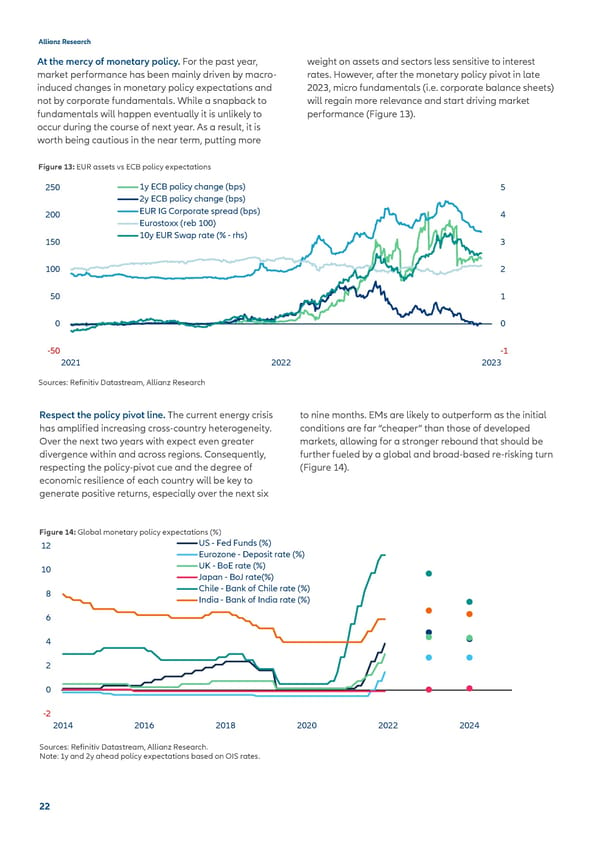

Allianz Research At the mercy of monetary policy. For the past year, weight on assets and sectors less sensitive to interest market performance has been mainly driven by macro- rates. However, after the monetary policy pivot in late induced changes in monetary policy expectations and 2023, micro fundamentals (i.e. corporate balance sheets) not by corporate fundamentals. While a snapback to will regain more relevance and start driving market fundamentals will happen eventually it is unlikely to performance (Figure 13). occur during the course of next year. As a result, it is worth being cautious in the near term, putting more Figure 13: EUR assets vs ECB policy expectations 250 1y ECB policy change (bps) 5 2y ECB policy change (bps) 200 EUR IG Corporate spread (bps) 4 Eurostoxx (reb 100) 150 10y EUR Swap rate (% - rhs) 3 100 2 50 1 0 0 -50 -1 2021 2022 2023 Sources: Refinitiv Datastream, Allianz Research Respect the policy pivot line. The current energy crisis to nine months. EMs are likely to outperform as the initial has amplified increasing cross-country heterogeneity. conditions are far “cheaper” than those of developed Over the next two years with expect even greater markets, allowing for a stronger rebound that should be divergence within and across regions. Consequently, further fueled by a global and broad-based re-risking turn respecting the policy-pivot cue and the degree of (Figure 14). economic resilience of each country will be key to generate positive returns, especially over the next six Figure 14: Global monetary policy expectations (%) 12 US - Fed Funds (%) Eurozone - Deposit rate (%) 10 UK - BoE rate (%) Japan - BoJ rate(%) 8 Chile - Bank of Chile rate (%) India - Bank of India rate (%) 6 4 2 0 -2 2014 2016 2018 2020 2022 2024 Sources: Refinitiv Datastream, Allianz Research. Note: 1y and 2y ahead policy expectations based on OIS rates. 22

Allianz 2022 Outlook final Page 21 Page 23

Allianz 2022 Outlook final Page 21 Page 23