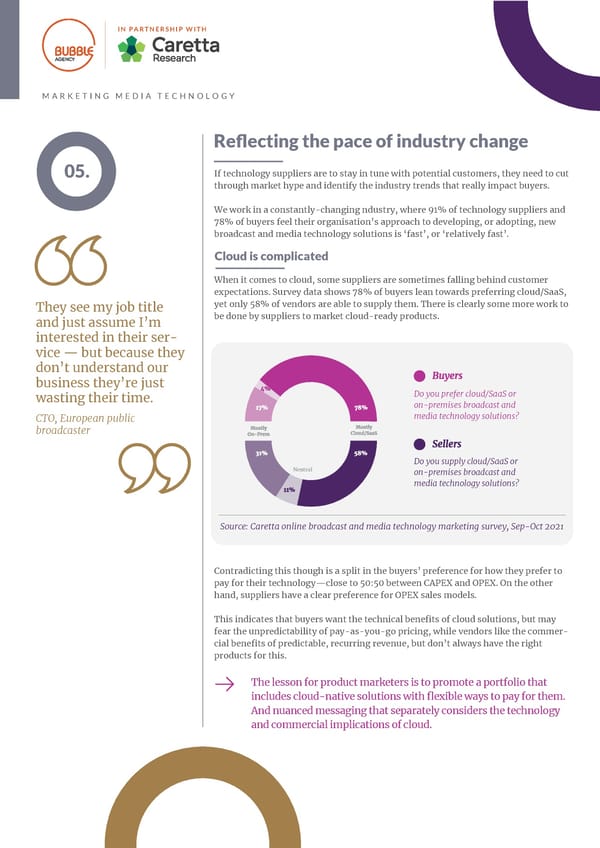

IN PARTNERSHIP WITH MARKETING MEDIA TECHNOLOGY Reflecting the pace of industry change 05. If technology suppliers are to stay in tune with potential customers, they need to cut through market hype and identify the industry trends that really impact buyers. We work in a constantly-changing ndustry, where 91% of technology suppliers and 78% of buyers feel their organisation’s approach to developing, or adopting, new broadcast and media technology solutions is ‘fast’, or ‘relatively fast’. Cloud is complicated When it comes to cloud, some suppliers are sometimes falling behind customer expectations. Survey data shows 78% of buyers lean towards preferring cloud/SaaS, They see my job title yet only 58% of vendors are able to supply them. There is clearly some more work to be done by suppliers to market cloud-ready products. and just assume I’m interested in their ser- vice — but because they don’t understand our business they’re just Do you prefer cloud/SaaS or wasting their time. on-premises broadcast and CTO, European public media technology solutions? broadcaster Do you supply cloud/SaaS or Neutral on-premises broadcast and media technology solutions? Source: Caretta online broadcast and media technology marketing survey, Sep-Oct 2021 Contradicting this though is a split in the buyers’ preference for how they prefer to pay for their technology—close to 50:50 between CAPEX and OPEX. On the other hand, suppliers have a clear preference for OPEX sales models. This indicates that buyers want the technical benefits of cloud solutions, but may fear the unpredictability of pay-as-you-go pricing, while vendors like the commer- cial benefits of predictable, recurring revenue, but don’t always have the right products for this. The lesson for product marketers is to promote a portfolio that includes cloud-native solutions with flexible ways to pay for them. And nuanced messaging that separately considers the technology and commercial implications of cloud.

2021 | Marketing Media Technology Page 13 Page 15

2021 | Marketing Media Technology Page 13 Page 15