTO, European public accounts. ‘Spray and pray’ marketing struggles to be e昀昀ective in a market with broadcaster 2,000+ other suppliers all trying to reach the same audience. Sales and marketing teams are mostly likely to stand out when they are laser-fo- cused on relevant accounts, show they understand a customer’s business drivers and challenges, and can position their product in that specific context. This drives an increased need for marketing communications. Buyers are very resistant to approaches from inside- and field-sales teams unless and until they have already identified that the supplier is relevant to them. “It’s a shift from sales teams knocking on doors to marketing teams knock- ing on virtual doors.” as one supplier’s marketing VP put it. A recurring theme of the focus group interviews is summed up in one buyer’s clear “The key thing: vendors need to communicate what they can do, message: what business problems they can solve, so we know what they can do.”

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Reflecting the pace of industry change 05. If technology suppliers are to stay in tune with potential customers, they need to cut through market hype and identify the industry trends that really impact buyers. We work in a constantly-changing ndustry, where 91% of technology suppliers and 78% of buyers feel their organisation’s approach to developing, or adopting, new broadcast and media technology solutions is ‘fast’, or ‘relatively fast’. Cloud is complicated When it comes to cloud, some suppliers are sometimes falling behind customer expectations. Survey data shows 78% of buyers lean towards preferring cloud/SaaS, They see my job title yet only 58% of vendors are able to supply them. There is clearly some more work to be done by suppliers to market cloud-ready products. and just assume I’m interested in their ser- vice — but because they don’t understand our business they’re just Do you prefer cloud/SaaS or wasting their time. on-premises broadcast and CTO, European public media technology solutions? broadcaster Do you supply cloud/SaaS or Neutral on-premises broadcast and media technology solutions? Source: Caretta online broadcast and media technology marketing survey, Sep-Oct 2021 Contradicting this though is a split in the buyers’ preference for how they prefer to pay for their technology—close to 50:50 between CAPEX and OPEX. On the other hand, suppliers have a clear preference for OPEX sales models. This indicates that buyers want the technical benefits of cloud solutions, but may fear the unpredictability of pay-as-you-go pricing, while vendors like the commer- cial benefits of predictable, recurring revenue, but don’t always have the right products for this. The lesson for product marketers is to promote a portfolio that includes cloud-native solutions with flexible ways to pay for them. And nuanced messaging that separately considers the technology and commercial implications of cloud.

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Indi昀昀erent How do you prefer to pay for broadcast and media technology? How do you prefer to charge for your products? Source: Caretta online broadcast and media technology marketing survey, Sep-Oct 2021 Spending is surprisingly strong Buyers are rather more optimistic about their spending on broadcast and media technology than their suppliers think. Two-thirds of buyers say their budgets have slightly/significantly increased over the last few years, yet only 44% of suppliers think that’s the case. This may well reflect the trend for those budgets to be spent in di昀昀erent ways: more money allocated to public cloud providers, internal development projects, or suppli- ers from outside the traditional media industry in areas like analytics—rather than being invested in conventional broadcast and media technology products. As a marketing response, suppliers should be clear how they fit in with public cloud, how they can provide modular components for ‘build-it-yourself’ integration, how they play with open source components, and with partners from the wider technology market. Has your organization's budget for Did not change broadcast and media technology changed over the past few years? Do you feel your customers' budgets for broadcast and media technology investment have changed over the past few years? Source: Caretta online broadcast and media technology marketing survey, Sep-Oct 2021

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY 06. A two-way process Modern marketing communications should be a two-way process—with a clear strategy for engaging with customers and prospects and hearing what they want. In our focus group interviews, buyers frequently stated the importance of working with suppliers who take the time to hear directly from them about their needs, business priorities and challenges. This is particularly important for emerging product categories, which require close alignment with beta customers to develop successfully. And for all suppliers, a Systems integrators dilute the message that structured approach to hearing from customers will guide a more relevant roadmap. the customer tries to The role of resellers, SIs and channel partners requires specific focus here. Many buyers reported frustration working with suppliers’ partners, particularly for more convey. We allow customers to directly complex solutions where detailed product knowledge is essential. influence our roadmap, which makes them trust Suppliers working via channel partners will want to keep a tight they are procuring a control over messaging, and ensure prospects have a direct line of communication. future-proof solution. Supplier, survey respondent I’m more likely to have a meeting with someone who doesn’t want to talk about their product but is more interested in understanding me. Senior director, broadcast network, North America

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY A modern media technology marketing playbook This research provides a playbook for broadcast and media technology suppliers wanting to maximise the e昀昀ectiveness of their marketing communications, based on what deci- sion-makers and budget holders told us has the most impact on their buying process. Summarising the key findings of this report provides a three-step approach for technology sales and marketing leaders: 01 Publishing content that clearly and specifically explains what business challenges a product can address, and the credentials of the vendor to do that successfully. This can be in the form of bite-sized emails, video, trade press articles, webinars and presentations that provide the evidence, making the supplier and products memorable so they are recalled when it is time for a project shortlist. 02 Building trust and rapport with buyers through face-to-face interactions across the suppliers’ team including management, product management, engineering and project delivery. Trade shows and industry events remain the most popular and e昀케cient place to do this. Buyers need to be sure their suppliers can deliver. 03 Focusing on a nuanced and relevant message that demonstrates a real understanding of the market in general and buyers’ business pain points in particular. This means taking time to understand broadcast and media companies individually and tailoring content and interactions accordingly. There is no one-size-fits-all approach. Methodology note Independent research and analysis was carried out by Caretta Research in September and October 2021. Based on in-depth semi-structured focus group interviews with a sample of broadcast and media technology decision makers, focused on their approach to understanding the market and engaging with vendors. And an online survey aimed at both media technology buyers and sellers, with corresponding questions to each. This survey was open for three weeks, publicised via email and social media, attracting 192 responses. Buyer respondents’ companies included broadcasters, OTT platforms, pay-TV providers, telecoms providers and post-production providers. Seller respondents’ companies included software providers, hardware providers, cloud/SaaS providers, managed service providers, resellers and systems integrators. Individual respondents were primarily in senior management and technology (buyers) or marketing (sellers) leadership roles. Survey respondents were self-selecting, and may not be fully representative of the entire industry. As such all data points in this report should be regarded as indicative of overall market trends rather than as a definitive measure.

MARKETING MEDIA TECHNOLOGY About Bubble Agency Founded in 1999, Bubble Agency is the go-to global PR, marketing and events specialist for the media and entertainment technology and services sectors. Transforming businesses with its knowledge and network, the company is headquartered in London with o昀케ces in Los Angeles. Bubble Agency clients are behind the most iconic on-screen, live event, and AV experiences in the world. To learn more visit www.bubbleagency.com About Caretta Research Caretta Research is helping media technology buyers and suppliers make better technology decisions by using real information. We combine decades of experience in the industry with continuous hands-on research and an exten- sive network of technology buyers and decision-makers to help vendors understand and target their potential market, and to help buyers identify the most-suitable solutions—saving time, reducing risk and lowering costs. To learn more visit www.carettaresearch.com. Stay connected with us 24/7